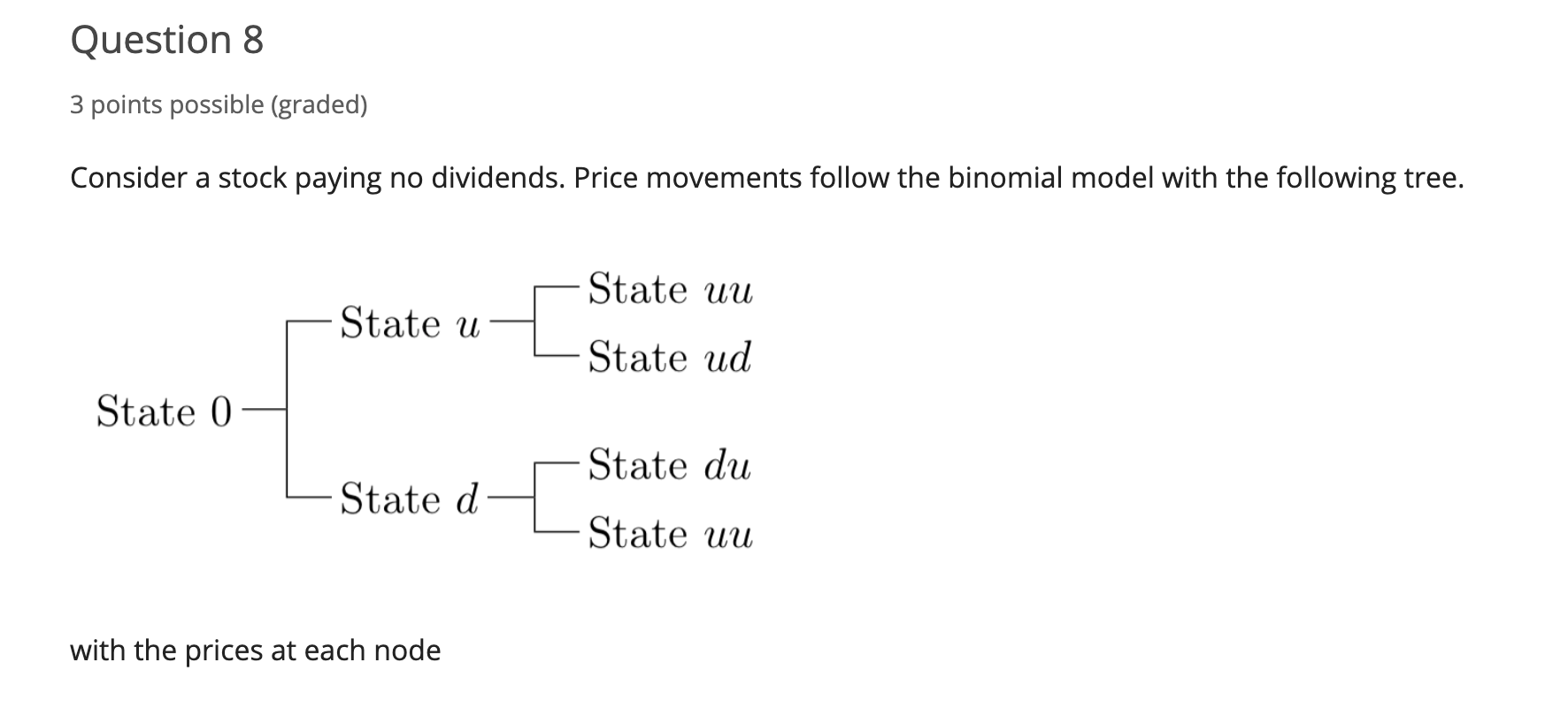

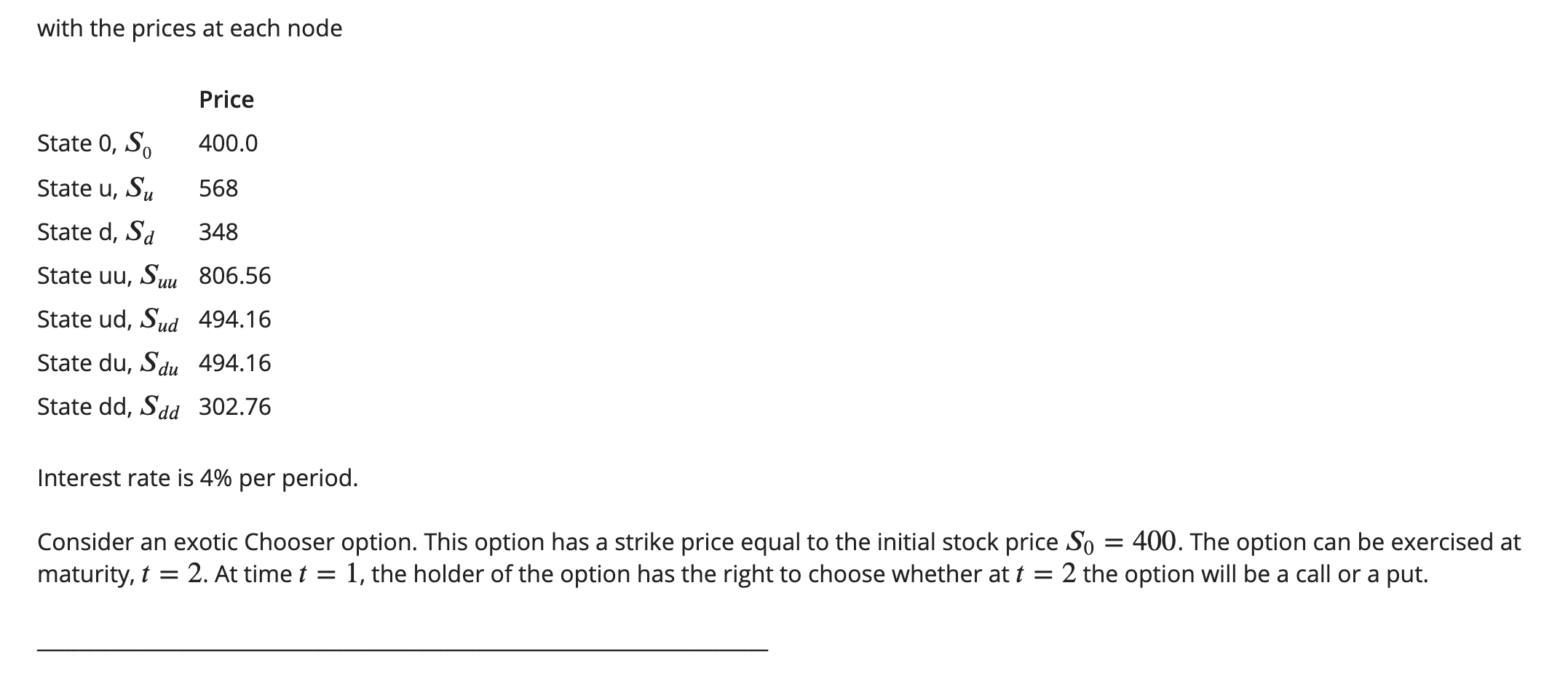

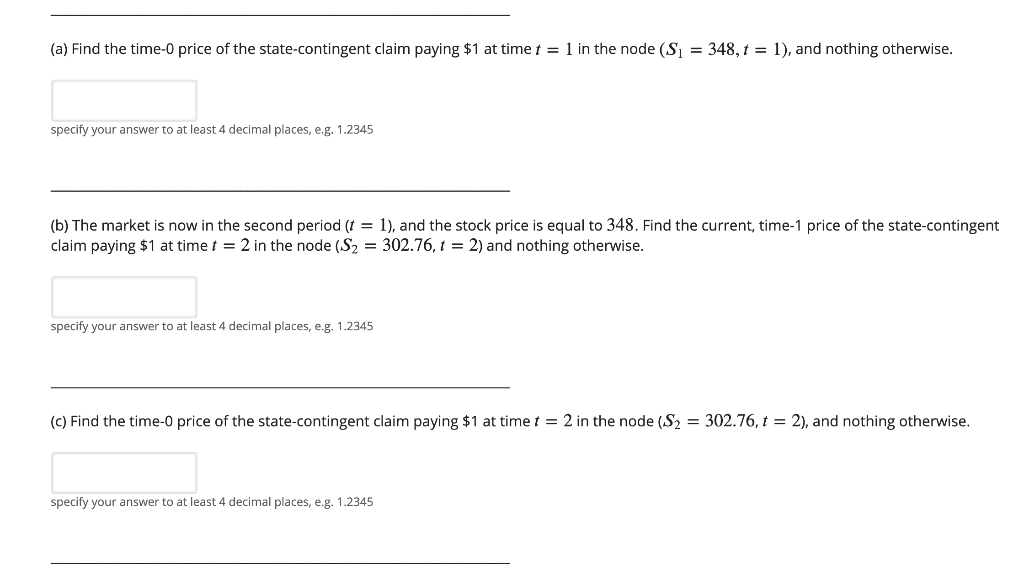

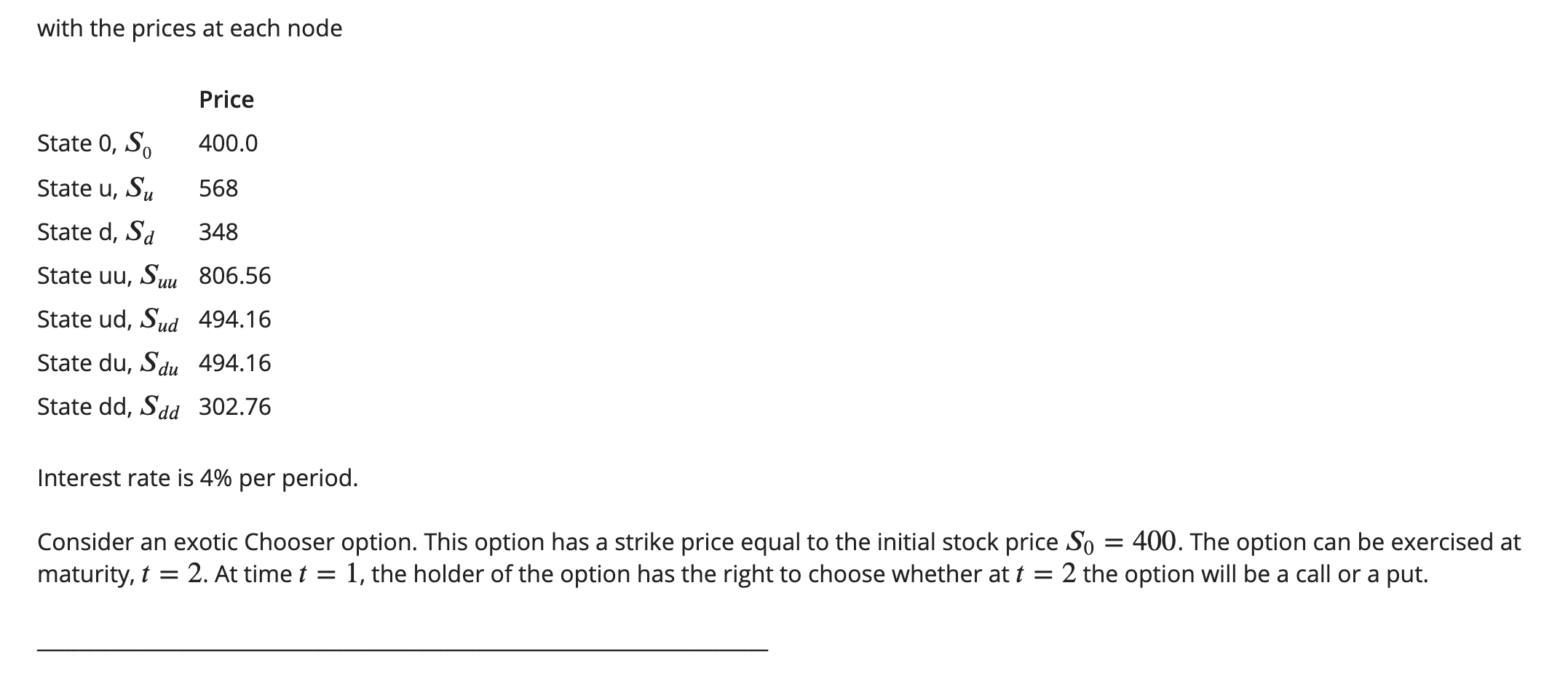

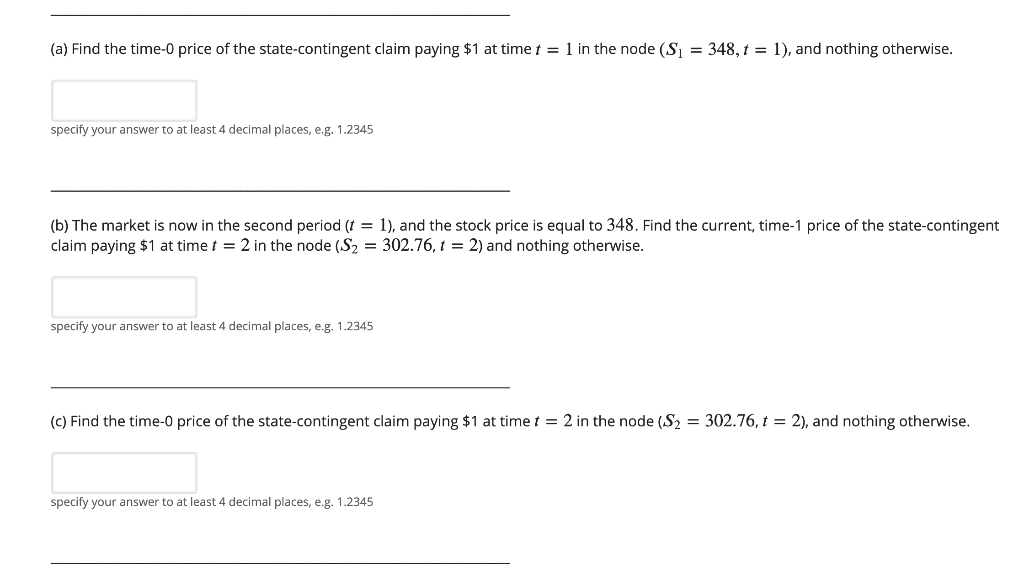

Question 8 3 points possible (graded) Consider a stock paying no dividends. Price movements follow the binomial model with the following tree. State uu State u State ud State 0 State du State d State uu with the prices at each node with the prices at each node Price 400.0 568 State 0, S. State u, Su State d, Sd State uu, Suu 348 806.56 State ud, Sud 494.16 State du, Sdu 494.16 State dd, Sdd 302.76 Interest rate is 4% per period. Consider an exotic Chooser option. This option has a strike price equal to the initial stock price So = 400. The option can be exercised at maturity, t = 2. At time t = 1, the holder of the option has the right to choose whether at t = 2 the option will be a call or a put. (a) Find the time-o price of the state-contingent claim paying $1 at time t = 1 in the node (S = 348, t = 1), and nothing otherwise. specify your answer to at least 4 decimal places, e.g. 1.2345 (b) The market is now in the second period (t = 1), and the stock price is equal to 348. Find the current, time-1 price of the state contingent claim paying $1 at time t = 2 in the node (S2 = 302.76,1 = 2) and nothing otherwise. specify your answer to at least 4 decimal places, e.g. 1.2345 (c) Find the time-o price of the state contingent claim paying $1 at time t = 2 in the node (S2 = 302.76, t = 2), and nothing otherwise. specify your answer to at least 4 decimal places, e.g. 1.2345 Question 8 3 points possible (graded) Consider a stock paying no dividends. Price movements follow the binomial model with the following tree. State uu State u State ud State 0 State du State d State uu with the prices at each node with the prices at each node Price 400.0 568 State 0, S. State u, Su State d, Sd State uu, Suu 348 806.56 State ud, Sud 494.16 State du, Sdu 494.16 State dd, Sdd 302.76 Interest rate is 4% per period. Consider an exotic Chooser option. This option has a strike price equal to the initial stock price So = 400. The option can be exercised at maturity, t = 2. At time t = 1, the holder of the option has the right to choose whether at t = 2 the option will be a call or a put. (a) Find the time-o price of the state-contingent claim paying $1 at time t = 1 in the node (S = 348, t = 1), and nothing otherwise. specify your answer to at least 4 decimal places, e.g. 1.2345 (b) The market is now in the second period (t = 1), and the stock price is equal to 348. Find the current, time-1 price of the state contingent claim paying $1 at time t = 2 in the node (S2 = 302.76,1 = 2) and nothing otherwise. specify your answer to at least 4 decimal places, e.g. 1.2345 (c) Find the time-o price of the state contingent claim paying $1 at time t = 2 in the node (S2 = 302.76, t = 2), and nothing otherwise. specify your answer to at least 4 decimal places, e.g. 1.2345