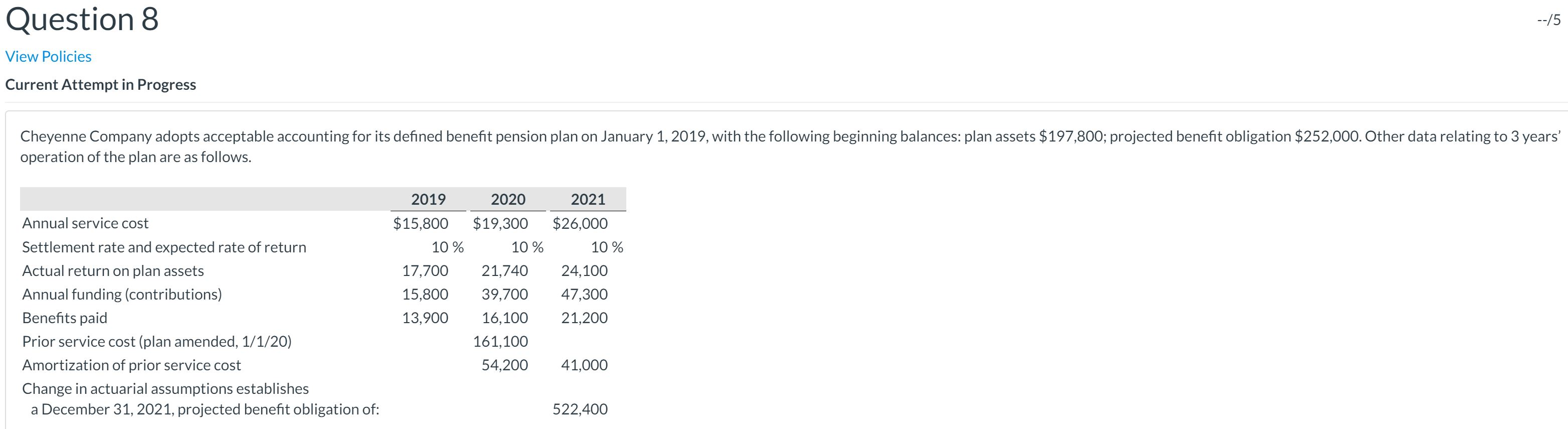

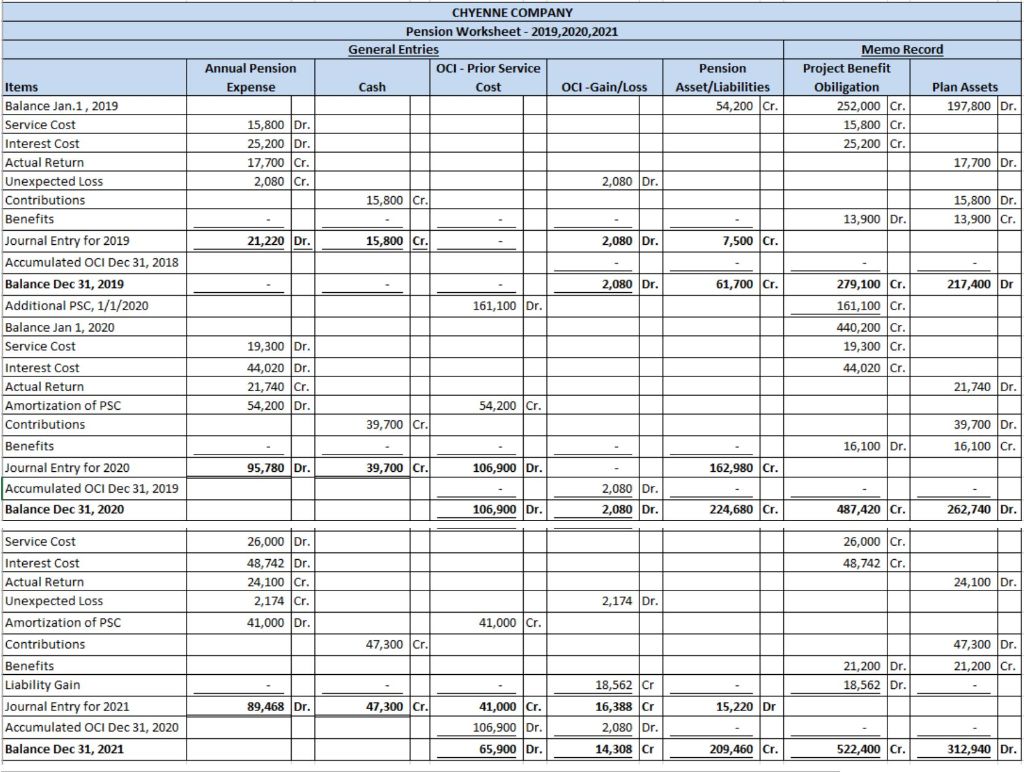

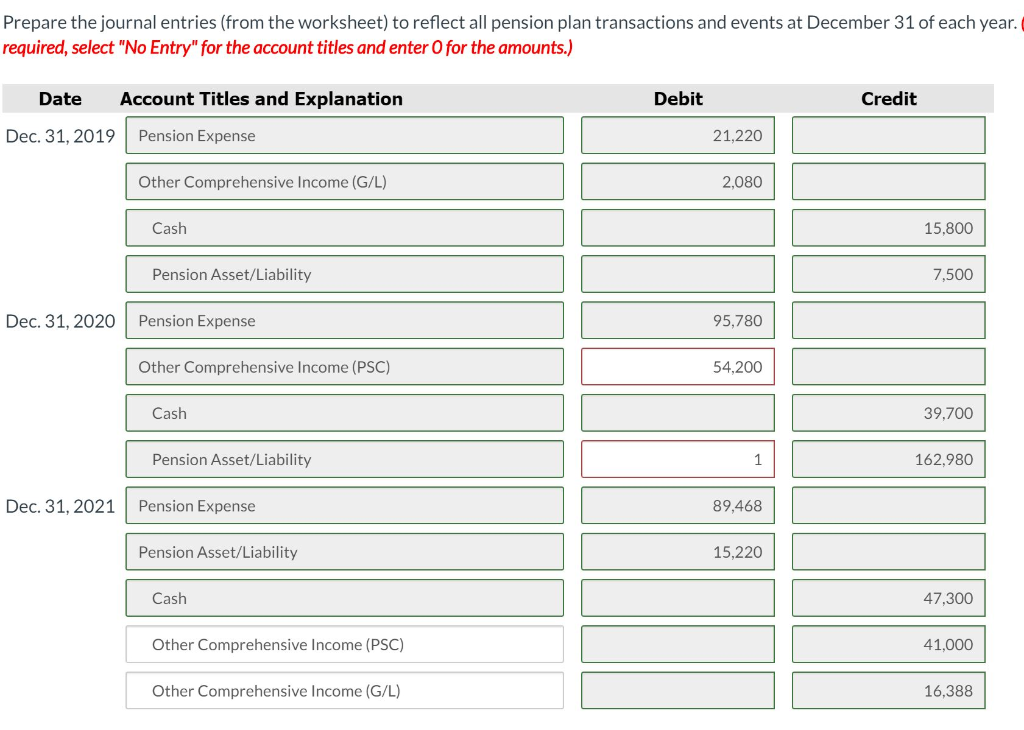

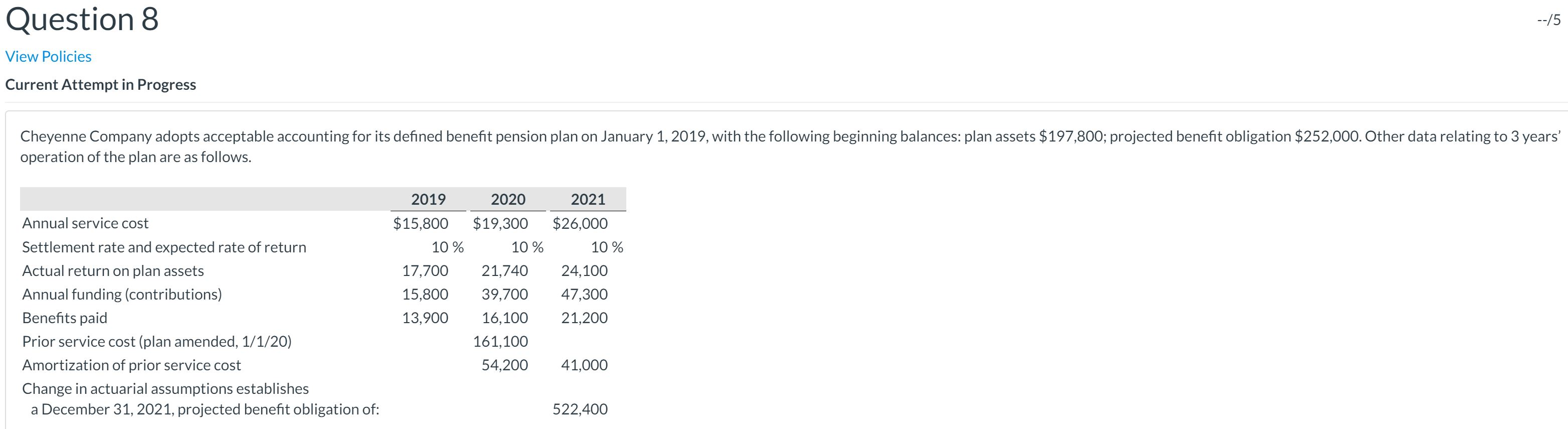

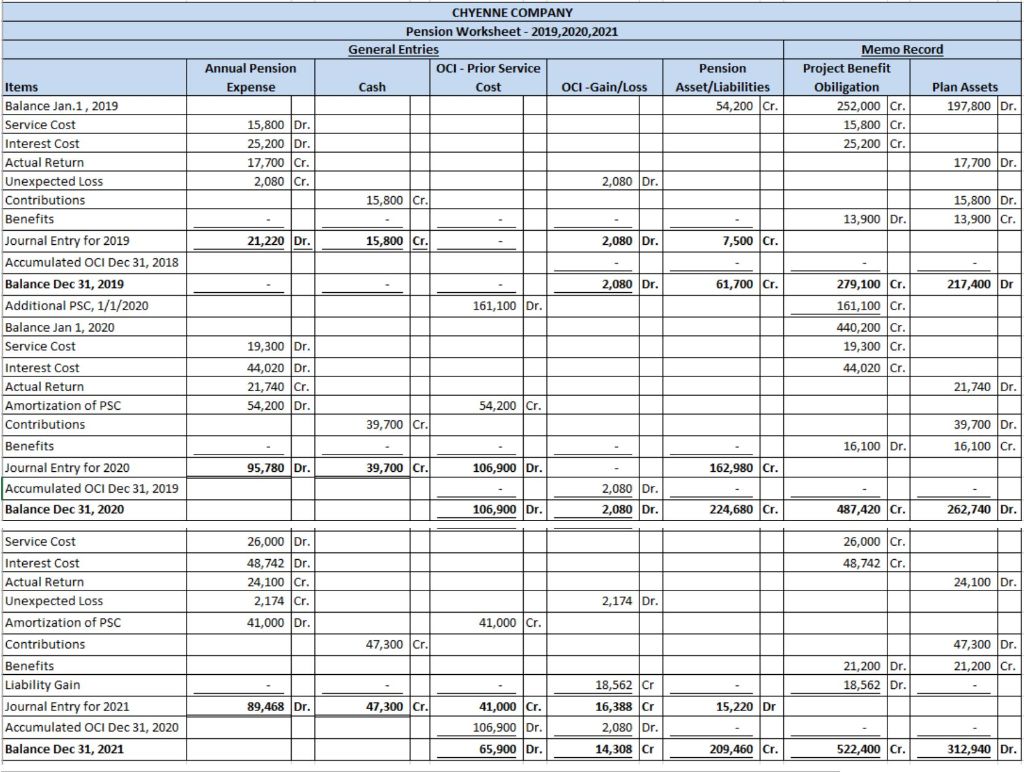

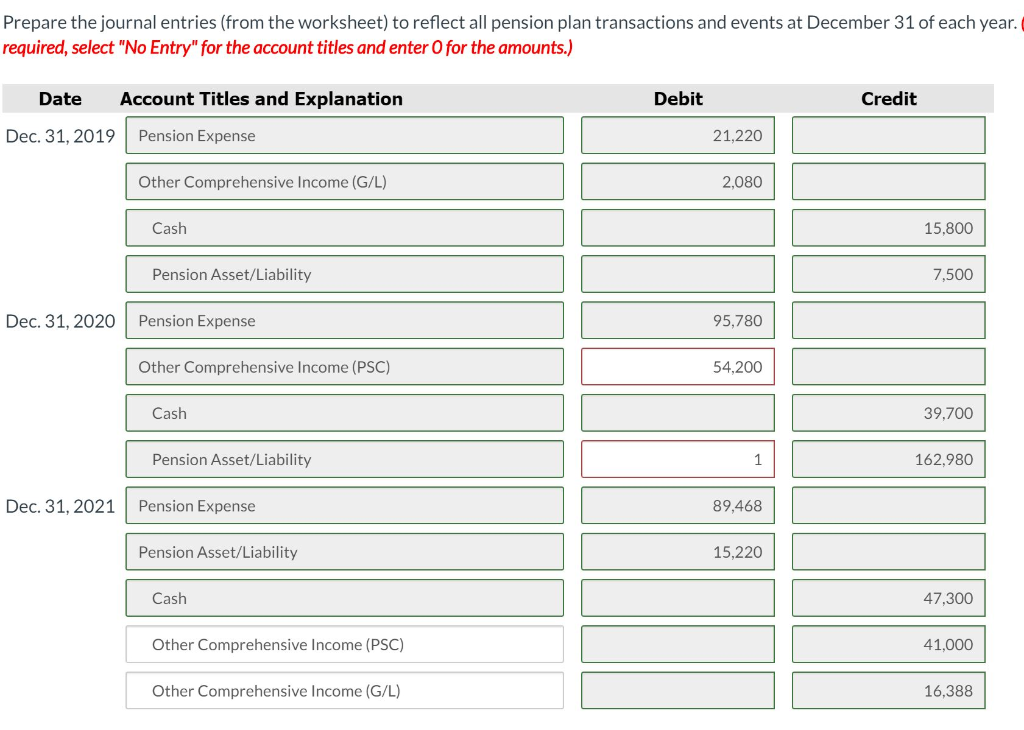

Question 8 --/5 View Policies Current Attempt in Progress Cheyenne Company adopts acceptable accounting for its defined benefit pension plan on January 1, 2019, with the following beginning balances: plan assets $197,800; projected benefit obligation $252,000. Other data relating to 3 years' operation of the plan are as follows. 2019 2021 2020 $26,000 $15,800 $19,300 Annual service cost Settlement rate and expected rate of return 10% 10% 10% Actual return on plan assets 17,700 21,740 24,100 Annual funding (contributions) 15,800 39,700 47,300 Benefits paid 16,100 13,900 21,200 Prior service cost (plan amended, 1/1/20) 161,100 Amortization of prior service cost 54,200 41,000 Change in actuarial assumptions establishes a December 31, 2021, projected benefit obligation of: 522,400 CHYENNE COMPANY Pension Worksheet- 2019,2020,2021 Memo Record General Entries Project Benefit Obiligation 252,000 Cr. 15.800 Cr. Pension Annual Pension oCI- Prior Service OCI-Gain/Loss Asset/Liabilities 54,200 Cr Cash Plan Assets Items Expense Cost 197,800 Dr. Balance Jan.1,2019 Service Cost Interest Cost Actual Return Unexpected Loss 15,800 Dr. 25,200 Dr. 25,200 Cr 17,700 Dr. 17,700 Cr. 2,080 Cr. 2,080 Dr. Contributions Benefits 15,800 Dr. 13,900 Cr. 15,800 Cr. 13,900 Dr. Journal Entry for 2019 15,800 Cr. 2,080 Dr. 7,500 Cr. 21,220 Dr. Accumulated OCI Dec 31, 2018 279,100 Cr. 2,080 Dr. 217,400 Dr 61,700 Cr. Balance Dec 31, 2019 Additional PSC, 1/1/2020 161.100 Cr. 161,100 Dr. Balance Jan 1, 2020 Service Cost 440,200 Cr. 19,300 Cr. 19,300 Dr. 44,020 Dr. Interest Cost Actual Return Amortization of PSC Contributions 44,020 Cr 21,740 Cr. 21,740 Dr. 54,200 Cr. 54,200 Dr. 39,700 Cr. 39,700 Dr. Benefits 16,100 Dr 16,100 Cr. 39,700 Cr. 106,900 Dr. 162,980 Cr. Journal Entry for 2020 95,780 Dr. Accumulated OCI Dec 31, 2019 2,080 Dr. 224,680 Cr. 487,420 Cr 106,900 Dr. 2,080 Dr. 262,740 Dr Balance Dec 31, 2020 26,000 Dr. Service Cost 26,000 Cr Interest Cost Actual Return 48,742 Dr. 24,100 Cr. 48,742 Cr. 24,100 Dr Unexpected Loss 2,174 Dr. 2,174 Cr. Amortization of PSC Contributions 41.000 Dr. 41,000 Cr. 47,300 Cr. 47,300 Dr. Benefits Liability Gain Journal Entry for 2021 21,200 Dr 18,562 Dr 21,200 Cr. 18,562 Cr 41,000 Cr. 16,388 Cr 15,220 Dr 89,468 Dr. 47,300 Cr. Accumulated OCI Dec 31, 2020 106,900 Dr. 2,080 Dr. Balance Dec 31, 2021 65,900 Dr. 209,460 Cr. 522,400 Cr. 312,940 Dr. 14,308 Cr Prepare the journal entries (from the worksheet) to reflect all pension plan transactions and events at December 31 of each year. required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit Date Dec. 31, 2019 Pension Expense 21,220 Other Comprehensive Income (G/L) 2,080 Cash 15,800 Pension Asset/Liability 7,500 Pension Expense Dec. 31, 2020 95,780 Other Comprehensive Income (PSC) 54,200 Cash 39,700 Pension Asset/Liability 1 162,980 Dec. 31, 2021 Pension Expense 89,468 Pension Asset/Liability 15,220 Cash 47,300 Other Comprehensive Income (PSC) 41,000 Other Comprehensive Income (G/L) 16,388 Question 8 --/5 View Policies Current Attempt in Progress Cheyenne Company adopts acceptable accounting for its defined benefit pension plan on January 1, 2019, with the following beginning balances: plan assets $197,800; projected benefit obligation $252,000. Other data relating to 3 years' operation of the plan are as follows. 2019 2021 2020 $26,000 $15,800 $19,300 Annual service cost Settlement rate and expected rate of return 10% 10% 10% Actual return on plan assets 17,700 21,740 24,100 Annual funding (contributions) 15,800 39,700 47,300 Benefits paid 16,100 13,900 21,200 Prior service cost (plan amended, 1/1/20) 161,100 Amortization of prior service cost 54,200 41,000 Change in actuarial assumptions establishes a December 31, 2021, projected benefit obligation of: 522,400 CHYENNE COMPANY Pension Worksheet- 2019,2020,2021 Memo Record General Entries Project Benefit Obiligation 252,000 Cr. 15.800 Cr. Pension Annual Pension oCI- Prior Service OCI-Gain/Loss Asset/Liabilities 54,200 Cr Cash Plan Assets Items Expense Cost 197,800 Dr. Balance Jan.1,2019 Service Cost Interest Cost Actual Return Unexpected Loss 15,800 Dr. 25,200 Dr. 25,200 Cr 17,700 Dr. 17,700 Cr. 2,080 Cr. 2,080 Dr. Contributions Benefits 15,800 Dr. 13,900 Cr. 15,800 Cr. 13,900 Dr. Journal Entry for 2019 15,800 Cr. 2,080 Dr. 7,500 Cr. 21,220 Dr. Accumulated OCI Dec 31, 2018 279,100 Cr. 2,080 Dr. 217,400 Dr 61,700 Cr. Balance Dec 31, 2019 Additional PSC, 1/1/2020 161.100 Cr. 161,100 Dr. Balance Jan 1, 2020 Service Cost 440,200 Cr. 19,300 Cr. 19,300 Dr. 44,020 Dr. Interest Cost Actual Return Amortization of PSC Contributions 44,020 Cr 21,740 Cr. 21,740 Dr. 54,200 Cr. 54,200 Dr. 39,700 Cr. 39,700 Dr. Benefits 16,100 Dr 16,100 Cr. 39,700 Cr. 106,900 Dr. 162,980 Cr. Journal Entry for 2020 95,780 Dr. Accumulated OCI Dec 31, 2019 2,080 Dr. 224,680 Cr. 487,420 Cr 106,900 Dr. 2,080 Dr. 262,740 Dr Balance Dec 31, 2020 26,000 Dr. Service Cost 26,000 Cr Interest Cost Actual Return 48,742 Dr. 24,100 Cr. 48,742 Cr. 24,100 Dr Unexpected Loss 2,174 Dr. 2,174 Cr. Amortization of PSC Contributions 41.000 Dr. 41,000 Cr. 47,300 Cr. 47,300 Dr. Benefits Liability Gain Journal Entry for 2021 21,200 Dr 18,562 Dr 21,200 Cr. 18,562 Cr 41,000 Cr. 16,388 Cr 15,220 Dr 89,468 Dr. 47,300 Cr. Accumulated OCI Dec 31, 2020 106,900 Dr. 2,080 Dr. Balance Dec 31, 2021 65,900 Dr. 209,460 Cr. 522,400 Cr. 312,940 Dr. 14,308 Cr Prepare the journal entries (from the worksheet) to reflect all pension plan transactions and events at December 31 of each year. required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit Date Dec. 31, 2019 Pension Expense 21,220 Other Comprehensive Income (G/L) 2,080 Cash 15,800 Pension Asset/Liability 7,500 Pension Expense Dec. 31, 2020 95,780 Other Comprehensive Income (PSC) 54,200 Cash 39,700 Pension Asset/Liability 1 162,980 Dec. 31, 2021 Pension Expense 89,468 Pension Asset/Liability 15,220 Cash 47,300 Other Comprehensive Income (PSC) 41,000 Other Comprehensive Income (G/L) 16,388