Answered step by step

Verified Expert Solution

Question

1 Approved Answer

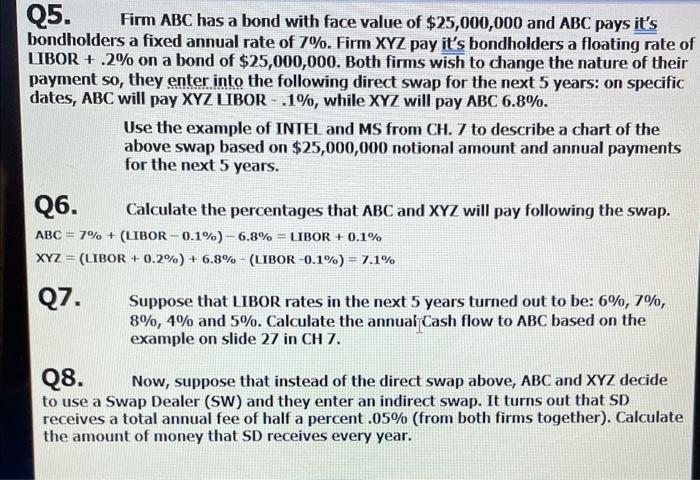

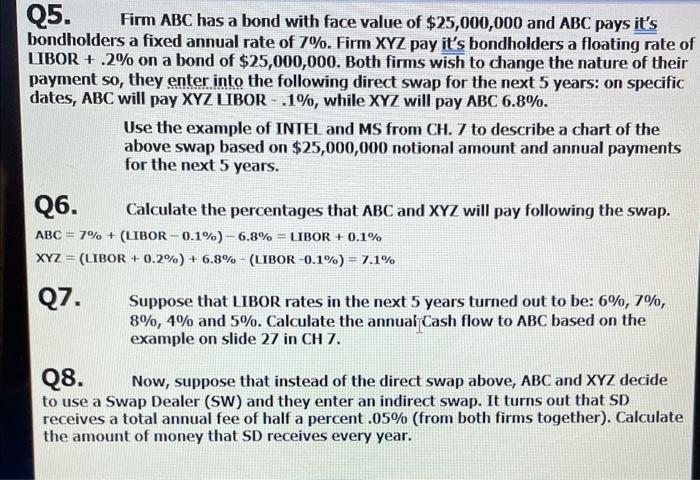

question 8 please Q5. Firm ABC has a bond with face value of $25,000,000 and ABC pays it's bondholders a fixed annual rate of 7%.

question 8 please

Q5. Firm ABC has a bond with face value of $25,000,000 and ABC pays it's bondholders a fixed annual rate of 7%. Firm XYZ pay it's bondholders a floating rate of UBOR +.2% on a bond of $25,000,000. Both firms wish to change the nature of their payment so, they enter into the following direct swap for the next 5 years: on specific dates, ABC will pay XYZ IIBOR - .1%, while XYZ will pay ABC6.8%. Use the example of INTEL and MS from CH. 7 to describe a chart of the above swap based on $25,000,000 notional amount and annual payments for the next 5 years. Q6. Calculate the percentages that ABC and XYZ will pay following the swap. ABC=7%+(IIBOR0.1%)6.8%=1IBOR+0.1% XYZ=(LIBOR+0.2%)+6.8%(LIBOR0.1%)=7.1% Q7. Suppose that IBOR rates in the next 5 years turned out to be: 6%,7%, 8%,4% and 5%. Calculate the annual Cash flow to ABC based on the example on slide 27 in CH7. Q8. Now, suppose that instead of the direct swap above, ABC and XYZ decide to use a Swap Dealer (SW) and they enter an indirect swap. It turns out that SD receives a total annual fee of half a percent .05\% (from both firms together). Calculate the amount of money that SD receives every year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started