Answered step by step

Verified Expert Solution

Question

1 Approved Answer

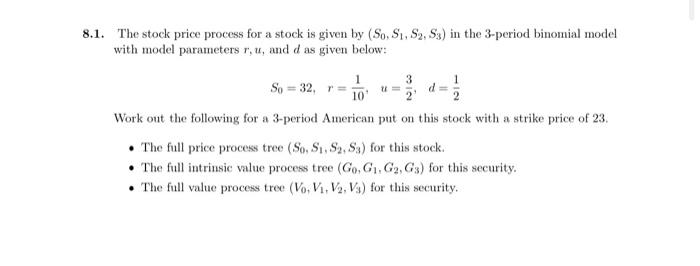

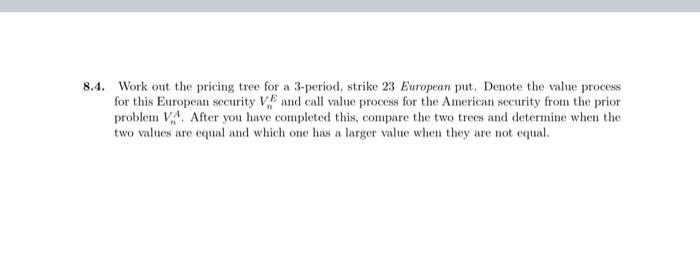

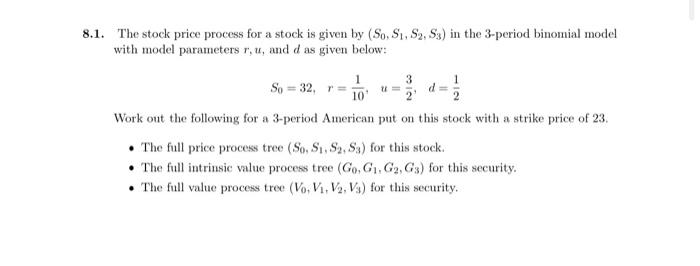

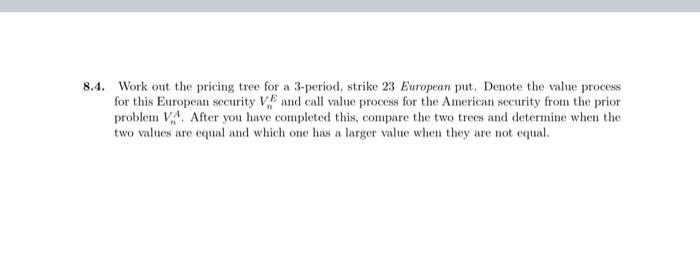

question 8.4 plz 8.1. The stock price process for a stock is given by (S0, S1, S2, S3) in the 3-period binomial model with model

question 8.4 plz

8.1. The stock price process for a stock is given by (S0, S1, S2, S3) in the 3-period binomial model with model parameters ru, and d as given below: 3 1 10 U d So = 32 Work out the following for a 3-period American put on this stock with a strike price of 23 The full price process tree (S0, S1,S2,S3) for this stock. The full intrinsic value process tree (Go, G1, G2, G3) for this security. . The full value process tree (V, VI, V2, V3) for this security. 8.4. Work out the pricing tree for a 3-period, strike 23 European put. Denote the value process for this European security and call value process for the American security from the prior problem V.. After you have completed this, compare the two trees and determine when the two values are equal and which one has a larger value when they are not equal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started