Question

Question 8 What is the effective rate of return per year if the annual rate of return is 9%, compounded continuously? Round off your answer

Question 8 What is the effective rate of return per year if the annual rate of return is 9%, compounded continuously? Round off your answer to four digits after the decimal point and state your answer as a percentage rate (i.e. 1.2345) please do not include '%' in your answer. Just input the numerical value Question 9 Suppose you bought three shares of RAFA on January 1 at a price of $64 per share. You subsequently sold one share at $69 a year later on January 1, and sold the other two shares a year after that for $62 each. At the same time, at the end of every year on December 31, shares of RAFA paid $3 dividend per share. What is your dollar-weighted or internal rate of return on this two-year investment? Round off your answer to four digits after the decimal point and state your answer as a percentage rate (i.e. 1.2345% as 1.2345) Question 10 Suppose you bought three shares of RAFA on January 1 at a price of $64 per share. You subsequently sold one share at $69 a year later on January 1, and sold the other two shares a year after that for $62 each. At the same time, at the end of every year on December 31, shares of RAFA paid $3 dividend per share. What is your time-weighted return? Round off your answer to four digits after the decimal point and state your answer as a percentage rate (i.e. 1.2345% as 1.2345)

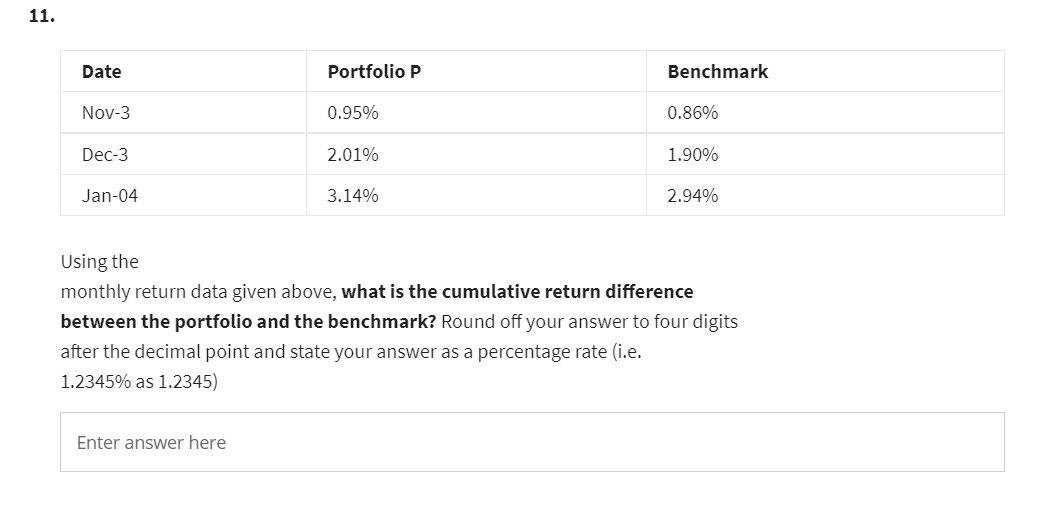

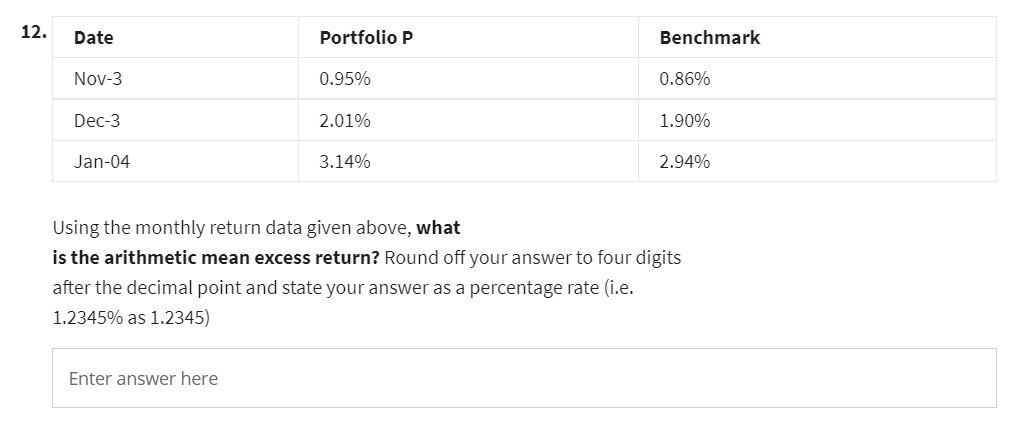

11. Date Nov-3 Dec-3 Jan-04 Portfolio P Enter answer here 0.95% 2.01% 3.14% Benchmark 0.86% 1.90% 2.94% Using the monthly return data given above, what is the cumulative return difference between the portfolio and the benchmark? Round off your answer to four digits after the decimal point and state your answer as a percentage rate (i.e. 1.2345% as 1.2345) 12. Date Nov-3 Dec-3 Jan-04 Portfolio P Enter answer here 0.95% 2.01% 3.14% Benchmark 0.86% 1.90% 2.94% Using the monthly return data given above, what is the arithmetic mean excess return? Round off your answer to four digits after the decimal point and state your answer as a percentage rate (i.e. 1.2345% as 1.2345)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started