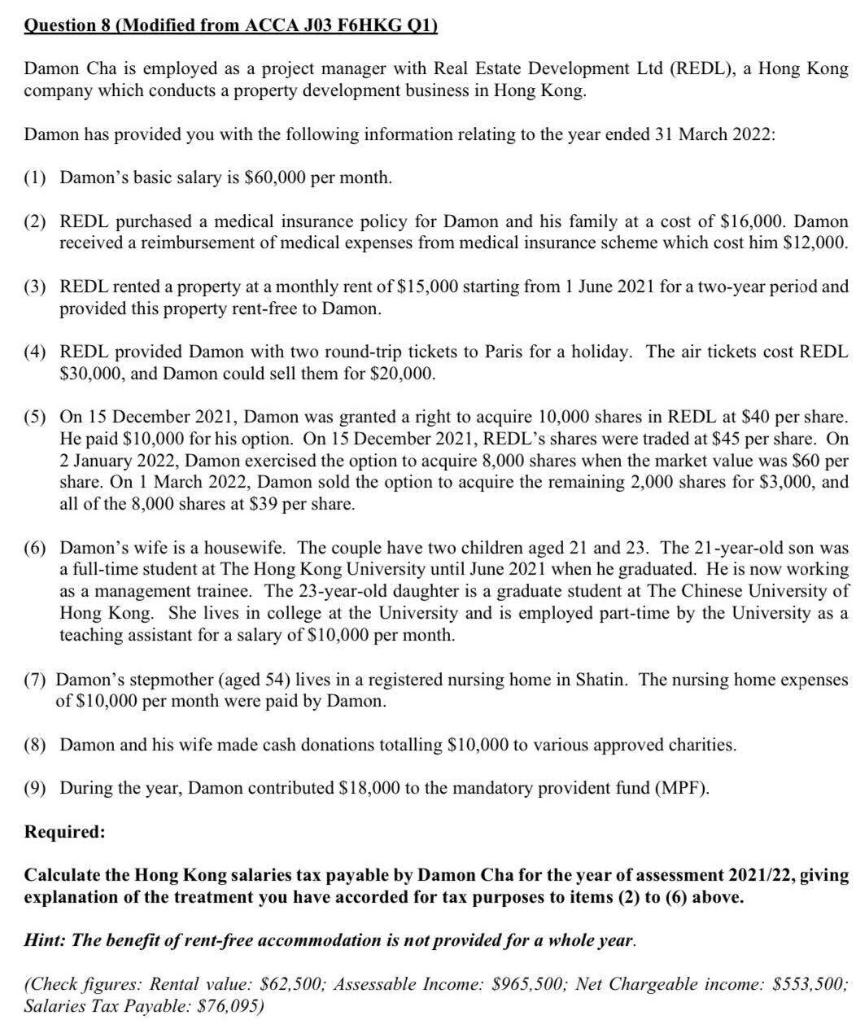

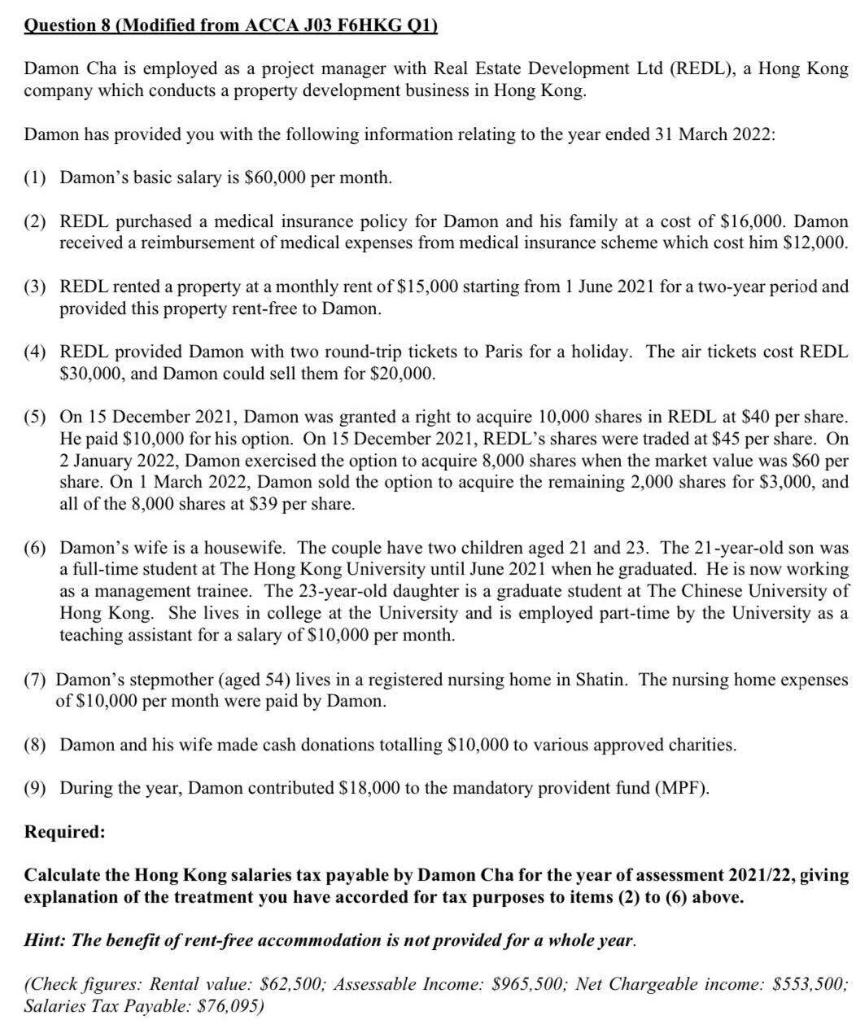

Question 8 (Modified from ACCA JO3 F6HKG 01) Damon Cha is employed as a project manager with Real Estate Development Ltd (REDL), a Hong Kong company which conducts a property development business in Hong Kong. Damon has provided you with the following information relating to the year ended 31 March 2022: (1) Damon's basic salary is $60,000 per month. (2) REDL purchased a medical insurance policy for Damon and his family at a cost of $16,000. Damon received a reimbursement of medical expenses from medical insurance scheme which cost him $12,000. (3) REDL rented a property at a monthly rent of $15,000 starting from 1 June 2021 for a two-year period and provided this property rent-free to Damon. (4) REDL provided Damon with two round-trip tickets to Paris for a holiday. The air tickets cost REDL $30,000, and Damon could sell them for $20,000. (5) On 15 December 2021, Damon was granted a right to acquire 10,000 shares in REDL at $40 per share. He paid $10,000 for his option. On 15 December 2021, REDL's shares were traded at $45 per share. On 2 January 2022, Damon exercised the option to acquire 8,000 shares when the market value was $60 per share. On 1 March 2022, Damon sold the option to acquire the remaining 2,000 shares for $3,000, and all of the 8,000 shares at $39 per share. (6) Damon's wife is a housewife. The couple have two children aged 21 and 23. The 21-year-old son was a full-time student at The Hong Kong University until June 2021 when he graduated. He is now working as a management trainee. The 23-year-old daughter is a graduate student at The Chinese University of Hong Kong. She lives in college at the University and is employed part-time by the University as a teaching assistant for a salary of $10,000 per month. (7) Damon's stepmother (aged 54) lives in a registered nursing home in Shatin. The nursing home expenses of $10,000 per month were paid by Damon. (8) Damon and his wife made cash donations totalling $10,000 to various approved charities. (9) During the year, Damon contributed $18,000 to the mandatory provident fund (MPF). Required: Calculate the Hong Kong salaries tax payable by Damon Cha for the year of assessment 2021/22, giving explanation of the treatment you have accorded for tax purposes to items (2) to (6) above. Hint: The benefit of rent-free accommodation is not provided for a whole year. (Check figures: Rental value: $62,500; Assessable Income: $965,500; Net Chargeable income: $553,500; Salaries Tax Payable: $76,095)