Answered step by step

Verified Expert Solution

Question

1 Approved Answer

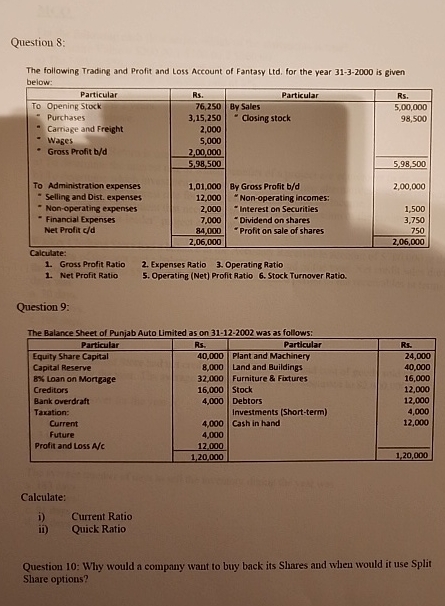

Question 8: The following Trading and Profit and Loss Account of Fantasy Ltd. for the year 31-3-2000 is given below: Particular Rs. Particular To

Question 8: The following Trading and Profit and Loss Account of Fantasy Ltd. for the year 31-3-2000 is given below: Particular Rs. Particular To Opening Stock 76,250 By Sales Purchases 3,15,250 Closing stock Rs. 5,00,000 98,500 Carriage and Freight 2,000 -Wages Gross Profit b/d 5,000 2,00,000 5,98,500 5,98,500 To Administration expenses Selling and Dist. expenses Non-operating expenses Financial Expenses Net Profit c/d Calculate: 1,01,000 By Gross Profit b/d 2,00,000 12,000 "Non-operating incomes: 2,000 "Interest on Securities 1,500 7,000 Dividend on shares 84,000 "Profit on sale of shares 2,06,000 3,750 750 2,06,000 1. Gross Profit Ratio 2. Expenses Ratio 3. Operating Ratio 1. Net Profit Ratio 5. Operating (Net) Profit Ratio 6. Stock Turnover Ratio. Question 9: The Balance Sheet of Punjab Auto Limited as on 31-12-2002 was as follows: Particular Equity Share Capital Capital Reserve 8% Loan on Mortgage Rs. Particular 40,000 Plant and Machinery Rs. 24,000 8,000 Land and Buildings 40,000 32,000 Furniture & Fixtures 16,000 Creditors Bank overdraft Taxation: Current Future 16,000 Stock 12,000 4,000 Debtors 12,000 Investments (Short-term) 4,000 4,000 Cash in hand 12,000 4,000 Profit and Loss A/c 12,000 1,20,000 1,20,000 Calculate: i) Current Ratio ii) Quick Ratio Question 10: Why would a company want to buy back its Shares and when would it use Split Share options?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started