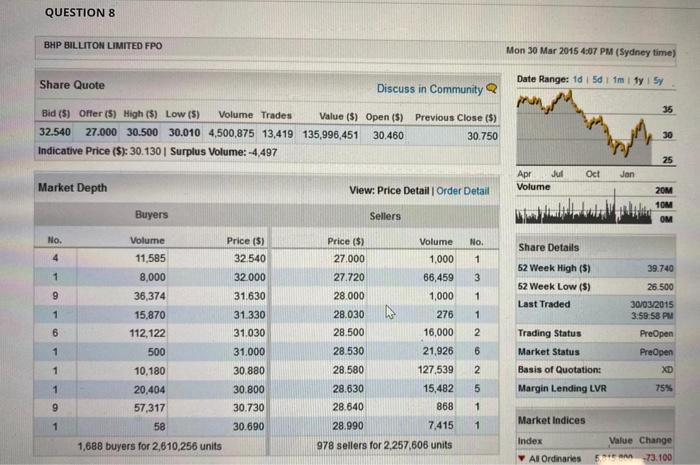

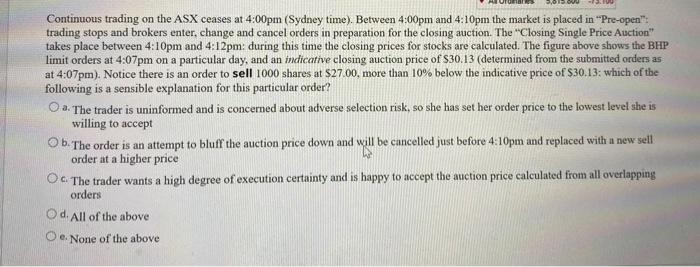

QUESTION 8 BHP BILLITON LIMITED FPO Mon 30 Mar 2015 4:07 PM (Sydney time) Share Quote Date Range: 1d5d 1m ty sy Discuss in Community pron 35 Bid (5) Offer (5) High ($) Low (5) Volume Trades Value (S) Open (S) Previous Close ($) 32.540 27.000 30.500 30.010 4,500,875 13,419 135,996,451 30.460 30.750 Indicative Price ($): 30.130 Surplus Volume: -4,497 30 25 Oct Jan Market Depth Apr Jul Volume View: Price Detail Order Detail 20M 10M OM Buyers Sellers No. No. Volume 11,585 Price (5) 32.540 Share Details 4 1 1 8,000 32000 3 52 Week High (5) 52 Week Low (5) Last Traded 9 36,374 1 31.630 31.330 1 1 6 39.740 26.500 30/03/2015 3.59.58 PM PreOpen PreOpen XD 2 Trading Status Price ($) Volume 27.000 1.000 27.720 66,459 28.000 1,000 28.030 276 28.500 16,000 28.530 21,926 28.580 127,539 28.630 15,482 28.640 868 28.990 7,415 978 sellers for 2.257,608 units 1 15,870 112,122 500 10,180 20,404 57,317 58 6 1 31.030 31.000 30.880 30.800 30.730 30.690 O N Market Status Basis of Quotation: Margin Lending LVR 1 75% 9 1 1 1 Market Indices Index 1,688 buyers for 2,610,256 units Value Change 5.73.100 Al Ordinaries Continuous trading on the ASX ceases at 4:00pm (Sydney time). Between 4:00pm and 4:10pm the market is placed in "Pre-open": trading stops and brokers enter, change and cancel orders in preparation for the closing auction. The "Closing Single Price Auction" takes place between 4:10pm and 4:12pm: during this time the closing prices for stocks are calculated. The figure above shows the BHP limit orders at 4:07pm on a particular day, and an indicative closing auction price of $30.13 (determined from the submitted orders as at 4:07pm). Notice there is an order to sell 1000 shares at $27.00, more than 10% below the indicative price of $30.13: which of the following is a sensible explanation for this particular order? O a. The trader is uninformed and is concerned about adverse selection risk, so she has set her order price to the lowest level she is willing to accept Ob The order is an attempt to bluff the auction price down and will be cancelled just before 4:10pm and replaced with a new sell order at a higher price Oc. The trader wants a high degree of execution certainty and is happy to accept the auction price calculated from all overlapping orders Od. All of the above Oe None of the above QUESTION 8 BHP BILLITON LIMITED FPO Mon 30 Mar 2015 4:07 PM (Sydney time) Share Quote Date Range: 1d5d 1m ty sy Discuss in Community pron 35 Bid (5) Offer (5) High ($) Low (5) Volume Trades Value (S) Open (S) Previous Close ($) 32.540 27.000 30.500 30.010 4,500,875 13,419 135,996,451 30.460 30.750 Indicative Price ($): 30.130 Surplus Volume: -4,497 30 25 Oct Jan Market Depth Apr Jul Volume View: Price Detail Order Detail 20M 10M OM Buyers Sellers No. No. Volume 11,585 Price (5) 32.540 Share Details 4 1 1 8,000 32000 3 52 Week High (5) 52 Week Low (5) Last Traded 9 36,374 1 31.630 31.330 1 1 6 39.740 26.500 30/03/2015 3.59.58 PM PreOpen PreOpen XD 2 Trading Status Price ($) Volume 27.000 1.000 27.720 66,459 28.000 1,000 28.030 276 28.500 16,000 28.530 21,926 28.580 127,539 28.630 15,482 28.640 868 28.990 7,415 978 sellers for 2.257,608 units 1 15,870 112,122 500 10,180 20,404 57,317 58 6 1 31.030 31.000 30.880 30.800 30.730 30.690 O N Market Status Basis of Quotation: Margin Lending LVR 1 75% 9 1 1 1 Market Indices Index 1,688 buyers for 2,610,256 units Value Change 5.73.100 Al Ordinaries Continuous trading on the ASX ceases at 4:00pm (Sydney time). Between 4:00pm and 4:10pm the market is placed in "Pre-open": trading stops and brokers enter, change and cancel orders in preparation for the closing auction. The "Closing Single Price Auction" takes place between 4:10pm and 4:12pm: during this time the closing prices for stocks are calculated. The figure above shows the BHP limit orders at 4:07pm on a particular day, and an indicative closing auction price of $30.13 (determined from the submitted orders as at 4:07pm). Notice there is an order to sell 1000 shares at $27.00, more than 10% below the indicative price of $30.13: which of the following is a sensible explanation for this particular order? O a. The trader is uninformed and is concerned about adverse selection risk, so she has set her order price to the lowest level she is willing to accept Ob The order is an attempt to bluff the auction price down and will be cancelled just before 4:10pm and replaced with a new sell order at a higher price Oc. The trader wants a high degree of execution certainty and is happy to accept the auction price calculated from all overlapping orders Od. All of the above Oe None of the above