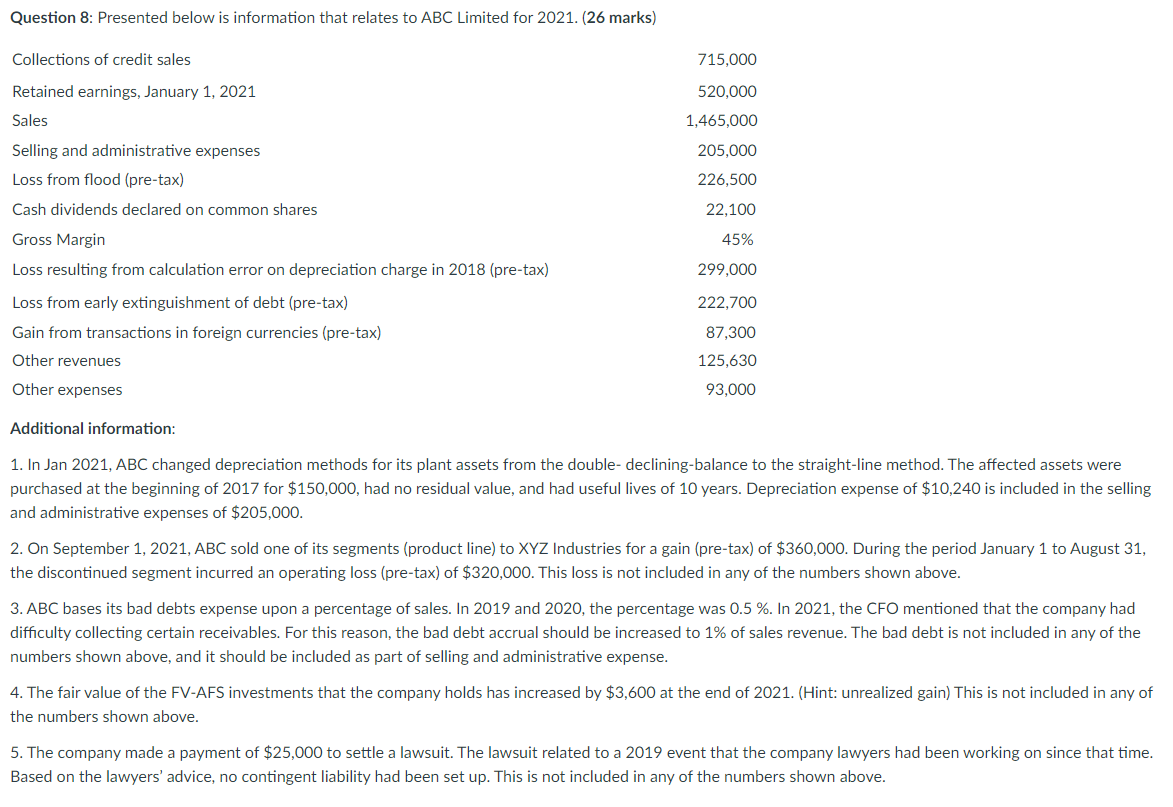

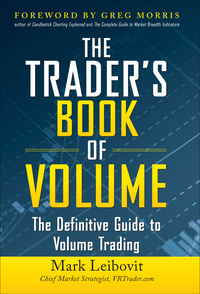

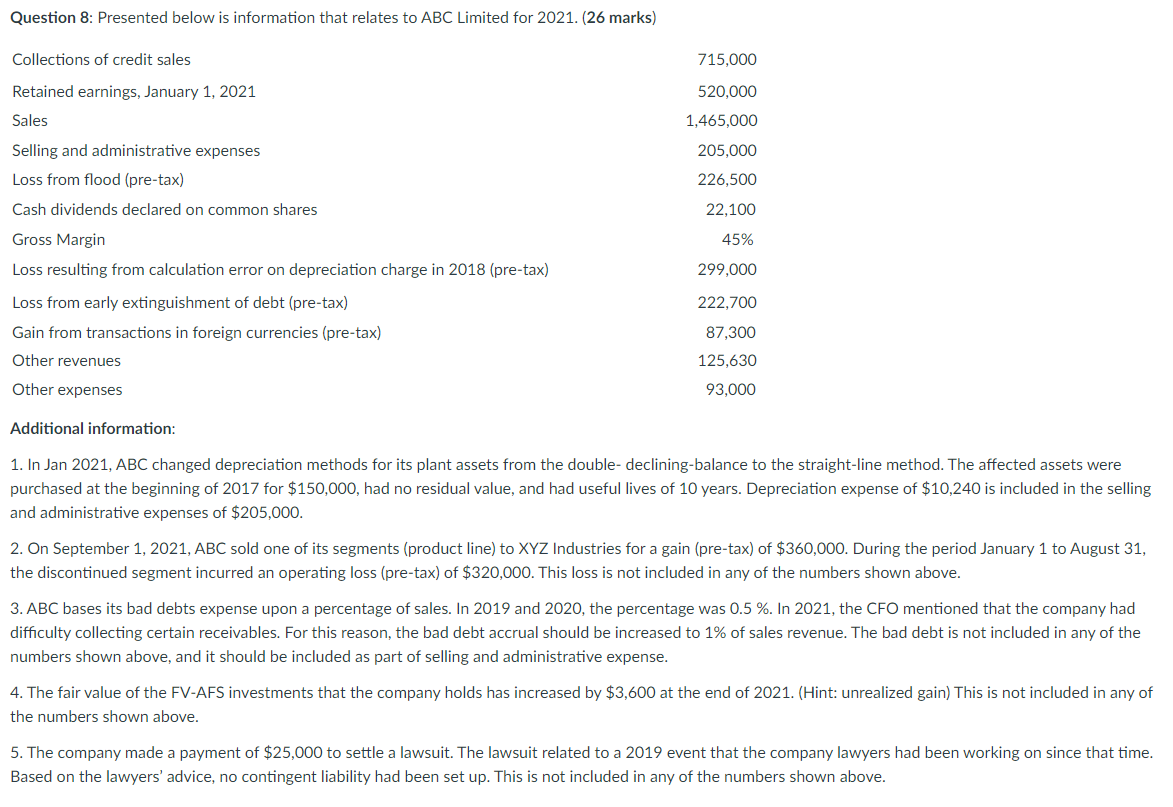

Question 8: Presented below is information that relates to ABC Limited for 2021. (26 marks) Collections of credit sales 715,000 520,000 1,465,000 205,000 226,500 22,100 Retained earnings, January 1, 2021 Sales Selling and administrative expenses Loss from flood (pre-tax) Cash dividends declared on common shares Gross Margin Loss resulting from calculation error on depreciation charge in 2018 (pre-tax) Loss from early extinguishment of debt (pre-tax) Gain from transactions in foreign currencies (pre-tax) Other revenues 45% 299,000 222,700 87,300 125,630 Other expenses 93,000 Additional information: 1. In Jan 2021, ABC changed depreciation methods for its plant assets from the double-declining-balance to the straight-line method. The affected assets were purchased at the beginning of 2017 for $150,000, had no residual value, and had useful lives of 10 years. Depreciation expense of $10,240 is included in the selling and administrative expenses of $205,000. 2. On September 1, 2021, ABC sold one of its segments (product line) to XYZ Industries for a gain (pre-tax) of $360,000. During the period January 1 to August 31, the discontinued segment incurred an operating loss (pre-tax) of $320,000. This loss is not included in any of the numbers shown above. 3. ABC bases its bad debts expense upon a percentage of sales. In 2019 and 2020, the percentage was 0.5 %. In 2021, the CFO mentioned that the company had difficulty collecting certain receivables. For this reason, the bad debt accrual should be increased to 1% of sales revenue. The bad debt is not included in any of the numbers shown above, and it should be included as part of selling and administrative expense. 4. The fair value of the FV-AFS investments that the company holds has increased by $3,600 at the end of 2021. (Hint: unrealized gain) This is not included in any of the numbers shown above. 5. The company made a payment of $25,000 to settle a lawsuit. The lawsuit related to a 2019 event that the company lawyers had been working on since that time. Based on the lawyers' advice, no contingent liability had been set up. This is not included in any of the numbers shown above. REQUIRED: 1) In good form, prepare a multiple-step income statement for 2021. Assume a 20% income tax rate and that 15,800 common shares were outstanding during the year. (Hint: include the calculation for Earnings per share) (24 Marks) 2) Briefly discuss the limitations of the income statement. (2 Marks) Question 8: Presented below is information that relates to ABC Limited for 2021. (26 marks) Collections of credit sales 715,000 520,000 1,465,000 205,000 226,500 22,100 Retained earnings, January 1, 2021 Sales Selling and administrative expenses Loss from flood (pre-tax) Cash dividends declared on common shares Gross Margin Loss resulting from calculation error on depreciation charge in 2018 (pre-tax) Loss from early extinguishment of debt (pre-tax) Gain from transactions in foreign currencies (pre-tax) Other revenues 45% 299,000 222,700 87,300 125,630 Other expenses 93,000 Additional information: 1. In Jan 2021, ABC changed depreciation methods for its plant assets from the double-declining-balance to the straight-line method. The affected assets were purchased at the beginning of 2017 for $150,000, had no residual value, and had useful lives of 10 years. Depreciation expense of $10,240 is included in the selling and administrative expenses of $205,000. 2. On September 1, 2021, ABC sold one of its segments (product line) to XYZ Industries for a gain (pre-tax) of $360,000. During the period January 1 to August 31, the discontinued segment incurred an operating loss (pre-tax) of $320,000. This loss is not included in any of the numbers shown above. 3. ABC bases its bad debts expense upon a percentage of sales. In 2019 and 2020, the percentage was 0.5 %. In 2021, the CFO mentioned that the company had difficulty collecting certain receivables. For this reason, the bad debt accrual should be increased to 1% of sales revenue. The bad debt is not included in any of the numbers shown above, and it should be included as part of selling and administrative expense. 4. The fair value of the FV-AFS investments that the company holds has increased by $3,600 at the end of 2021. (Hint: unrealized gain) This is not included in any of the numbers shown above. 5. The company made a payment of $25,000 to settle a lawsuit. The lawsuit related to a 2019 event that the company lawyers had been working on since that time. Based on the lawyers' advice, no contingent liability had been set up. This is not included in any of the numbers shown above. REQUIRED: 1) In good form, prepare a multiple-step income statement for 2021. Assume a 20% income tax rate and that 15,800 common shares were outstanding during the year. (Hint: include the calculation for Earnings per share) (24 Marks) 2) Briefly discuss the limitations of the income statement. (2 Marks)