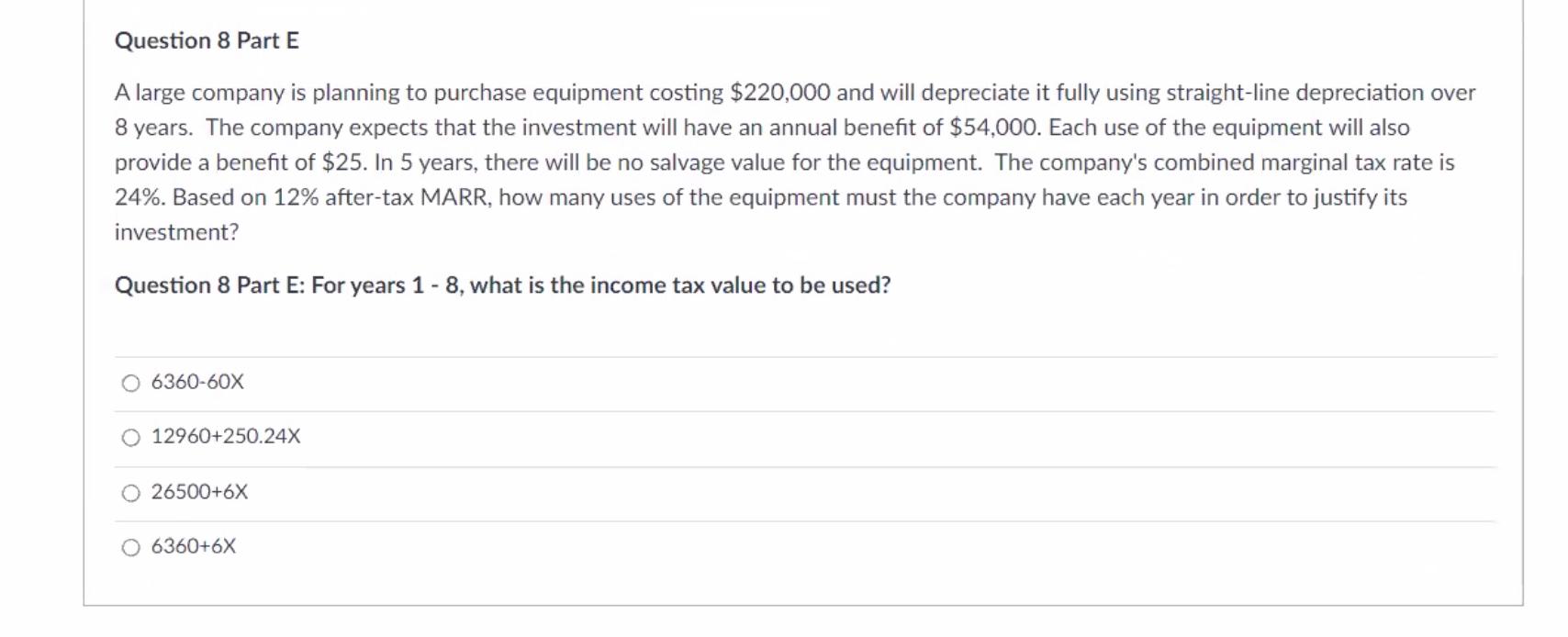

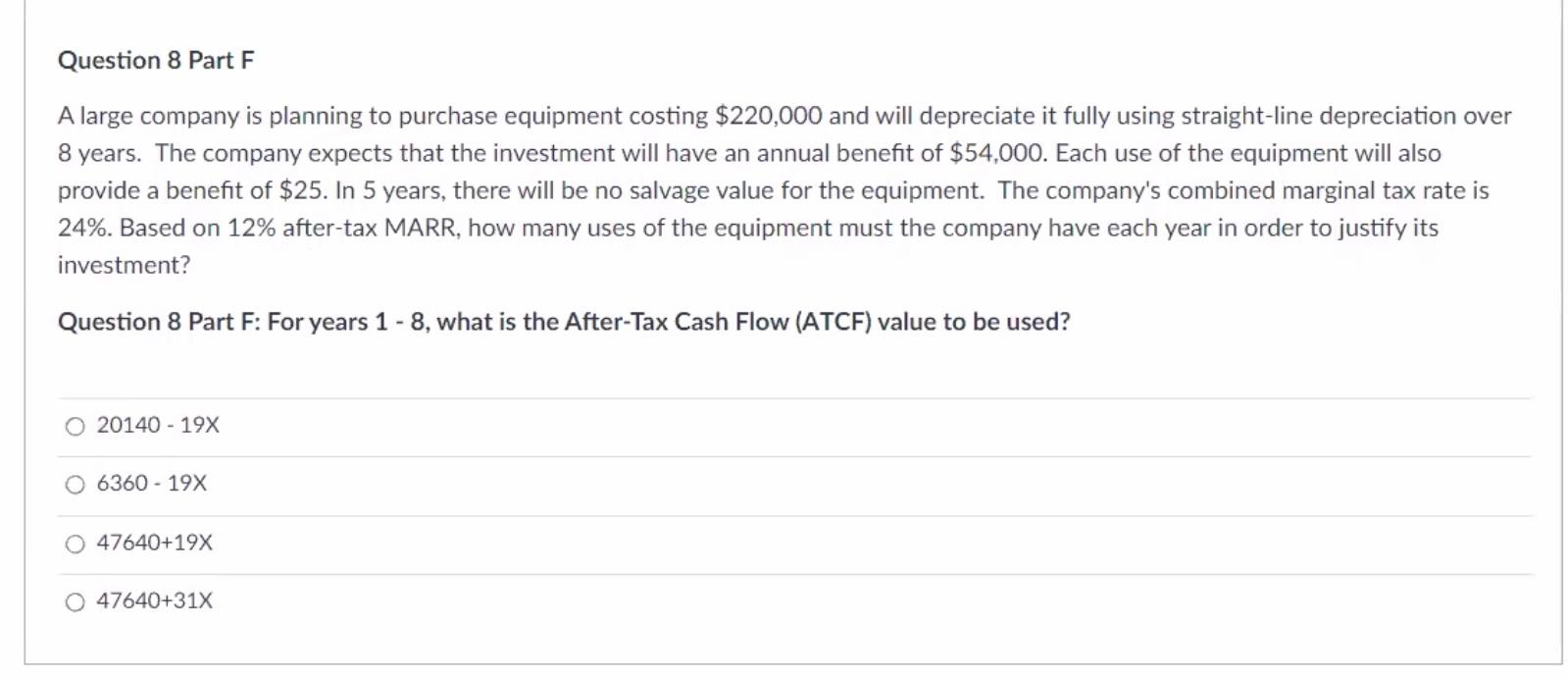

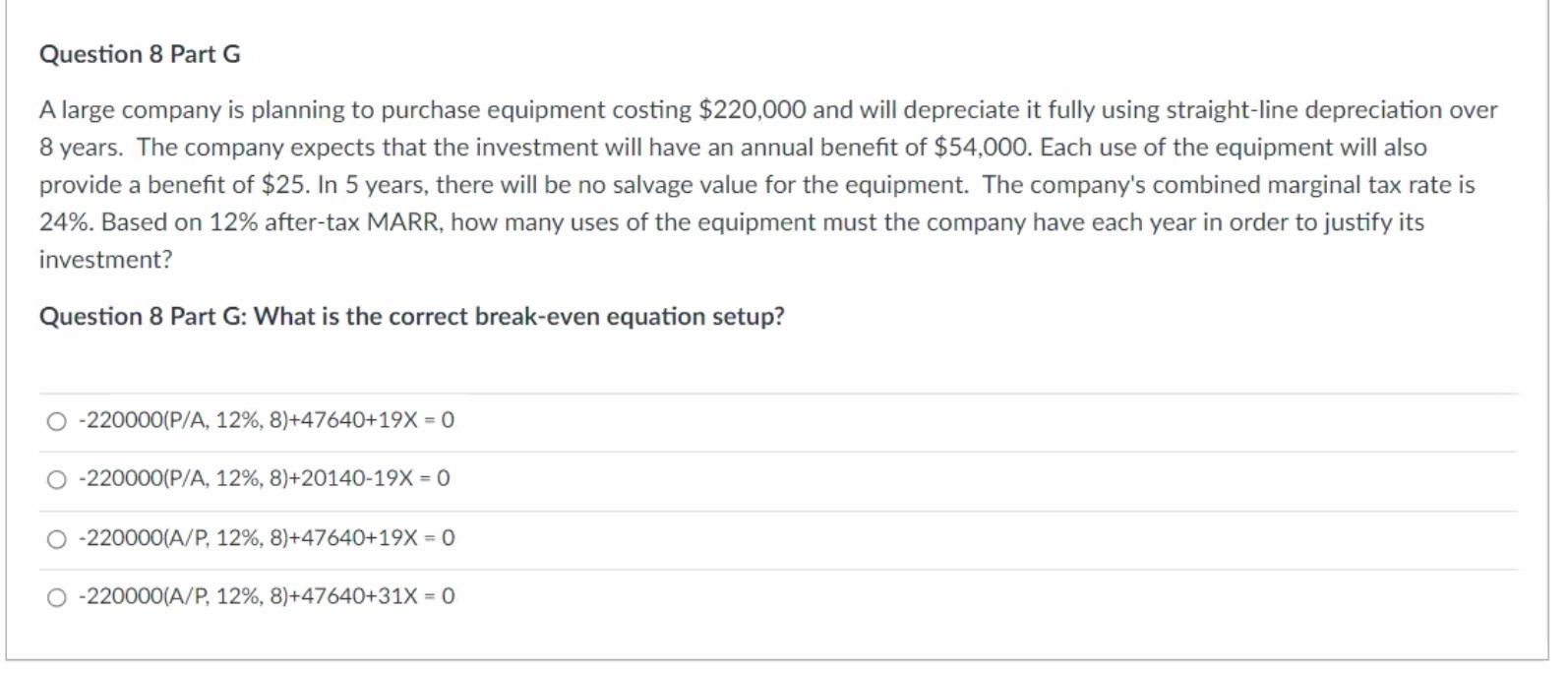

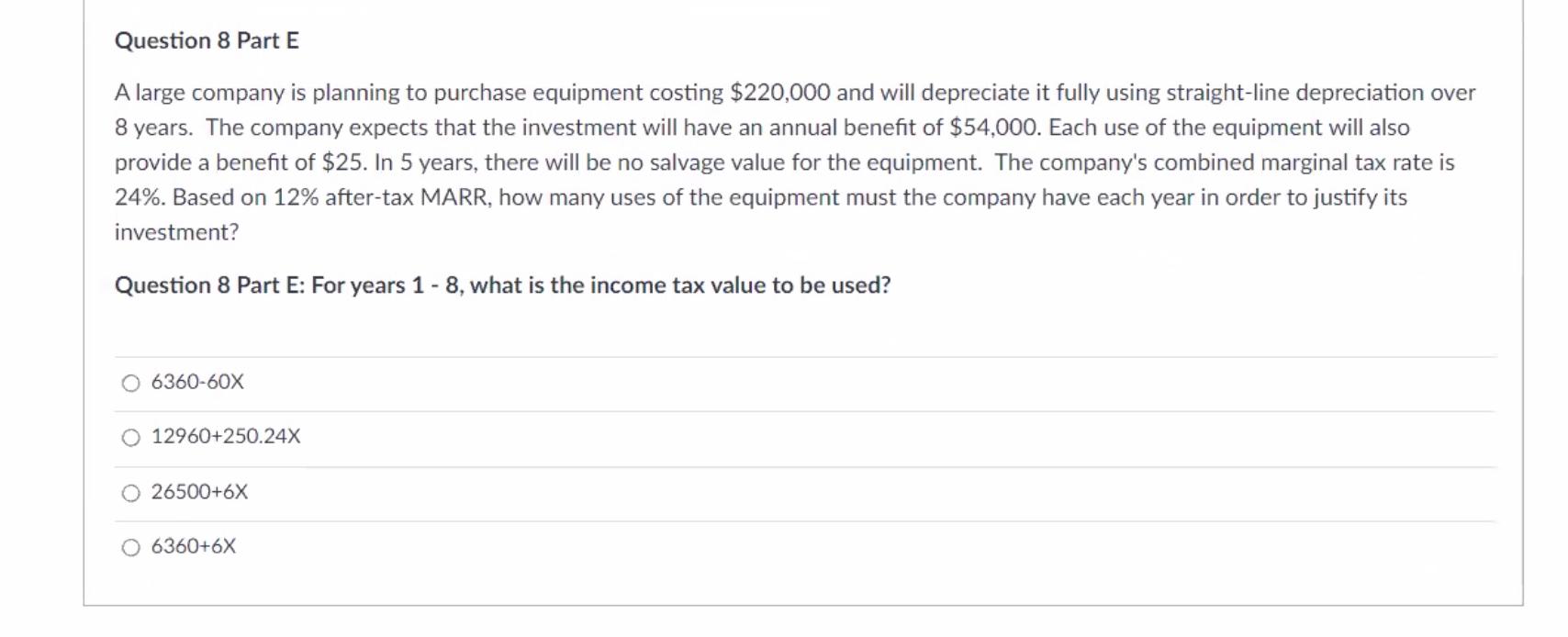

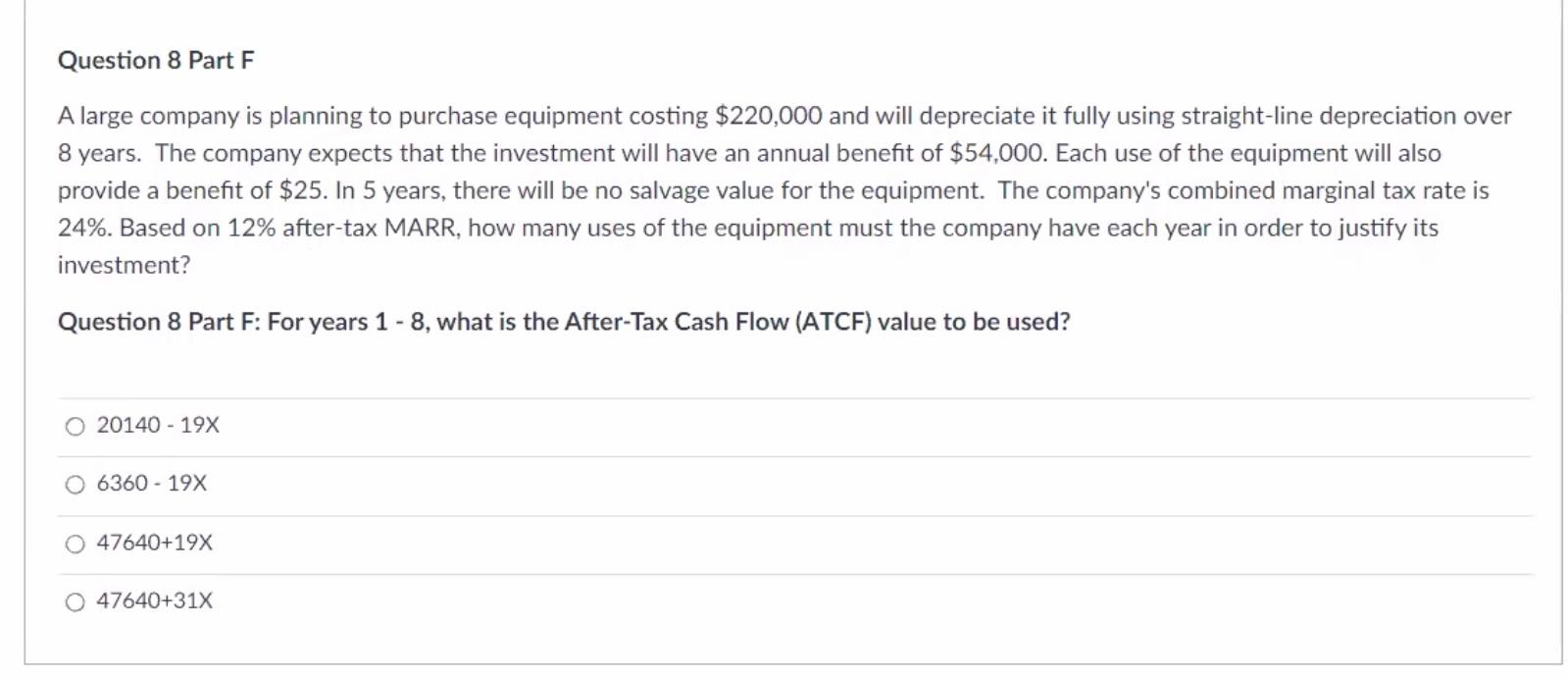

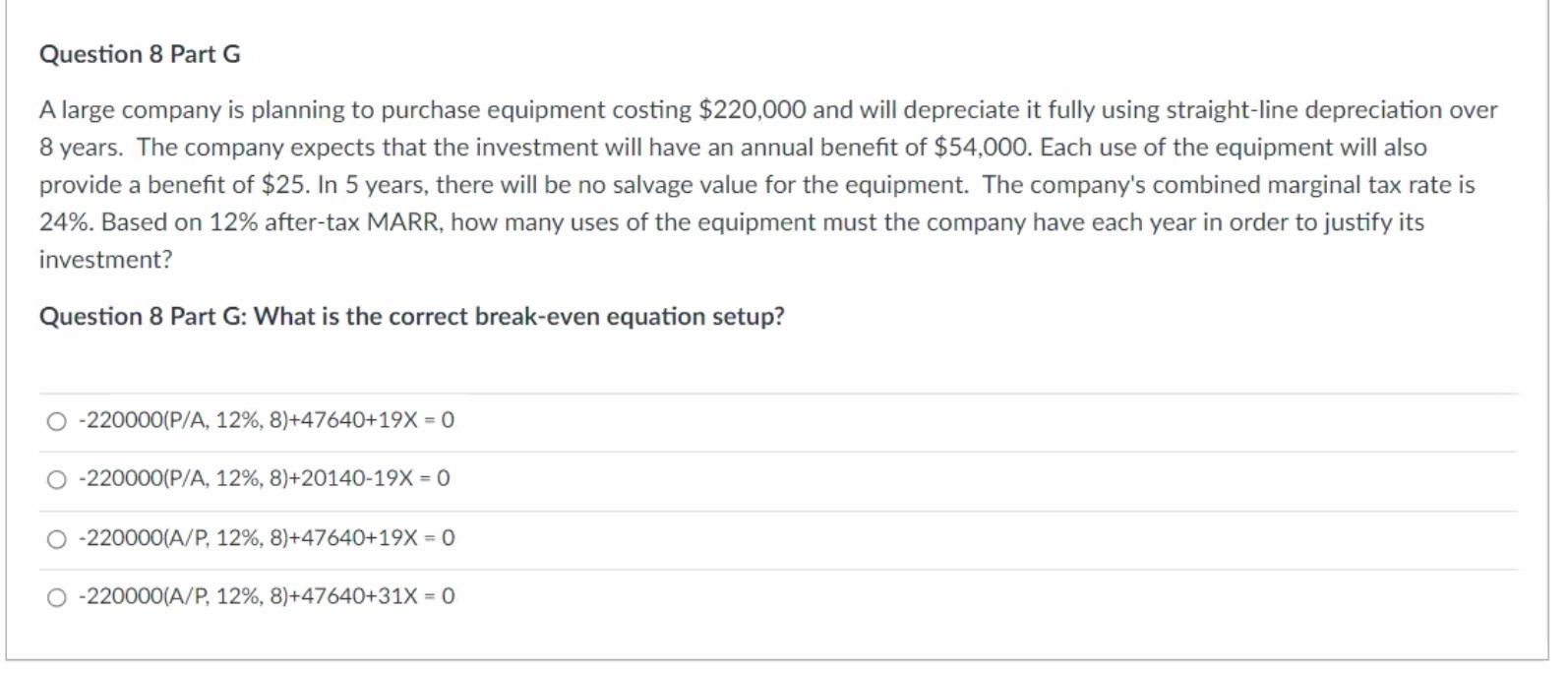

Question 8 Part E A large company is planning to purchase equipment costing $220,000 and will depreciate it fully using straight-line depreciation over 8 years. The company expects that the investment will have an annual benefit of $54,000. Each use of the equipment will also provide a benefit of $25. In 5 years, there will be no salvage value for the equipment. The company's combined marginal tax rate is 24%. Based on 12% after-tax MARR, how many uses of the equipment must the company have each year in order to justify its investment? Question 8 Part E: For years 1-8, what is the income tax value to be used? 6360-60X 12960+250.24X 0 26500+6X 6360+6X Question 8 Part F A large company is planning to purchase equipment costing $220,000 and will depreciate it fully using straight-line depreciation over 8 years. The company expects that the investment will have an annual benefit of $54,000. Each use of the equipment will also provide a benefit of $25. In 5 years, there will be no salvage value for the equipment. The company's combined marginal tax rate is 24%. Based on 12% after-tax MARR, how many uses of the equipment must the company have each year in order to justify its investment? Question 8 Part F: For years 1 - 8, what is the After-Tax Cash Flow (ATCF) value to be used? O 20140 - 19X O 6360 - 19X O 47640+19% O 47640+31X Question 8 Part G A large company is planning to purchase equipment costing $220,000 and will depreciate it fully using straight-line depreciation over 8 years. The company expects that the investment will have an annual benefit of $54,000. Each use of the equipment will also provide a benefit of $25. In 5 years, there will be no salvage value for the equipment. The company's combined marginal tax rate is 24%. Based on 12% after-tax MARR, how many uses of the equipment must the company have each year in order to justify its investment? Question 8 Part G: What is the correct break-even equation setup? -220000(P/A, 12%, 8)+47640+19X = 0 O 220000(P/A, 12%, 8)+20140-19x = 0 O 220000(A/P, 12%, 8)+47640+19x = 0 O-220000(A/P, 12%, 8)+47640+31% = 0 Question 8 Part 1 A large company is planning to purchase equipment costing $220,000 and will depreciate it fully using straight-line depreciation over 8 years. The company expects that the investment will have an annual benefit of $54,000. Each use of the equipment will also provide a benefit of $25. In 5 years, there will be no salvage value for the equipment. The company's combined marginal tax rate is 24%. Based on 12% after-tax MARR, how many uses of the equipment must the company have each year in order to justify its investment? Question 8 Part H: What is the break-even value