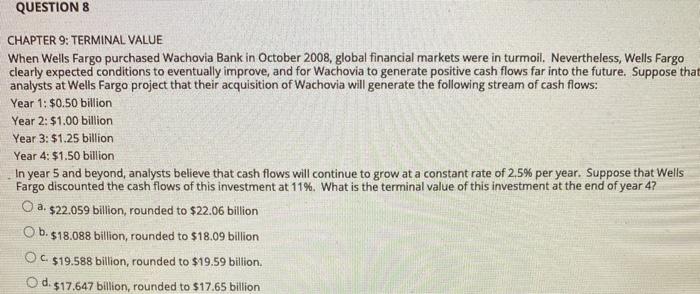

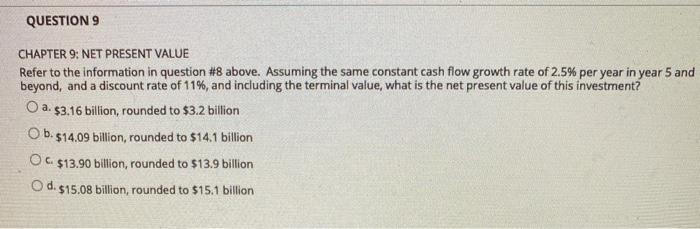

QUESTION 8 CHAPTER 9: TERMINAL VALUE When Wells Fargo purchased Wachovia Bank in October 2008, global financial markets were in turmoil. Nevertheless, Wells Fargo clearly expected conditions to eventually improve, and for Wachovia to generate positive cash flows far into the future. Suppose that analysts at Wells Fargo project that their acquisition of Wachovia will generate the following stream of cash flows: Year 1: $0.50 billion Year 2: $1.00 billion Year 3: $1.25 billion Year 4: $1.50 billion In year 5 and beyond analysts believe that cash flows will continue to grow at a constant rate of 2,5% per year. Suppose that Wells Fargo discounted the cash flows of this investment at 11%. What is the terminal value of this investment at the end of year 47 O a. $22.059 billion, rounded to $22.06 billion O b. $18.088 billion, rounded to $18.09 billion OC $19.588 billion, rounded to $19.59 billion. O di $17.647 billion, rounded to $17.65 billion QUESTION 9 CHAPTER 9: NET PRESENT VALUE Refer to the information in question #8 above. Assuming the same constant cash flow growth rate of 2.5% per year in year 5 and beyond, and a discount rate of 11%, and including the terminal value, what is the net present value of this investment O a $3.16 billion, rounded to $3.2 billion Ob. $14.09 billion, rounded to $14.1 billion OC. $13.90 billion, rounded to $13.9 billion O d. $15.08 billion, rounded to $15.1 billion QUESTION 10 CHAPTER 9: INCREMENTAL CASH FLOWS Blueberry Electronics is exploring the possibility of producing a new hand held device that will serve both as a basic PC, with Internet access, and as a cell phone. Which of the following items would NOT be considered a relevant incremental cash flow for the project's analysis? O a. The various costs of ramping up production of the new device if the project is accepted. O b. The company's current generation product has no cell phone capability. The new product may therefore make the old one obsolete in the eyes of many consumers, thereby reducing its sales. O Research and development funds that the company has spent in the past while working on a prototype of the new product. Od. The company would use raw land that it purchased several years ago for expansion of their manufacturing facilities to produce the new product, which would require canceling an agreement with a local farmer who was paying them for the use of the land during the growing season each year