Question

Question #8 XYZ Company, a 'for-profit' business, had revenues of $15 million in 2018. Expenses other than depreciation totaled 75 percent of revenues, and

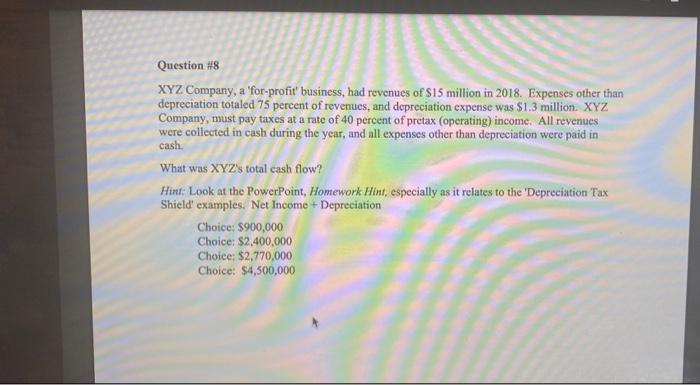

Question #8 XYZ Company, a 'for-profit' business, had revenues of $15 million in 2018. Expenses other than depreciation totaled 75 percent of revenues, and depreciation expense was $1.3 million. XYZ Company, must pay taxes at a rate of 40 percent of pretax (operating) income. All revenues were collected in cash during the year, and all expenses other than depreciation were paid in cash. What was XYZ's total cash flow? Hint: Look at the PowerPoint, Homework Hint, especially as it relates to the 'Depreciation Tax Shield' examples. Net Income + Depreciation Choice: $900,000 Choice: $2,400,000 Choice: $2,770,000 Choice: $4,500,000

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

The image youve provided shows a question that is somewhat hard to read due to the glare on the scre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Management Accounting

Authors: Charles T. Horngren, Gary L. Sundem, William O. Stratton, Phillip Beaulieu

6th Canadian edition

013257084X, 1846589207, 978-0132570848

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App