Answered step by step

Verified Expert Solution

Question

1 Approved Answer

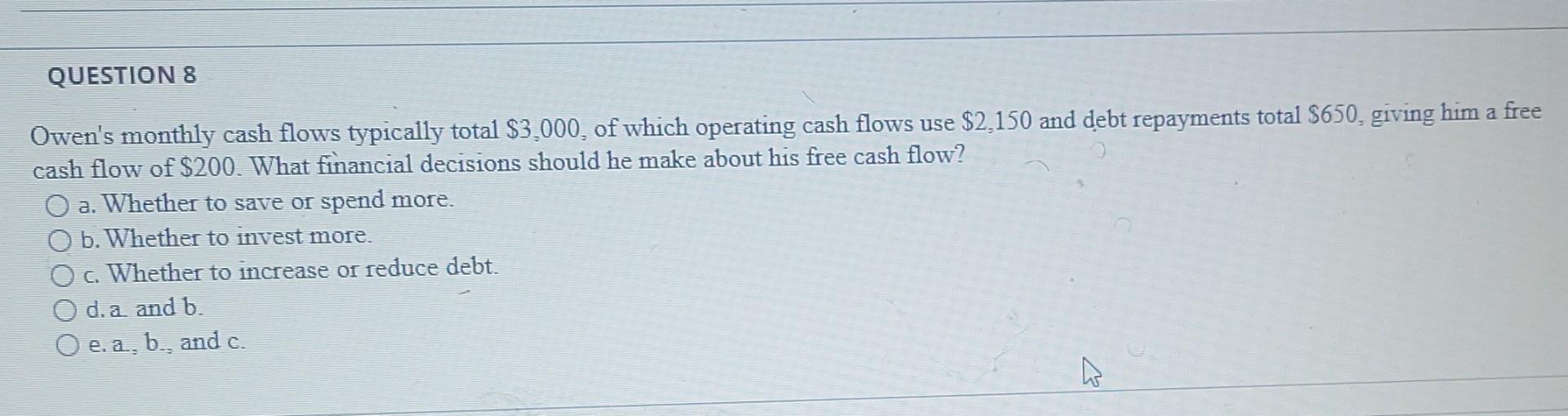

QUESTION 8 Owen's monthly cash flows typically total $3,000, of which operating cash flows use $2,150 and debt repayments total $650- giving him a free

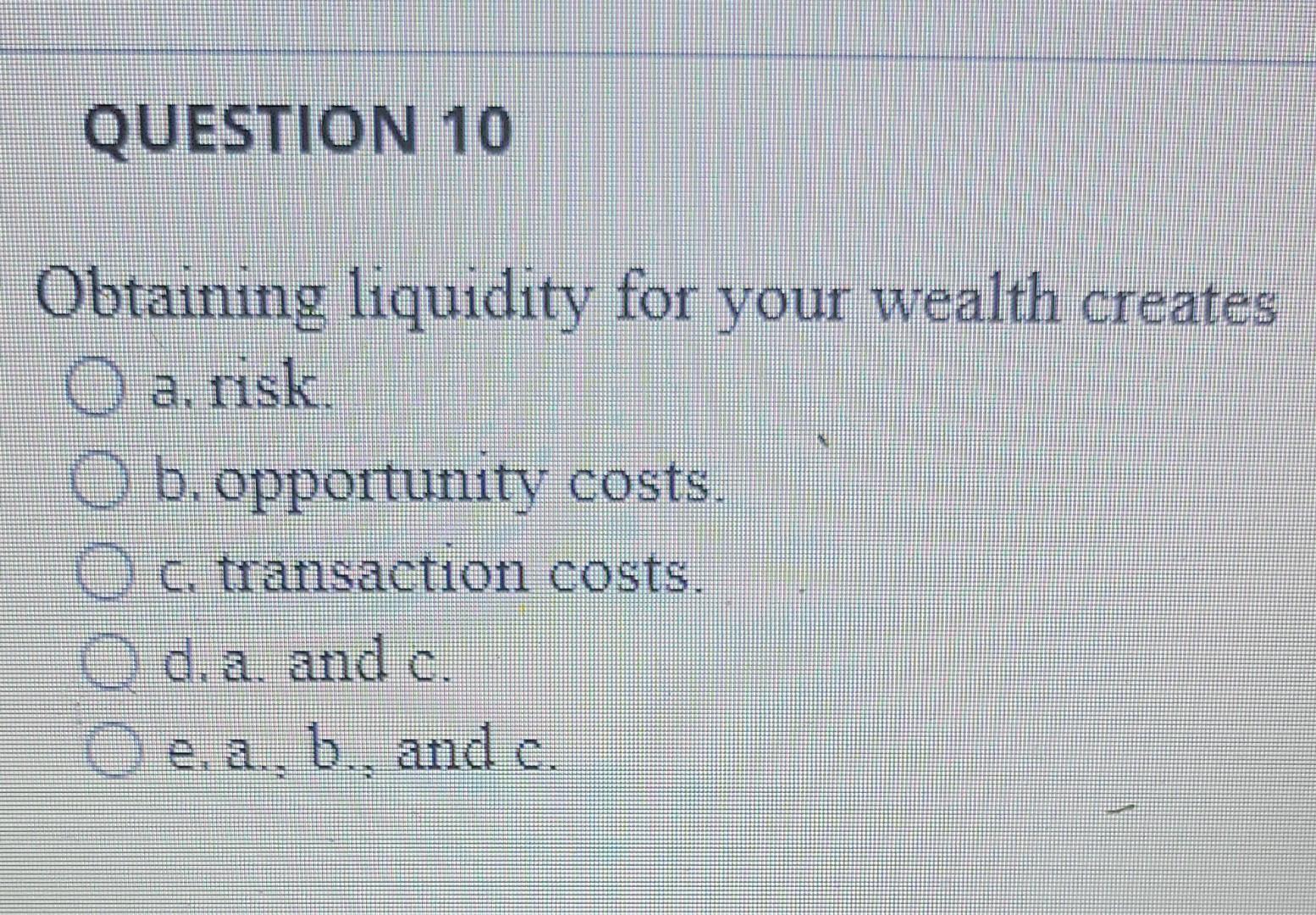

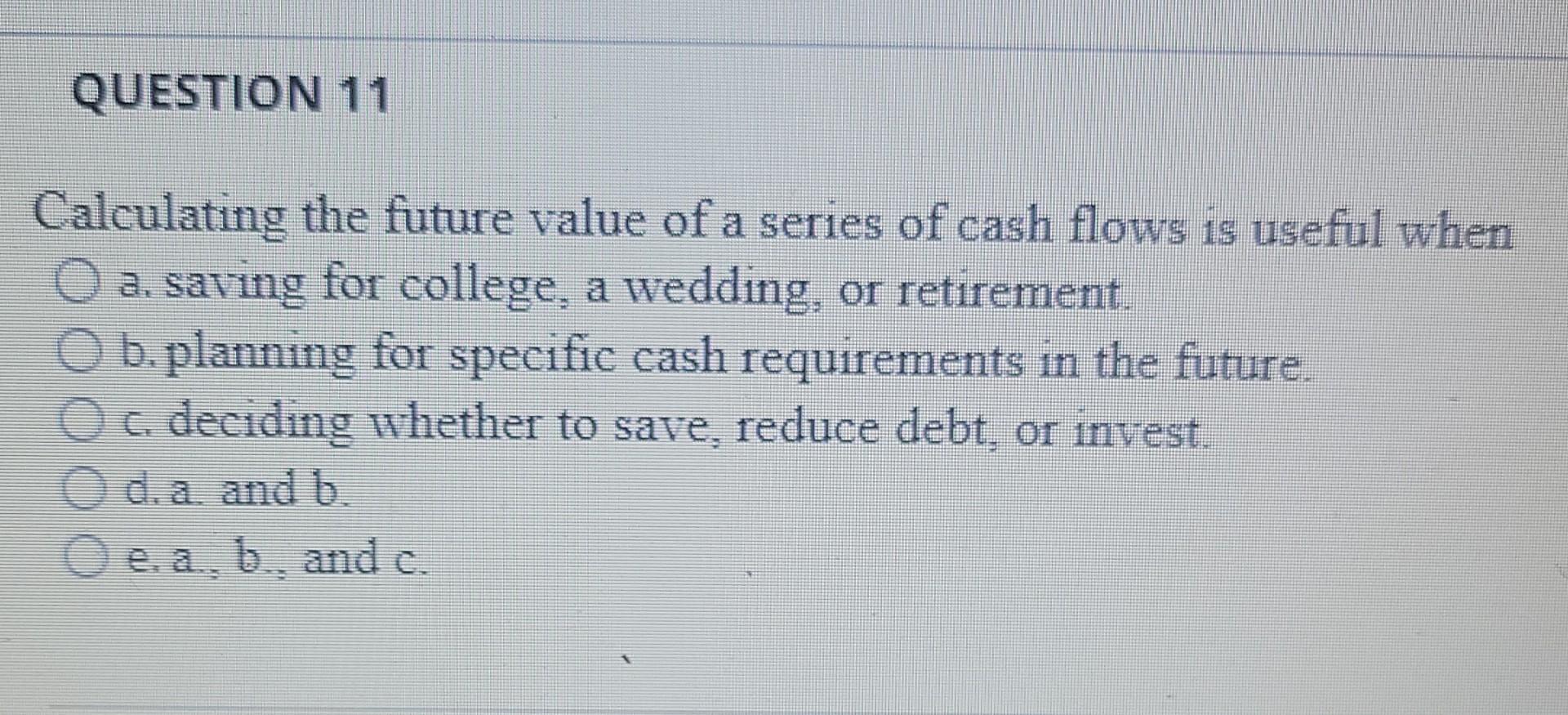

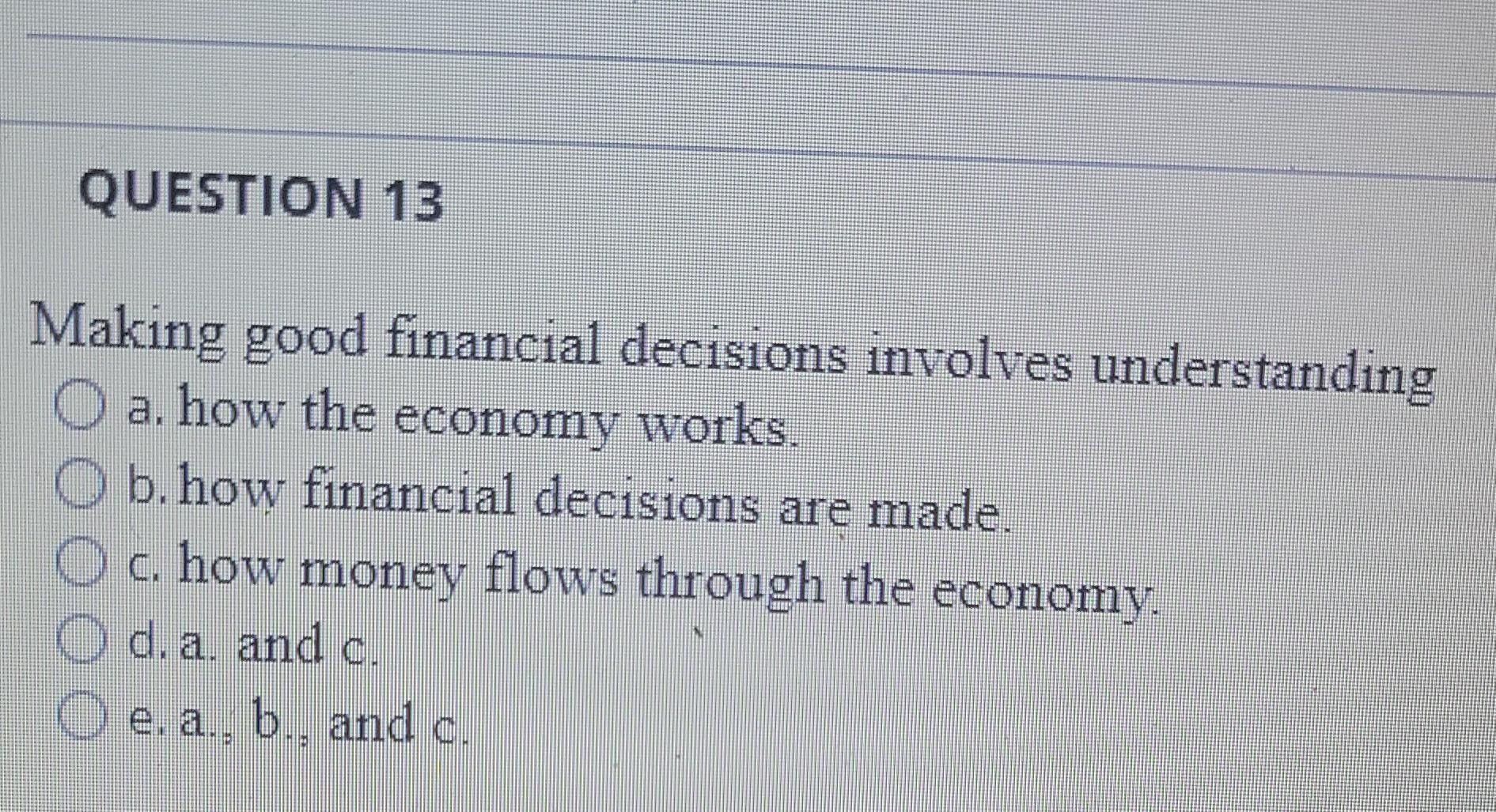

QUESTION 8 Owen's monthly cash flows typically total $3,000, of which operating cash flows use $2,150 and debt repayments total $650- giving him a free cash flow of $200. What financial decisions should he make about his free cash flow? a. Whether to save or spend more. O b. Whether to invest more. c. Whether to increase or reduce debt. d. a and b. O e.a. b., and c. QUESTION 10 Obtaining liquidity for your wealth creates O a, risk. O b. opportunity costs. O c. transaction costs. O da, and c. O e.a. b., and e. QUESTION 11 Calculating the future value of a series of cash flows is useful when O a. saving for college, a wedding, or retirement. O b. planning for specific cash requirements in the future. O c. deciding whether to save, reduce debt, or invest. oda and b. o e.a. b. and c. QUESTION 13 Making good financial decisions involves understanding a. how the economy works. b. how financial decisions are made. O c. how money flows through the economy. O d.a, and c. O e.a., b., and c

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started