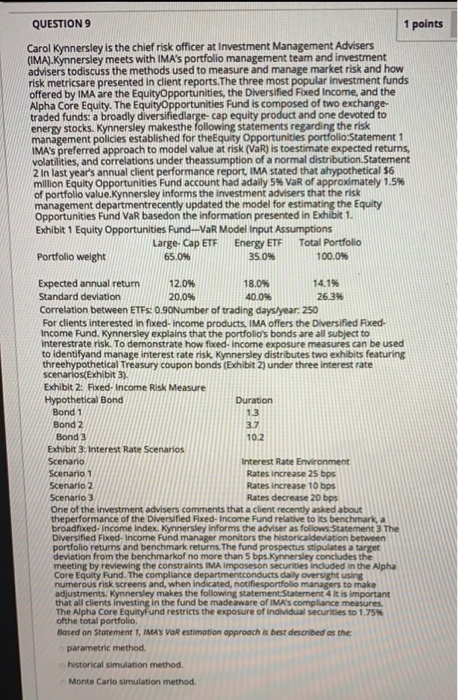

QUESTION 9 1 points Carol Kynnersley is the chief risk officer at Investment Management Advisers (IMA). Kynnersley meets with IMA's portfolio management team and investment advisers todiscuss the methods used to measure and manage market risk and how risk metricsare presented in client reports. The three most popular investment funds offered by IMA are the EquityOpportunities, the Diversified Foxed Income, and the Alpha Core Equity. The Equity Opportunities Fund is composed of two exchange traded funds: a broadly diversifiedlarge-cap equity product and one devoted to energy stocks. Kynnersley makesthe following statements regarding the risk management policies established for theEquity Opportunities portfolio Statement 1 IMA's preferred approach to model value at risk (VaR) is toestimate expected returns, volatilities, and correlations under theassumption of a normal distribution Statement 2 in last year's annual client performance report. IMA stated that hypothetical 36 million Equity Opportunities Fund account had adaily 5% VaR of approximately 1.5% of portfolio value. Kynnersley informs the investment advisers that the risk management departmentrecently updated the model for estimating the Equity Opportunities Fund VaR basedon the information presented in Exhibit 1. Exhibit 1 Equity Opportunities Fund-VaR Model Input Assumptions Large-Cap ETF Energy ETF Total Portfolio Portfolio weight 65.0% 35.0% 100.0% 102 Expected annual return 12.0% 18.09 14.1% Standard deviation 20.0% 40.0% 26.3% Correlation between ETFs: 0.90Number of trading days/year: 250 For clients interested in fixed-income products, IMA offers the Diversified Fixed- Income Fund. Kynnersley explains that the portfolio's bonds are all subject to Interestrate risk. To demonstrate how fixed-income exposure measures can be used to identifyand manage interest rate risk. Kynnersley distributes two exhibits featuring threehypothetical Treasury coupon bonds (Exhibit 2) under three interest rate scenarios Exhibit 3) Exhibit 2 Fixed Income Risk Measure Hypothetical Bond Duration Bond 1 Bond 2 Bond 3 Exhibit 3. Interest Rate Scenarios Scenario Interest Rate Environment Scenario 1 Rates increase 25 bps Scenario 2 Rates increase 10 bps Scenario 3 Rates decrease 20 bps One of the investment advisers comments that a client recently asked about the performance of the Diversified Fixed Income Fund relative to its benchmark, a broadfixed-income Index. Kynnersley informs the adviser as follows Statement 3 The Diversified Fixed Income Fund manager monitors the historica deviation between portfolio returns and benchmark returns. The fund prospectus stipulates a target deviation from the benchmarkof no more than 5 bps. Kynnersley concludes the meeting by reviewing the constraints IMA imposeson securities included in the Alpha Core Equity Fund. The compliance departmentconducts daily oversight using numerous risk screens and when indicated, notifiesportfolio managers to make adjustments. Kynnersley makes the following statement Statement 4 it is important that all clients investing in the fund be made aware of IMA's compliance measures The Alpha Core Equity Fund restricts the exposure of individual securities to 1.75 of the total portfolio Bosed on Statement 1, IMAS VOR estimation approach is best described as the parametric method. historical simulation method Monte Carlo simulation method