Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 8 of 34 > 75 E Pina Colada Corporation is preparing its December 31, 2020 statement of financial position. The following items may be

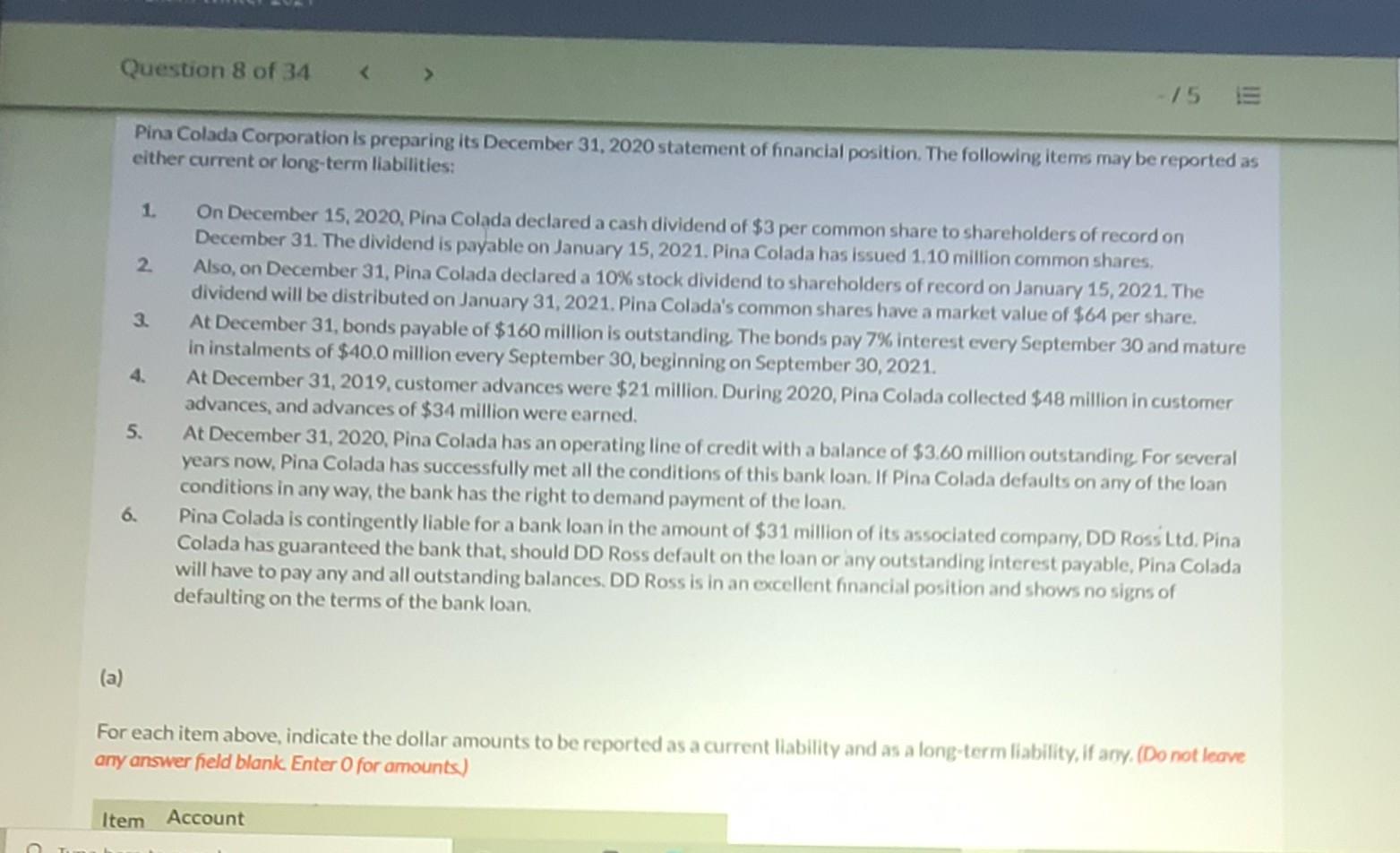

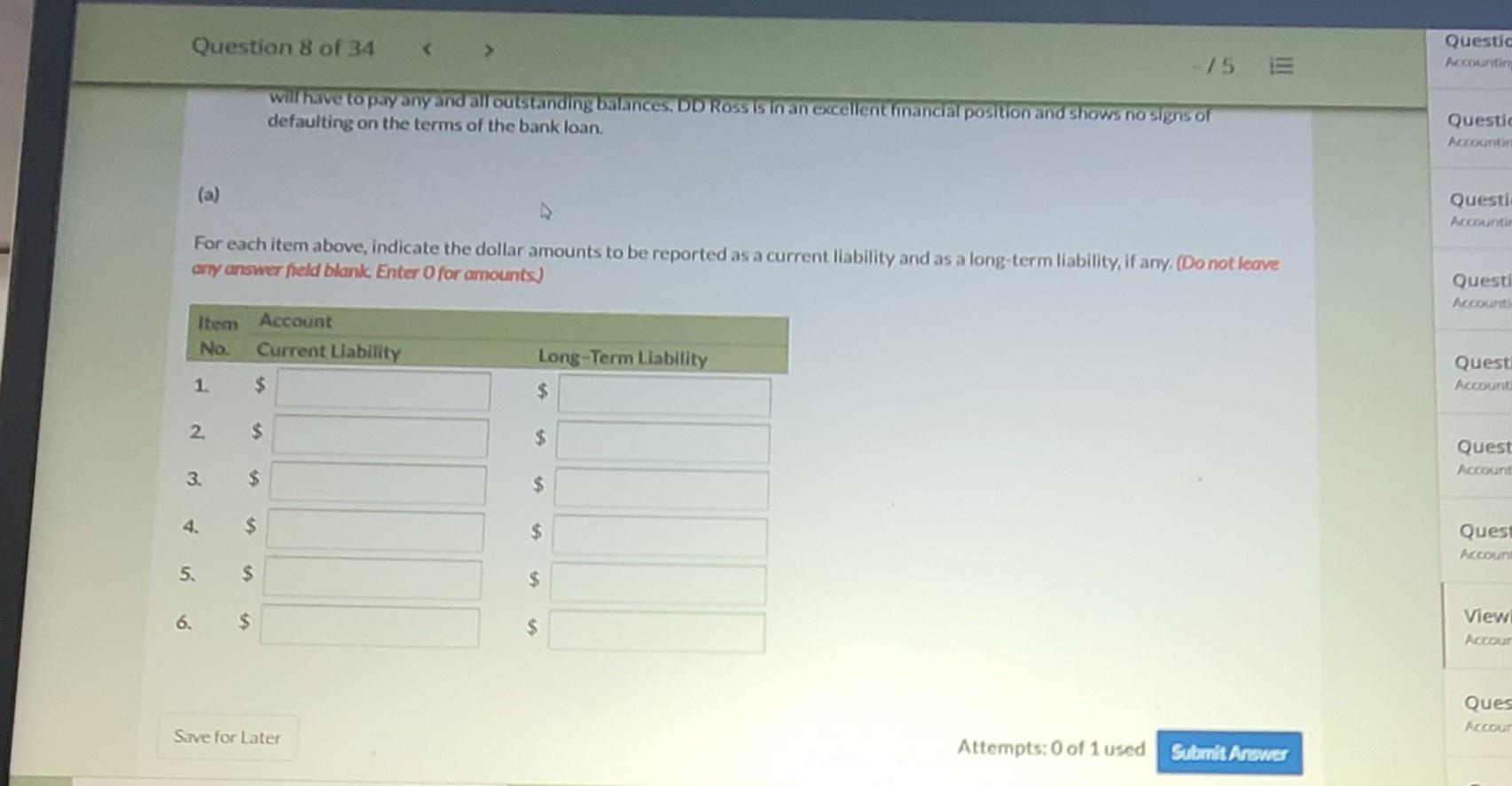

Question 8 of 34 > 75 E Pina Colada Corporation is preparing its December 31, 2020 statement of financial position. The following items may be reported as either current or long-term liabilities: 2 3 4. On December 15, 2020, Pina Colada declared a cash dividend of $3 per common share to shareholders of record on December 31. The dividend is payable on January 15, 2021. Pina Colada has issued 1.10 million common shares, Also, on December 31, Pina Colada declared a 10% stock dividend to shareholders of record on January 15, 2021. The dividend will be distributed on January 31, 2021. Pina Colada's common shares have a market value of $64 per share. At December 31, bonds payable of $160 million is outstanding. The bonds pay 7% interest every September 30 and mature in instalments of $40.0 million every September 30, beginning on September 30, 2021. At December 31, 2019, customer advances were $21 million. During 2020, Pina Colada collected $48 million in customer advances, and advances of $34 million were earned. At December 31, 2020, Pina Colada has an operating line of credit with a balance of $3,60 million outstanding For several years now, Pina Colada has successfully met all the conditions of this bank loan. If Pina Colada defaults on any of the loan conditions in any way, the bank has the right to demand payment of the loan Pina Colada is contingently liable for a bank loan in the amount of $31 million of its associated company, DD Ross Ltd. Pina Colada has guaranteed the bank that, should DD Ross default on the loan or any outstanding interest payable, Pina Colada will have to pay any and all outstanding balances. DD Ross is in an excellent hinancial position and shows no signs of defaulting on the terms of the bank loan. 5. 6. (a) For each item above, indicate the dollar amounts to be reported as a current liability and as a long-term liability, if any. (Do not leave any answer field blank. Enter O for amounts) Item Account Question 8 of 34 > Questid Accountin 15 E will have to pay any and all outstanding balances. DD ROSsis in an excellent financial position and shows no signs of defaulting on the terms of the bank loan. Questid Account Questi Account For each item above, indicate the dollar amounts to be reported as a current liability and as a long-term liability, if any. (Do not leave arty answer field blank Enter 0 for amounts) Questi Account Item Account No. Current Liability Long-Term Liability Questi Account 1 $ $ 2. $ $ Quest Account 3. $ $ 4 $ $ Ques Accoun 5. $ $ 6. $ S. View Accou Ques Accou Save for Later Attempts: 0 of 1 used Submit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started