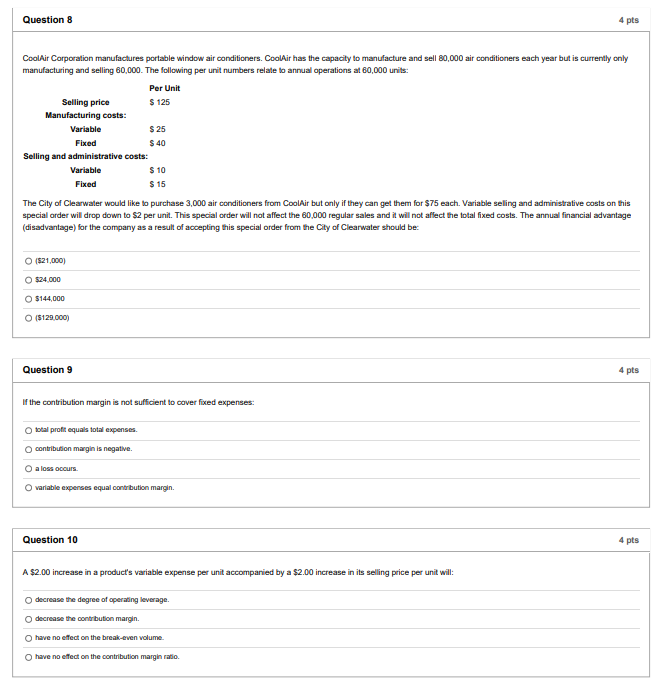

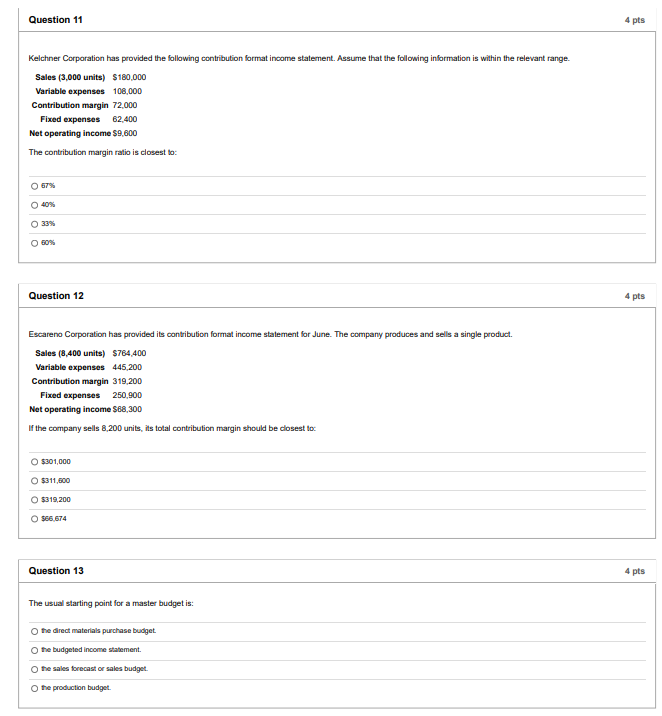

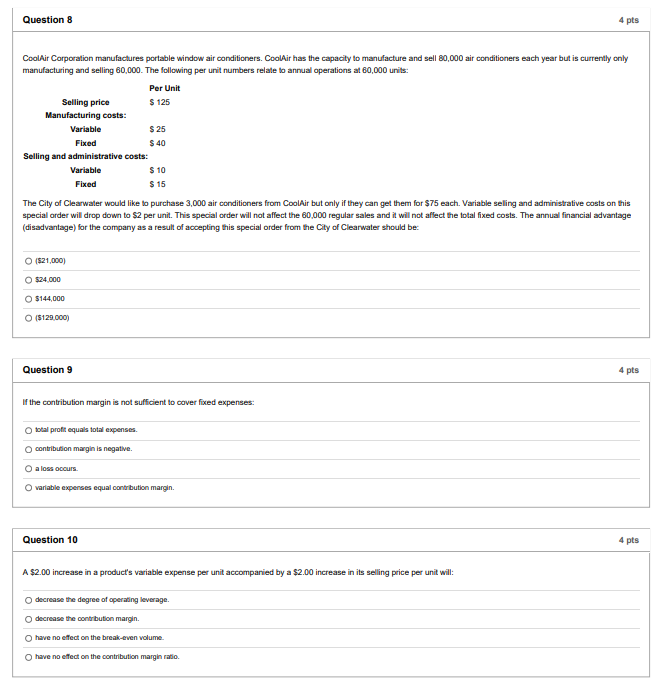

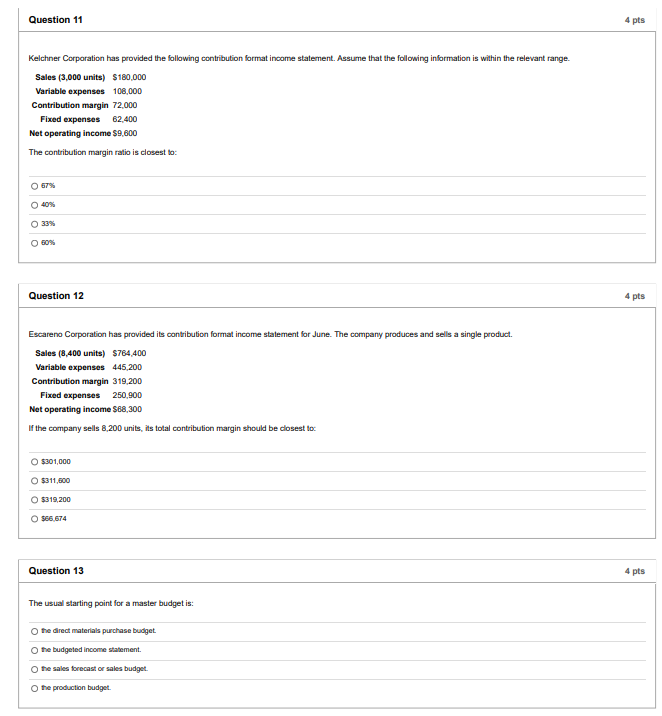

Question 8 4 pts CoolAir Corporation manufactures portable window air conditioners. CoolAir has the capacity to manufacture and sell 80,000 air conditioners each year but is currently only manufacturing and selling 60,000. The following per unit numbers relate to annual operations at 60,000 units: Per Unit Selling price $ 125 Manufacturing costs: Variable $ 25 Fixed $ 40 Selling and administrative costs: Variable $ 10 Fixed $ 15 The City of Clearwater would like to purchase 3,000 air conditioners from CoolAir but only if they can get them for $75 each. Variable selling and administrative costs on this special order will drop down to $2 per unit. This special order will not affect the 60.000 regular sales and it will not affect the total fixed costs. The annual financial advantage (disadvantage) for the company as a result of accepting this special order from the City of Clearwater should be: O ($21,000) $24.000 O $144,000 O (5129.000) Question 9 4 pts of the contribution margin is not sufficient to cover fixed expenses. total profit equals total expenses contribution margin is negative. a loss occurs. variable expenses equal contribution margin. Question 10 4 pts A $2.00 increase in a product's variable expense per unit accompanied by a $2.00 increase in its selling price per unit will: decrease the degree of operating leverage decrease the contribution margin. have no effect on the break-even volume. have no effect on the contribution marginalio Question 11 4 pts Kelchner Corporation has provided the following contribution format income statement. Assume that the following information is within the relevant range. Sales (3,000 units) $180,000 Variable expenses 108,000 Contribution margin 72,000 Fixed expenses 62.400 Net operating income $9.600 The contribution margin ratio is closest to: 67% 40% 33% 50 Question 12 4 pts Escareno Corporation has provided its contribution format income statement for June. The company produces and sells a single product. Sales (8,400 units) $764,400 Variable expenses 445,200 Contribution margin 319,200 Fixed expenses 250,900 Net operating income S68,300 of the company sells 8.200 units, its total contribution margin should be closest to O $301,000 O $311,800 O $319,200 O $66.674 Question 13 4 pts The usual starting point for a master budget is: the direct materials purchase budget the budgeted income statement the sales forecastor sales budget. the production budget