Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 8 Fred currently earns $ willing to pay Fred $103,900. How much U.S. gross income will Fred report it he accepts the assignment abroad

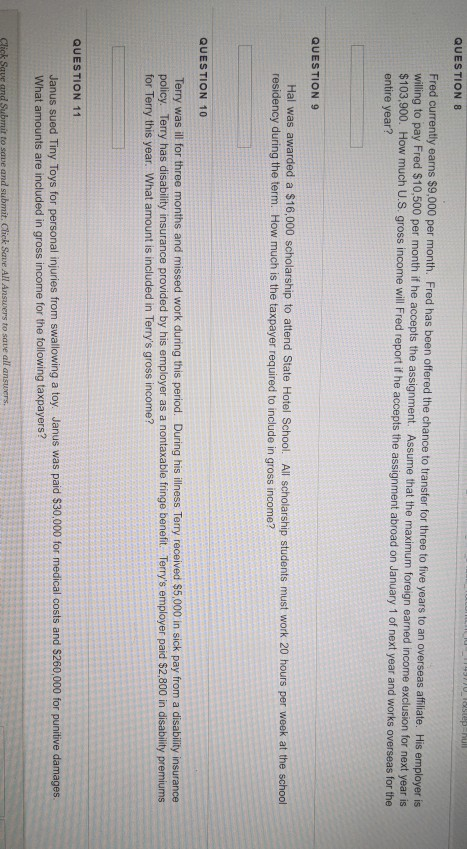

QUESTION 8 Fred currently earns $ willing to pay Fred $103,900. How much U.S. gross income will Fred report it he accepts the assignment abroad on January 1 of next year and works overseas for s9,000 per month. Fred has been offered the chance to transfer for three to five years to an overseas aflilate. His employer is $10,500 per month if he accepts the assignment. Assume that the maximum foreign earned income exclusion for next year is entire year? QUESTION 9 Hal was awarded a $16,000 scholarship to attend State Hotel School. All scholarship students must work 20 hours per week at the schocol residency during the term. How much is the taxpayer required to include in gross income? QUESTION 10 Terry was ill for three months and missed work during this period. During his illness Terry received $5,000 in sick pay from a disability insurance policy. Terry has disability insurance provided by his employer as a nontaxable fringe benefit. Terry's employer paid $2,800 in disability premiums for Terry this year. What amount is included in Terry's gross income? QUESTION 11 Janus sued Tiny Toys for personal injuries from swallowing a toy Janus was paid $30,000 for medical costs and S260,000 for punitive damages What amounts are included in gross income for the following taxpayers? Click Saue and Submit to save and submit, Cick Save All Answers to save all a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started