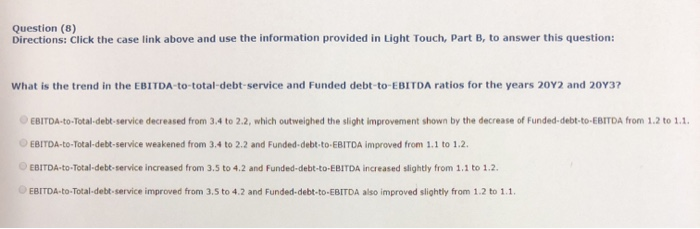

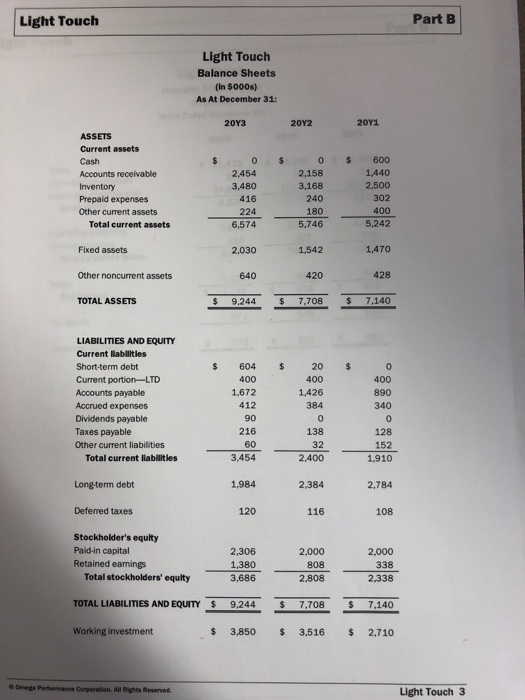

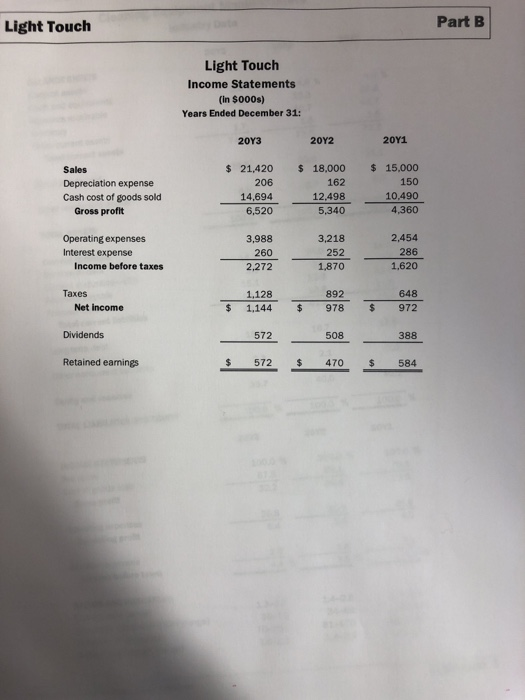

Question (8) Directions: Click the case link above and use the information provided in Light Touch, Part B, to answer this question: What is the trend in the EBITDA-to-total-debt-service and Funded debt-to-EBITDA ratios for the years 20Y2 and 20Y3? EBITDA-to-Total-debt-service decreased from 3.4 to 2.2, which outweighed the slight improvement shown by the decrease of Funded-debt-to-EBITDA from 1.2 to 1.1. EBITDA-to-Total-debt-service weakened from 3.4 to 2.2 and Funded-debt-to-EBITDA improved from 1.1 to 1.2 EBITDA-to-Total-debt-service increased from 3.5 to 4.2 and Funded-debt-to-EBITDA increased slightly from 1.1 to 1.2 EBITDA-to-Total-debt-service improved from 3.5 to 4.2 and Funded-debt-to-EBITDA also inmproved slightly from 1.2 to 1.1 Light Touch Part B Light Touch Balance Sheets (in $000s) As At December 31: 202 20Y1 203 ASSETS Current assets $ 0 600 Cash 1,440 2,500 2,454 2,158 Accounts receivable 3,168 Inventory 3,480 416 224 Prepaid expenses 240 302 400 Other current assets 180 5,746 5,242 Total current assets 6,574 Fixed assets 1,542 1,470 2,030 428 Other noncurrent assets 640 420 TOTAL ASSETS 9,244 7,708 $ 7,140 $ LIABILITIES AND EQUITY Current llabilties 604 Short-term debt $ 20 $ Current portion-LTD 400 400 400 1,672 Accounts payable 1,426 890 Accrued expenses 412 384 340 Dividends payable 90 0 0 Taxes payable 216 138 128 Other current liabilities 60 32 152 Total current labilities 3,454 2,400 1,910 Longterm debt 1,984 2,384 2,784 Deferred taxes 120 116 108 Stockholder's equity Paid-in capital Retained eamings Total stockholders' equlty 2,000 2,306 2,000 1,380 808 338 3,686 2,808 2,338 TOTAL LIABILITIES AND EQUITY $ 9,244 $ 7,708 7.140 Working investment 3,850 3,516 $ 2,710 Omega Performance Corporatian. All Rights Reserved Light Touch 3 Part B Light Touch Light Touch Income Statements (in $000s) Years Ended December 31: 203 202 201 $ 15,000 $ 21,420 $ 18,000 Sales 162 150 Depreciation expense Cash cost of goods sold Gross profit 206 10,490 14,694 12,498 4,360 6,520 5,340 2,454 Operating expenses 3,988 3,218 286 Interest expense 260 252 Income before taxes 1,870 1,620 2,272 Taxes 1,128 892 648 Net income $ 1,144 $ 978 $ 972 Dividends 572 508 388 Retained eamings $ 572 $ 470 $ 584