Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information was obtained from the accounting records of Sun Ltd, a listed company, for the financial year ended 30 June 20.0: Ordinary

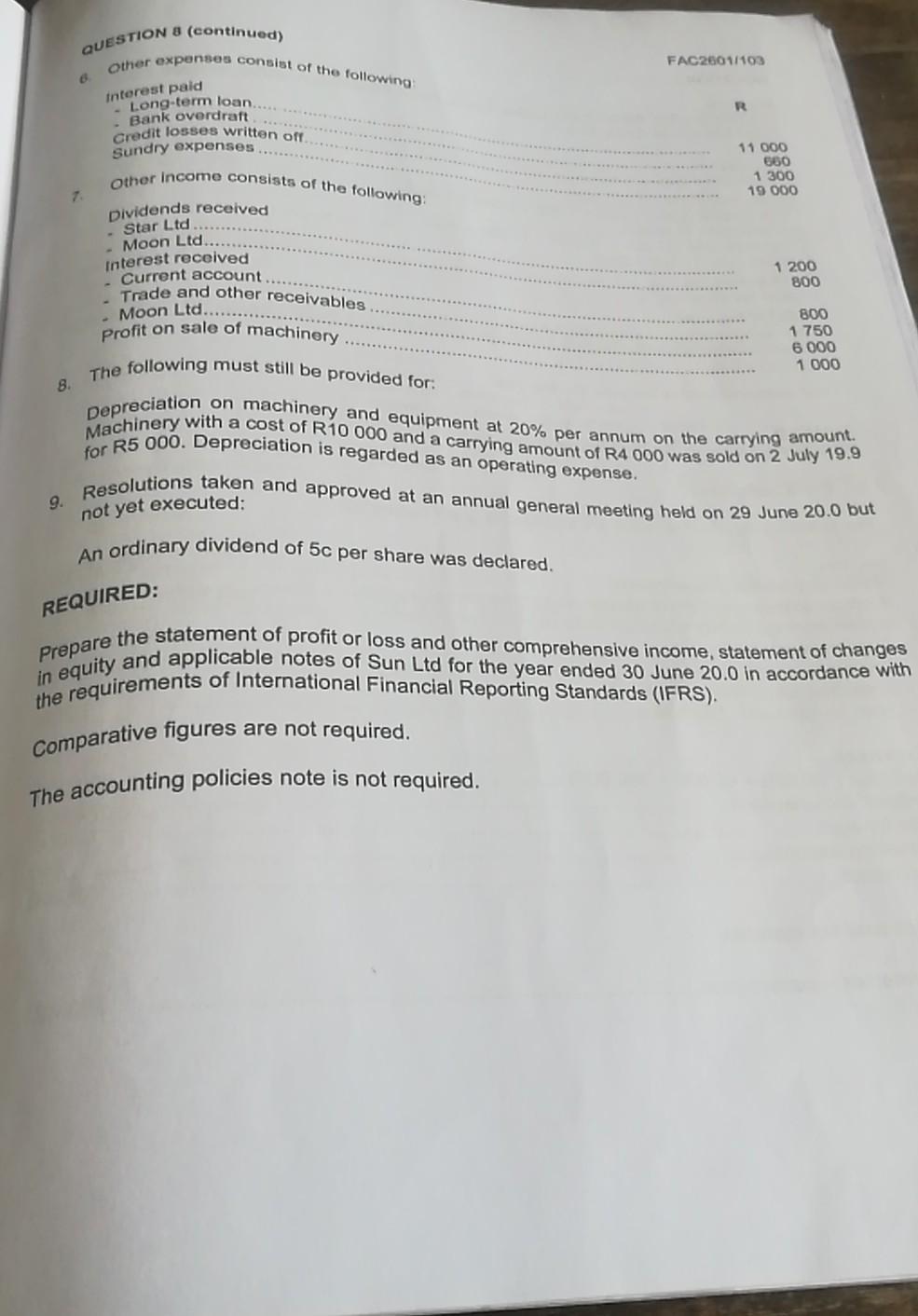

The following information was obtained from the accounting records of Sun Ltd, a listed company, for the financial year ended 30 June 20.0: Ordinary share capital (issued at 50cents per share). 12% Long-term loan... 10% Non-cumulative preference shares Retained earnings (1/7/19.9). Machinery and equipment at cost (1/7/19.9). Accumulated depreciation - Machinery and equipment (1/7/19.9).. Revenue (turnover) Other income.. Other expenses (additional information 6 and 9).. Administrative expenses Investments at cost. .1 000 000 190 000 300 000 380 000 160 000 75 000 .3 500 000 11 550 31 960 410 650 245 000 Loan granted to Moon Ltd. Income tax expense 60 000 263 421 Additional information: 1. The long-term loan from Sun Ltd was incurred on 1 January 20.0 and bears interest at 12% per annum. The interest is payable monthly in arrears. The capital portion of the loan is repayable on 31 December 20.4 2. Investments consist of the following: 100 000 Ordinary shares in Star Ltd, purchased at R2 each. Star Ltd's total issued ordinary share capital consists of 1 000 000 ordinary shares. Star Ltd's shares are traded on the JSE and the price on 30 June 20.0 was R2.50 each. This investment was designated as at fair value through other comprehensive income (not held for trading). 30 000 Ordinary shares in Moon Ltd at a cost of R45 000. Moon Ltd's total issued ordinary share capital consists of 50 000 shares. Moon Ltd's shares trade on the JSE and the price on 30 June 20.0 was R1,50 each. The loan to Moon Ltd was granted on 1 July 19.9 at an interest rate of 10% per annum. The interest is payable monthly in arrears and the capital portion of the loan is repayable on 30 June 20.5. Sun Ltd maintained a gross profit percentage of 40% on sales during the year. Administrative expenses consist of the following: R Remuneration of directors and prescribed officers... Auditors' remuneration Travelling expenses. - Fee for audit.. Accountant's salary. Wages. Telephone. Water and electricity Stationery... 180 000 350 12 000 60 000 150 000 3 000 4 200 1 100 QUESTION 8 (continued) The following must still be provided for: The accounting policies note is not required. in equity and applicable notes of Sun Ltd for the year ended 30 June 20.0 in accordance with the requirements of International Financial Reporting Standards (IFRS). Depreciation on machinery and equipment at 20% per annum on the carrying amount. Prepare the statement of profit or loss and other comprehensive income, statement of changes for R5 000. Depreciation is regarded as an operating expense. An ordinary dividend of 5c per share was declared. 9. Resolutions taken and approved at an annual general meeting held on 29 June 20.0 but Other Income consists of the following: Other expenses consist of the following Machinery with a cost of R10 000 and a carrying amount of R4 000 was sold on 2 July 19.9 Comparative figures are not required. 6. FAC2601/103 Interest paid Long-term loan. . Bank overdraft Credit losses written off Sundry expenses 11 000 660 1 300 19 000 7. Dividends received - Star Ltd Moon Ltd. Interest received "Current account Trade and other receivables 1 200 800 - Moon Ltd. Profit on sale of machinery 800 1 750 6 000 1 000 8. not yet executed: REQUIRED:

Step by Step Solution

★★★★★

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started