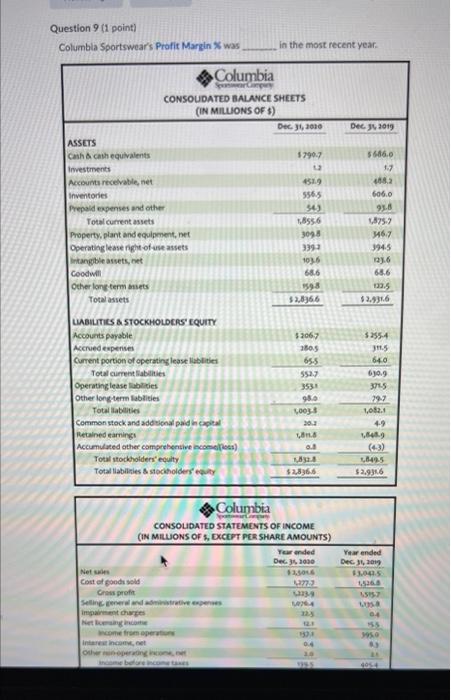

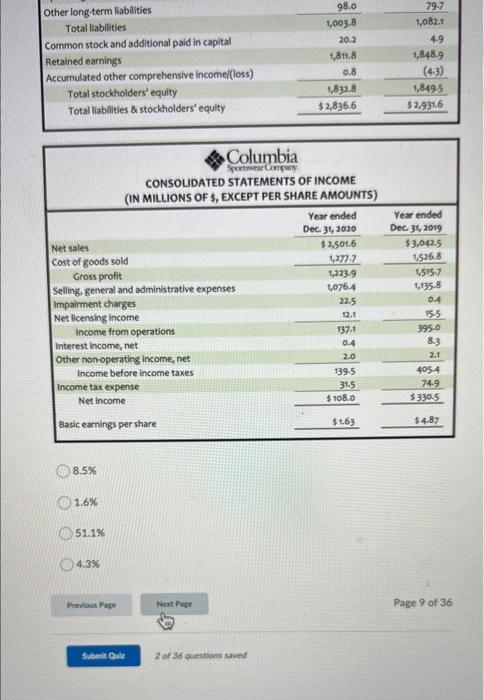

Question 9 (1 point) Columbia Sportswear's Profit Margin % was in the most recent year Columbia Dec. 1019 CONSOUDATED BALANCE SHEETS (IN MILLIONS OF $) Dec 31, 2010 ASSETS cash cash equivalents 5790.7 Inwestments Accounts receivable net 4519 Inventories 556.5 Prepaid expenses and other Total current assets 1956 Property, plant and equipment.net 3098 Operating lease of use assets 3395 Intangible assets, 1036 Goodwill 686 Other long-term sets Total assets $2,8366 543 56860 17 6883 6060 93.8 1875- 3467 3945 12.6 65.6 $2.931.6 LIABILITIES STOCKHOLDERS' EQUITY Accounts payable Accrued expenses Current portion of operating lease abilities Total current abilities Operating tease abilities Other long-term labilities Total abilities Common stock and additional pain capital Retained earnings Accumulated other comprehensive in.com) Total stockholders' equity Total abilities & stockholders $2067 2005 655 5527 3531 956 0033 202 $255.4 1.5 640 60.9 371-5 1,082.1 49 42 (43) $2.8966 $2.9316 Columbia CONSOLIDATED STATEMENTS OF INCOME (IN MILLIONS OF 5. EXCEPT PER SHARE AMOUNTS) Year ended Dec 31, 2010 Net $3,5006 Cost of goods sold 72 Cross profit 139 Selling and over impairment we Met income Income from per intestino Othe wong 20 Year ended Dec. 20 53.045 15266 04 95.0 3 04 Other long-term liabilities Total liabilities Common stock and additional paid in capital Retained earnings Accumulated other comprehensive Income (loss) Total stockholders' equity Total liabilities & stockholders' equity 98.0 1,003.8 20.2 1811.8 0.8 1,832.8 $2,836.6 79.7 1,082.1 4.9 1,848,9 (4-3) 1,849.5 $2.931.6 Columbia Sportwear Company CONSOLIDATED STATEMENTS OF INCOME (IN MILLIONS OF $, EXCEPT PER SHARE AMOUNTS) Year ended Dec 31, 2020 Net sales $ 2,501.6 Cost of goods sold 1,277.7 Gross profit 1223.9 Selling, general and administrative expenses 1,076.4 Impairment charges 22.5 Net licensing income 12.1 Income from operations 137.1 Interest Income, net 0.4 Other non-operating income, net 2.0 Income before income taxes 139.5 Income tax expense 31.5 Net Income $ 108.0 Basic earnings per share $1.63 Year ended Dec 31, 2019 $3,043.5 1.526.8 1515-7 1,135.8 0.4 15-5 395.0 8.3 2.1 405 4 74-9 $330.5 $4.87 8.5% 1.6% 51.1% 4.3% Previous Page Next Page Page 9 of 36 Submit Quit 2 of 36 questions saved