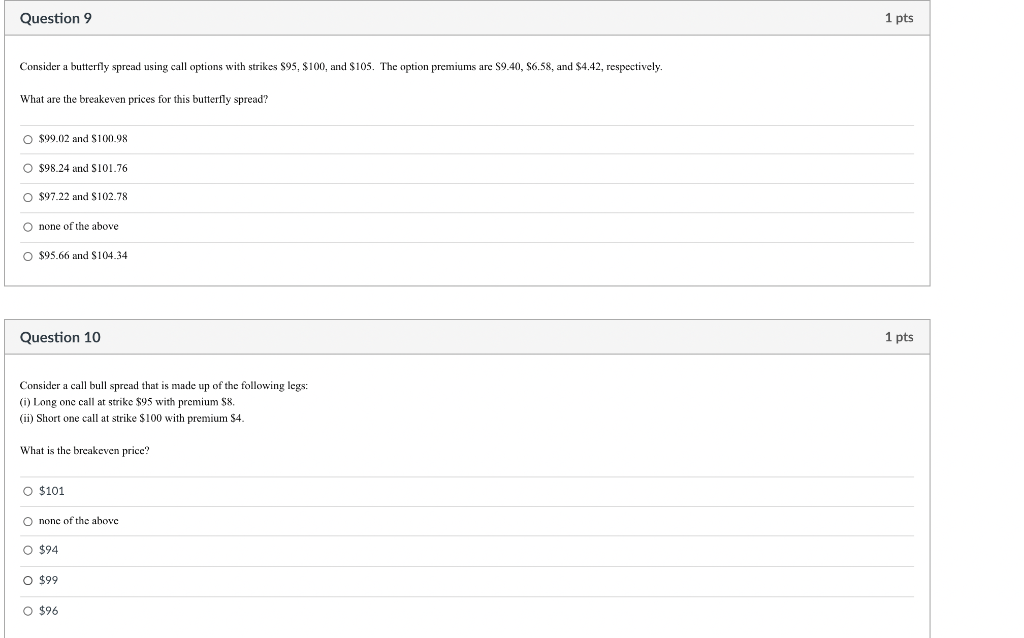

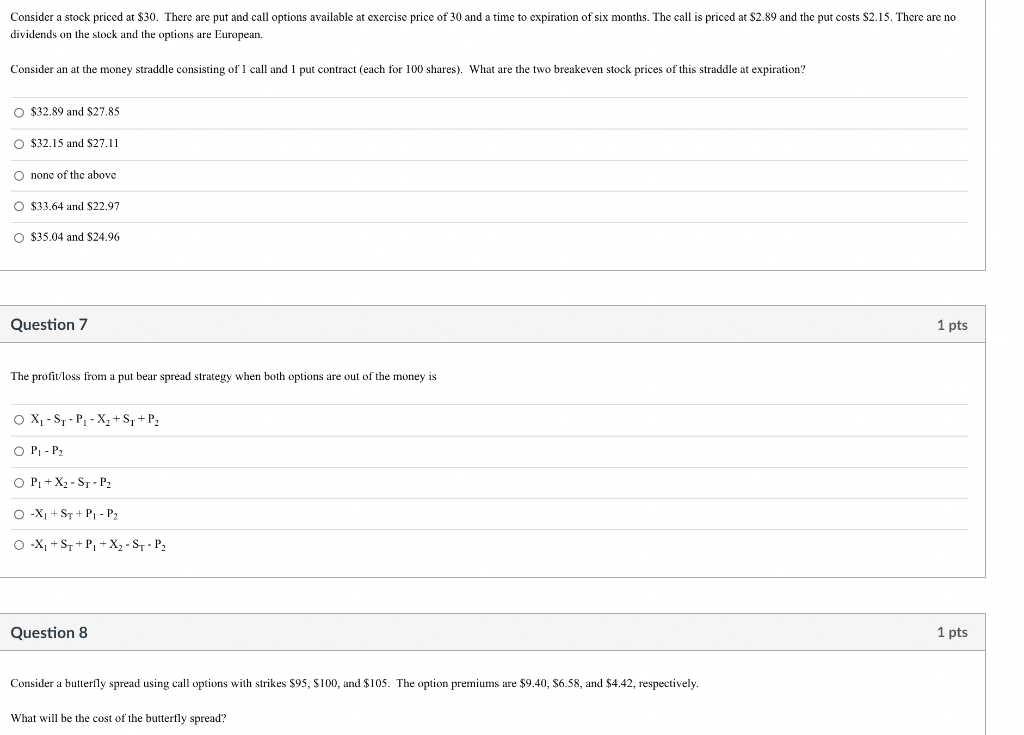

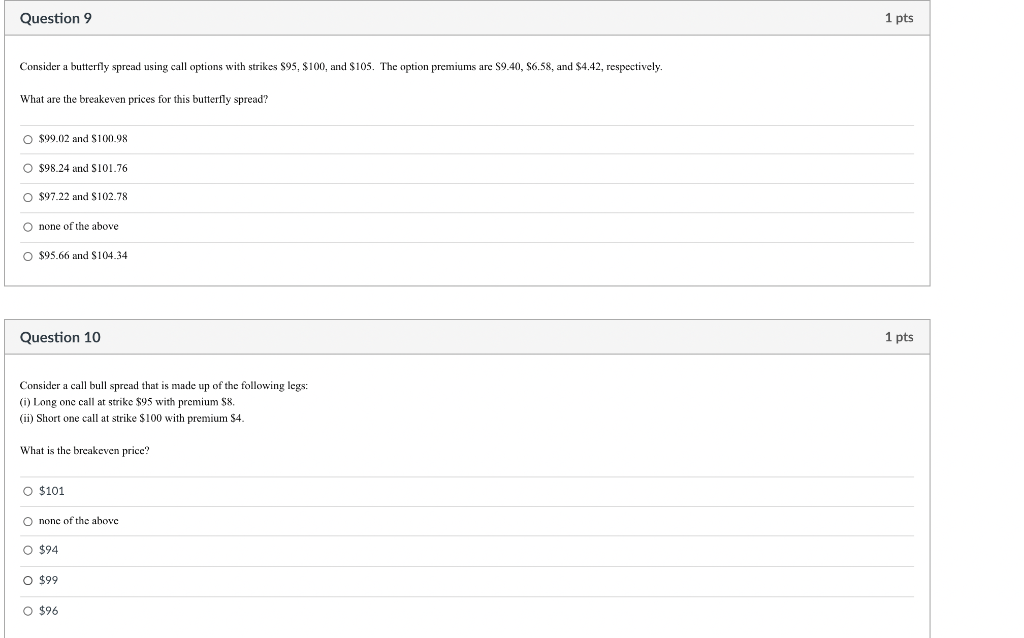

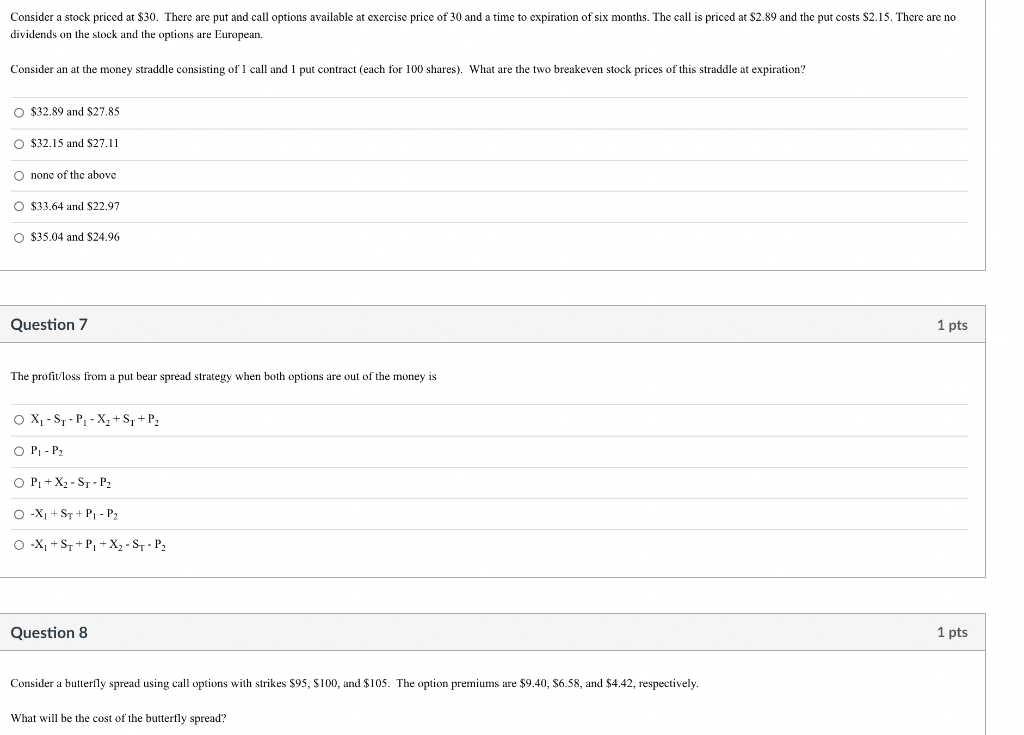

Question 9 1 pts Consider a butterfly spread using call options with strikes $95, $100, and $105. The option premiums are $9.40, $6.58, and $4.42, respectively. What are the breakeven prices for this butterfly spread? $99.02 and $100.98 O $98.24 and S101.76 O $97.22 and S102.78 O none of the above O $95.66 and $104.34 Question 10 1 pts Consider a call bull spread that is made up of the following legs: (1) Long one call at strike $95 with premium $8. (ii) Short one call at strike $100 with premium $4. What is the breakeven price? O $101 O none of the above O $99 O $96 Consider a stock priced at $30. There are put and call options available at exercise price of 30 and a time to expiration of six months. The call is priced at $2.89 and the put costs $2.15. There are no dividends on the stock and the options are European Consider an at the money straddle consisting of I call and I put contract (each for 100 shares). What are the two breakeven stock prices of this straddle at expiration? $32.89 and $27.85 $32.15 and $27.11 O none of the above O $33.64 and $22.97 O $35.04 and S24.96 Question 7 1 pts The profit/loss from a put bear spread strategy when both options are out of the money is OX-S,-P, -X,+S,+P, OP-P2 OP,+ X2 - STEP: O-X, +St+P,- P2 -X,+S,+P+X2-S-P, Question 8 1 pts Consider a butterfly spread using call options with strikes $95, $100, and $105. The option premiums are $9.40, $6.58, and $4.42, respectively. What will be the cost of the butterfly spread? Question 9 1 pts Consider a butterfly spread using call options with strikes $95, $100, and $105. The option premiums are $9.40, $6.58, and $4.42, respectively. What are the breakeven prices for this butterfly spread? $99.02 and $100.98 O $98.24 and S101.76 O $97.22 and S102.78 O none of the above O $95.66 and $104.34 Question 10 1 pts Consider a call bull spread that is made up of the following legs: (1) Long one call at strike $95 with premium $8. (ii) Short one call at strike $100 with premium $4. What is the breakeven price? O $101 O none of the above O $99 O $96 Consider a stock priced at $30. There are put and call options available at exercise price of 30 and a time to expiration of six months. The call is priced at $2.89 and the put costs $2.15. There are no dividends on the stock and the options are European Consider an at the money straddle consisting of I call and I put contract (each for 100 shares). What are the two breakeven stock prices of this straddle at expiration? $32.89 and $27.85 $32.15 and $27.11 O none of the above O $33.64 and $22.97 O $35.04 and S24.96 Question 7 1 pts The profit/loss from a put bear spread strategy when both options are out of the money is OX-S,-P, -X,+S,+P, OP-P2 OP,+ X2 - STEP: O-X, +St+P,- P2 -X,+S,+P+X2-S-P, Question 8 1 pts Consider a butterfly spread using call options with strikes $95, $100, and $105. The option premiums are $9.40, $6.58, and $4.42, respectively. What will be the cost of the butterfly spread