Answered step by step

Verified Expert Solution

Question

1 Approved Answer

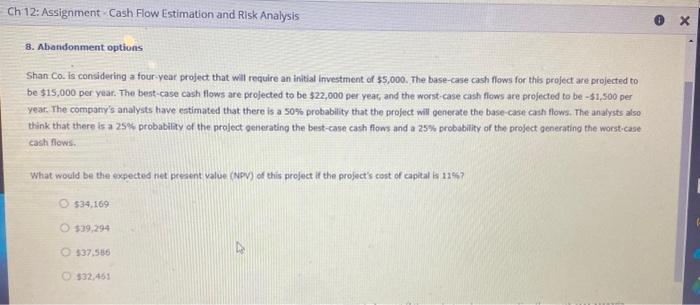

question 8 Shan Co. is considering a four-year project that will require an initial investment of 35,000 . The base-case cash flows for this project

question 8

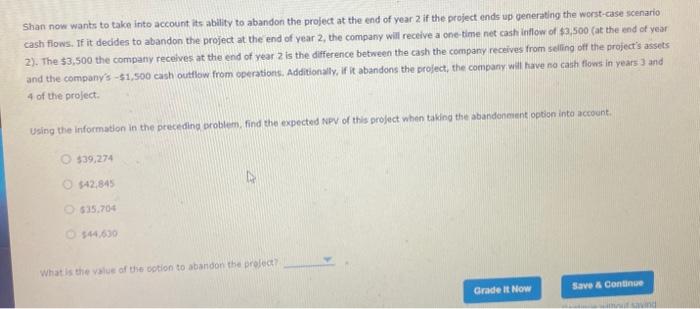

Shan Co. is considering a four-year project that will require an initial investment of 35,000 . The base-case cash flows for this project are projected to be $15,000 per year. The best-case cash flows are projected to be $22,000 per yeat, and the worst-case cash flows are projected to be - $1,500 per year. The company's analysts have estimated that there is a so\% probability that the project will generate the base-case cash flows. The analysts also think that there is a 25% probability of the project generating the best-case cash ffows and a 25% probability of the project generating the worst-case cash flewis. What would be the expected net preaent value (NPV) of this project if the project's cost of capital is 11 os? 534,169 539,294 537,516 532.441 Shan now wants to take into account its ability to abandon the project at the end of year 2 if the project ends up generating the worst-case scenario cash flows. If it decides to abandon the project at the end of year 2 , the company will receive a one-time net cash inilow of 53500 . fat the end of year 2). The $3,500 the company receives at the end of year z is the difference between the cash the company receives from seiling off the groject's assets and the company's - 51,500 cash outflow from operations. Additionally, if it abandons the project, the company wit have no cash fiows in years 3 and 4 of the prolect. Using the information in the preceding problem, find the expected NFY of this project when taking the abandencient option into account. What is the value of the ootion to abandon the prolect

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started