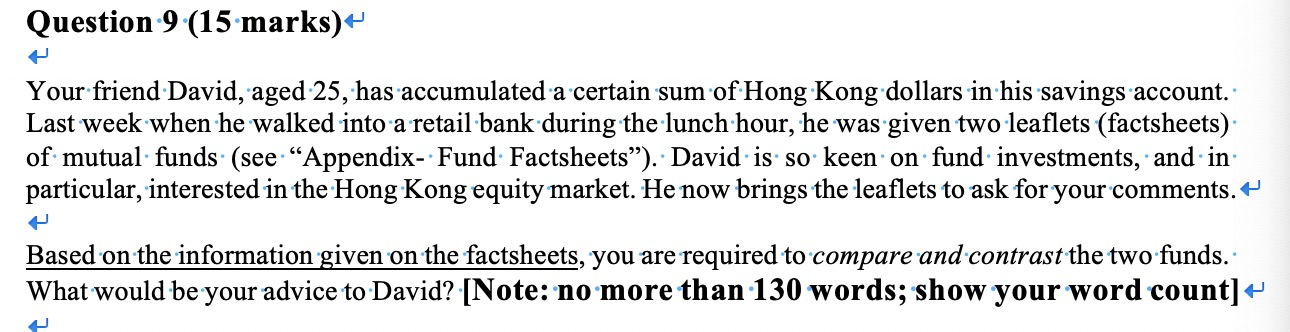

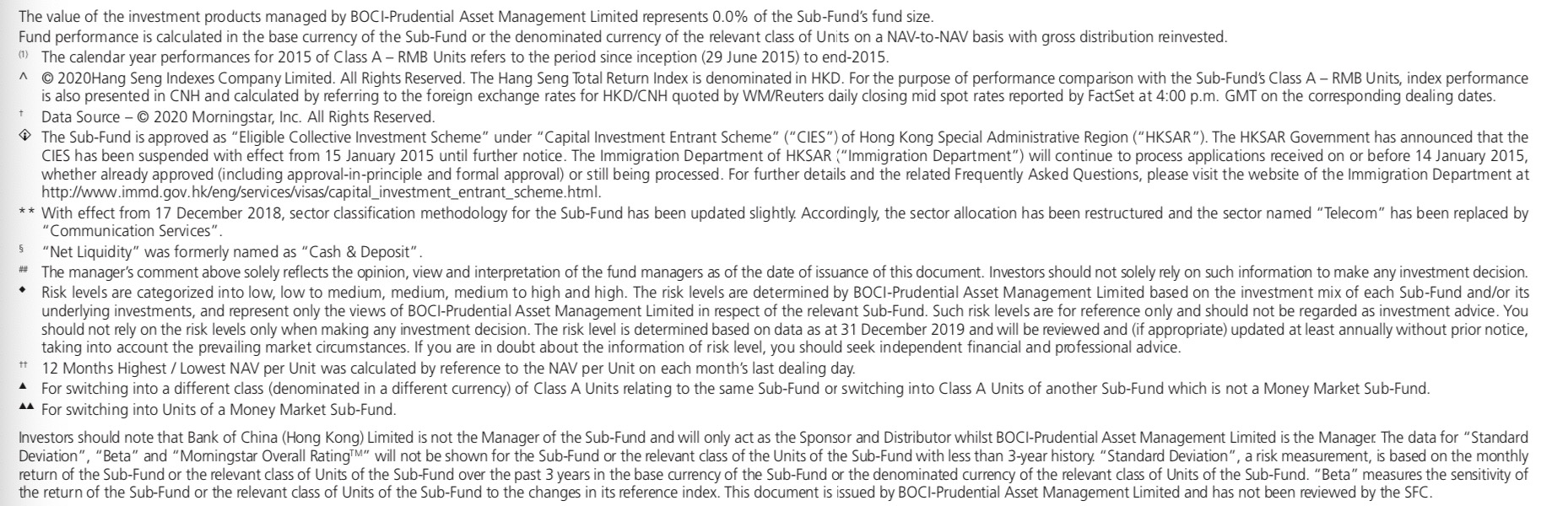

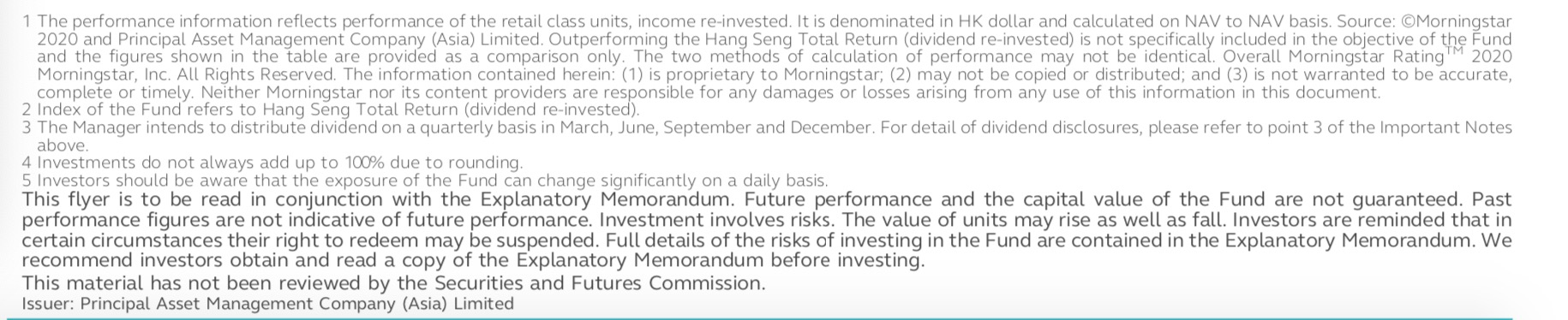

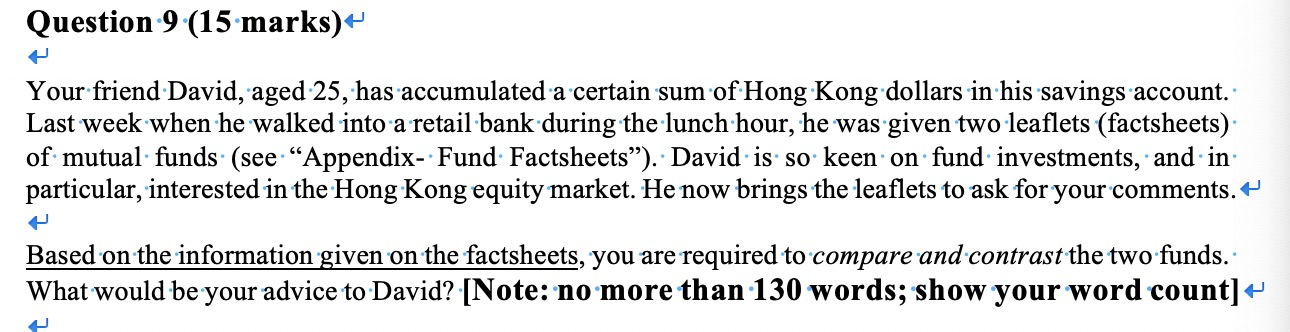

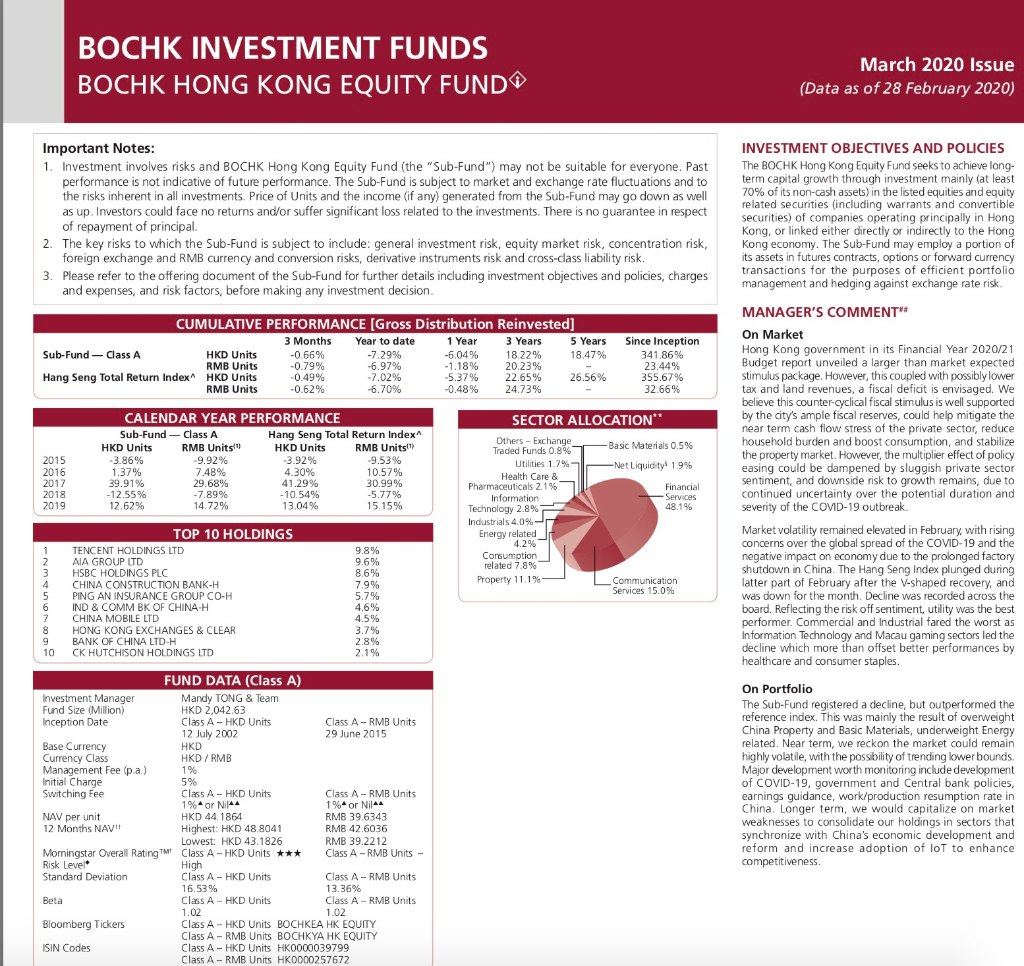

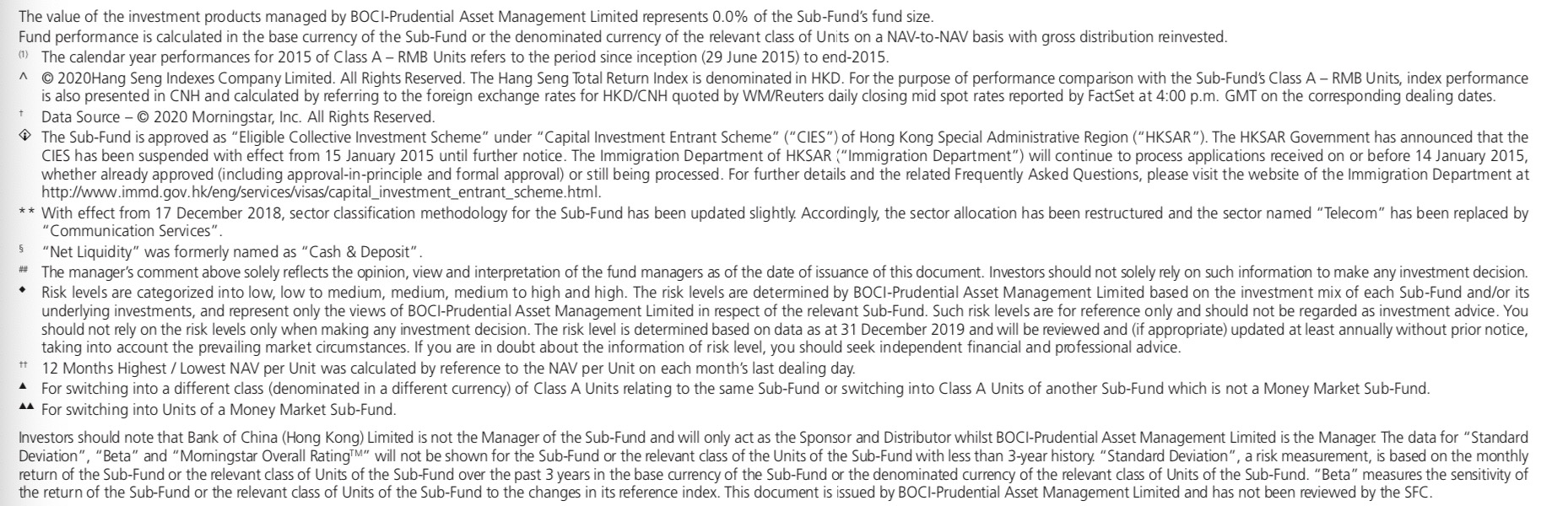

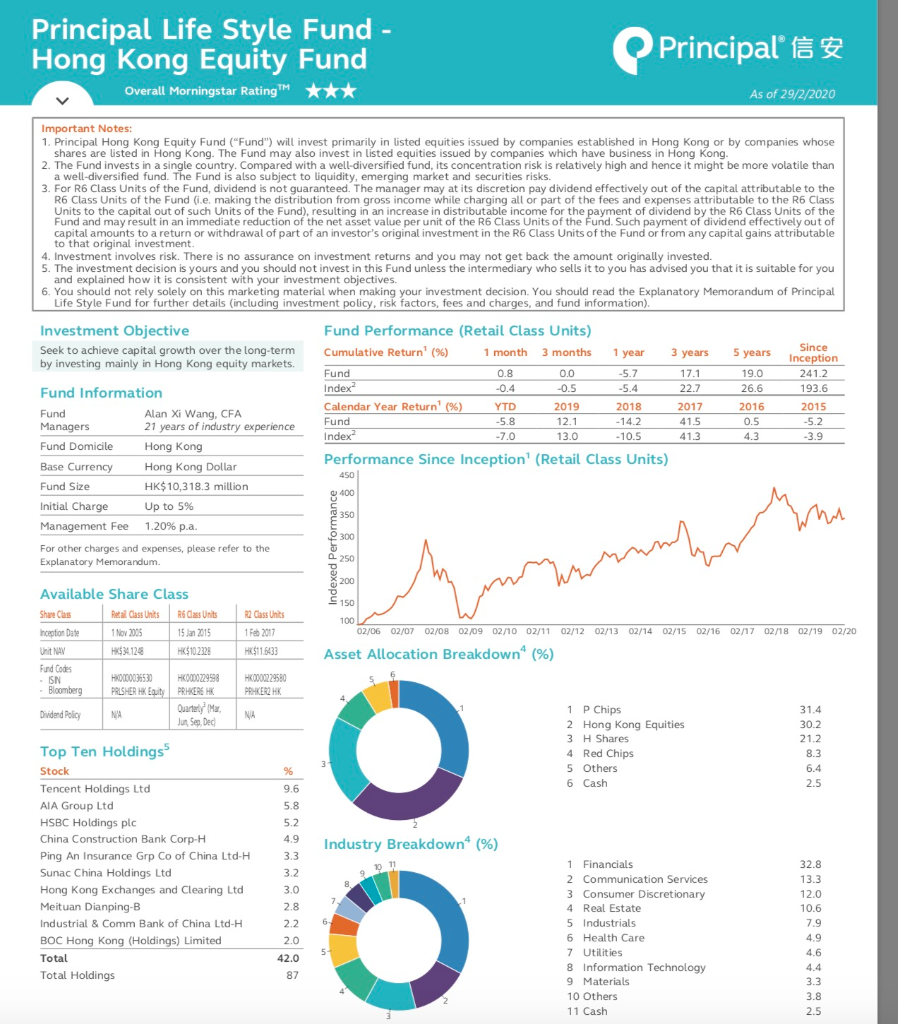

Question 9 (15 marks) Your friend David, aged 25, has accumulated a certain sum of Hong Kong dollars in his savings account. Last week when he walked into a retail bank during the lunch hour, he was given two leaflets (factsheets) of mutual funds (see. Appendix- Fund. Factsheets). David is so keen on fund investments, and in particular, interested in the Hong Kong equity market. He now brings the leaflets to ask for your comments. Based on the information given on the factsheets, you are required to compare and contrast the two-funds. What would be your advice to David? [Note: no more than 130 words; show your word count] BOCHK INVESTMENT FUNDS BOCHK HONG KONG EQUITY FUND March 2020 Issue (Data as of 28 February 2020) Important Notes: 1. Investment involves risks and BOCHK Hong Kong Equity Fund (the "Sub-Fund") may not be suitable for everyone. Past performance is not indicative of future performance. The Sub-Fund is subject to market and exchange rate fluctuations and to the risks inherent in all investments. Price of Units and the income (if any) generated from the Sub-Fund may go down as well as up. Investors could face no returns and/or suffer significant loss related to the investments. There is no guarantee in respect of repayment of principal. 2. The key risks to which the Sub-Fund is subject to include: general investment risk, equity market risk, concentration risk, foreign exchange and RMB currency and conversion risks, derivative instruments risk and cross-class liability risk. 3. Please refer to the offering document of the Sub-Fund for further details including investment objectives and policies, charges and expenses, and risk factors, before making any investment decision INVESTMENT OBJECTIVES AND POLICIES The BOCHK Hong Kong Equity Fund seeks to achieve long- term capital growth through investment mainly (at least 70% of its non-cash assets) in the listed equities and equity related securities (including warrants and convertible securities) of companies operating principally in Hong Kong, or linked either directly or indirectly to the Hong Kong economy. The Sub-Fund may employ a portion of its assets in futures contracts, options or forward currency transactions for the purposes of efficient portfolio management and hedging against exchange rate risk CUMULATIVE PERFORMANCE (Gross Distribution Reinvested] 3 Months Year to date 1 Year 3 Years 5 Years Sub-Fund - Class A HKD Units -0.66% -7.29% -6,04% 18.22% 18.47% RMB Units -0.79% -6.97% - 1.18% 20.23% Hang Seng Total Return Index HKD Units -0.49% -7.02% -5.37% 22.65% 26.56% RMB Units -0.62% -6.70% -0.48% 24.73% Since Inception 341.86% 23.44% 355.67% 32.66% 2015 2016 2017 2018 2019 CALENDAR YEAR PERFORMANCE Sub-Fund Class A Hang Seng Total Return Index HKD Units RMB Units HKD Units RMB Unitsit) -3.86% -9.92% -3.92% -9.53% 1.37% 7.48% 4.30% 10.57% 39.91% 29.68% 41.29% 30.99% -12.55% -7.89% -10.54% -5.77% 12.62% 14.72% 13.04% 15.15% SECTOR ALLOCATION** Others - Exchange Traded Funds 0.8% -Basic Materials 0.5% Utilities 1.7% -Net Liquidity 1.9% Health Care & Pharmaceuticals 2.1% Financial Information Services Technology 2.8% 48.1% Industrials 4.0% Energy related 4.2% Consumption related 7.8% Property 11.1% Communication Services 15.0% MANAGER'S COMMENT** On Market Hong Kong government in its Financial Year 2020/21 Budget report unveiled a larger than market expected stimulus package. However, this coupled with possibly lower tax and land revenues, a fiscal deficit is envisaged. We believe this counter-cyclical fiscal stimulus is well supported by the city's ample fiscal reserves, could help mitigate the near term cash flow stress of the private sector, reduce household burden and boost consumption, and stabilize the property market. However, the multiplier effect of policy easing could be dampened by sluggish private sector sentiment, and downside risk to growth remains, due to continued uncertainty over the potential duration and severity of the COVID-19 outbreak. Market volatility remained elevated in February, with rising concerns over the global spread of the COVID-19 and the negative impact on economy due to the prolonged factory shutdown in China. The Hang Seng Index plunged during latter part of February after the V-shaped recovery, and was down for the month. Decline was recorded across the board. Reflecting the risk off sentiment, utility was the best performer. Commercial and Industrial fared the worst as Information Technology and Macau gaming sectors led the decline which more than offset better performances by healthcare and consumer staples. 1 2 3 4 5 6 7 8 9 10 TOP 10 HOLDINGS TENCENT HOLDINGS LTD AIA GROUP LTD HSBC HOLDINGS PLC CHINA CONSTRUCTION BANK-H PING AN INSURANCE GROUP CO-H IND & COMM BK OF CHINA-H CHINA MOBILE LTD HONG KONG EXCHANGES & CLEAR BANK OF CHINA LTD-H CK HUTCHISON HOLDINGS LTD 9.8% 9.6% 8.6% 7.9% 5.7% 4.6% 4.5% 3.7% 2.8% 2.1% FUND DATA (Class A) Investment Manager Mandy TONG & Team Fund Size (Million) HKD 2,042.63 Inception Date Class A - HKD Units Class A - RMB Units 12 July 2002 29 June 2015 Base Currency HKD Currency Class HKD/RMB Management Fee (p.a.) 1% Initial Charge 5% Switching Fee Class A - HKD Units Class A - RMB Units 1% or Nils 1% or Nils NAV per unit HKD 44,1864 RMB 39.6343 12 Months NAVI Highest: HKD 48.8041 RMB 42.6036 Lowest: HKD 43.1826 RMB 39.2212 Morningstar Overall Rating Class A - HKD Units *** Class A - RMB Units - Risk Level High Standard Deviation Class A - HKD Units Class A - RMB Units 16.53% 13.36% Beta Class A - HKD Units Class A - RMB Units 1.02 1.02 Bloomberg Tickers Class A - HKD Units BOCHKEA HK EQUITY Class A - RMB Units BOCHKYA HK EQUITY ISIN Codes Class A - HKD Units HK0000039799 Class A - RMB Units HK0000257672 On Portfolio The Sub-Fund registered a decline, but outperformed the reference index. This was mainly the result of overweight China Property and Basic Materials, underweight Energy related. Near term, we reckon the market could remain highly volatile, with the possibility of trending lower bounds. Major development worth monitoring include development of COVID-19. government and Central bank policies, earnings guidance, work/production resumption rate in China. Longer term, we would capitalize on market weaknesses to consolidate our holdings in sectors that synchronize with China's economic development and reform and increase adoption of lot to enhance competitiveness. + S The value of the investment products managed by BOCI-Prudential Asset Management Limited represents 0.0% of the Sub-Fund's fund size. Fund performance is calculated in the base currency of the Sub-Fund or the denominated currency of the relevant class of Units on a NAV-CO-NAV basis with gross distribution reinvested. (1) The calendar year performances for 2015 of Class A - RMB Units refers to the period since inception (29 June 2015) to end-2015. ^ 2020Hang Seng Indexes Company Limited. All Rights Reserved. The Hang Seng Total Return Index is denominated in HKD. For the purpose of performance comparison with the Sub-Fund's Class A - RMB Units, index performance is also presented in CNH and calculated by referring to the foreign exchange rates for HKD/CNH quoted by WM/Reuters daily closing mid spot rates reported by FactSet at 4:00 p.m. GMT on the corresponding dealing dates. Data Source - 2020 Morningstar, Inc. All Rights Reserved. The Sub-Fund is approved as "Eligible Collective Investment Scheme" under "Capital Investment Entrant Scheme" ("CIES") of Hong Kong Special Administrative Region ("HKSAR"). The HKSAR Govemment has announced that the CIES has been suspended with effect from 15 January 2015 until further notice. The Immigration Department of HKSAR "Immigration Department") will continue to process applications received on or before 14 January 2015, whether already approved (including approval-in-principle and formal approval) or still being processed. For further details and the related Frequently Asked Questions, please visit the website of the Immigration Department at http://www.immd.gov.hk/eng/services/visas/capital_investment_entrant_scheme.html. ** With effect from 17 December 2018, sector classification methodology for the Sub-Fund has been updated slightly. Accordingly, the sector allocation has been restructured and the sector named "Telecom" has been replaced by "Communication Services". "Net Liquidity" was formerly named as "Cash & Deposit". # The manager's comment above solely reflects the opinion, view and interpretation of the fund managers as of the date of issuance of this document. Investors should not solely rely on such information to make any investment decision. Risk levels are categorized into low, low to medium, medium, medium to high and high. The risk levels are determined by BOCI-Prudential Asset Management Limited based on the investment mix of each Sub-Fund and/or its underlying investments, and represent only the views of BOCI-Prudential Asset Management Limited in respect of the relevant Sub-Fund. Such risk levels are for reference only and should not be regarded as investment advice. You should not rely on the risk levels only when making any investment decision. The risk level is determined based on data as at 31 December 2019 and will be reviewed and (if appropriate) updated at least annually without prior notice, taking into account the prevailing market circumstances. If you are in doubt about the information of risk level, you should seek independent financial and professional advice. # 12 Months Highest / Lowest NAV per Unit was calculated by reference to the NAV per Unit on each month's last dealing day. For switching into a different class (denominated in a different currency) of Class A Units relating to the same Sub-Fund or switching into Class A Units of another Sub-Fund which is not a Money Market Sub-Fund. - For switching into Units of a Money Market Sub-Fund. Investors should note that Bank of China (Hong Kong) Limited is not the Manager of the Sub-Fund and will only act as the Sponsor and Distributor whilst BOCI-Prudential Asset Management Limited is the Manager. The data for "Standard Deviation", "Beta" and "Momingstar Overall Rating" will not be shown for the Sub-Fund or the relevant class of the Units of the Sub-Fund with less than 3-year history. "Standard Deviation", a risk measurement, is based on the monthly return of the Sub-Fund or the relevant class of Units of the Sub-Fund over the past 3 years in the base currency of the Sub-Fund or the denominated currency of the relevant class of Units of the Sub-Fund. "Beta" measures the sensitivity of the return of the Sub-Fund or the relevant class of Units of the Sub-Fund to the changes in its reference index. This document is issued by BOCI-Prudential Asset Management Limited and has not been reviewed by the SFC. Principal Life Style Fund - Hong Kong Equity Fund Principal' & Overall Morningstar RatingTM *** As of 29/2/2020 Important Notes: 1. Principal Hong Kong Equity Fund ("Fund") will invest primarily in listed equities issued by companies established in Hong Kong or by companies whose shares are listed in Hong Kong. The Fund may also invest in listed equities issued by companies which have business in Hong Kong. 2. The Fund invests in a single country. Compared with a well-diversified fund, its concentration risk is relatively high and hence it might be more volatile than a well-diversified fund. The Fund is also subject to liquidity, emerging market and securities risks. 3. For R6 Class Units of the Fund, dividend is not guaranteed. The manager may at its discretion pay dividend effectively out of the capital attributable to the R6 Class Units of the Fund (.e. making the distribution from gross income while charging all or part of the fees and expenses attributable to the R6 Class Units to the capital out of such Units of the Fund), resulting in an increase in distributable income for the payment of dividend by the R6 Class Units of the Fund and may result in an immediate reduction of the net asset value per unit of the R6 Class Units of the Fund. Such payment of dividend effectively out of capital amounts to a return or withdrawal of part of an investor's original investment in the R6 Class Units of the Fund or from any capital gains attributable to that original investment. 4. Investment involves risk. There is no assurance on investment returns and you may not get back the amount originally invested. 5. The investment decision is yours and you should not invest in this Fund unless the intermediary who sells it to you has advised you that it is suitable for you and explained how it is consistent with your investment objectives. 6. You should not rely solely on this marketing material when making your investment decision. You should read the Explanatory Memorandum of Principal Life Style Fund for further details (including investment policy, risk factors, fees and charges, and fund information). Investment Objective Seek to achieve capital growth over the long-term by investing mainly in Hong Kong equity markets. 5 years Since Inception 241.2 193.6 19.0 26.6 2016 0.5 4.3 Fund Performance (Retail Class Units) Cumulative Return!(%) 1 month 3 months 1 year 3 years Fund 0.8 0.0 -5.7 17.1 Index? -0.4 -0.5 -5.4 22.7 Calendar Year Return' (%) YTD 2019 2018 2017 Fund -5.8 12.1 - 14.2 41.5 Index? -7.0 13.0 -10.5 41.3 Performance Since Inception' (Retail Class Units) 450 Fund Information Fund Alan Xi Wang, CFA Managers 21 years of industry experience Fund Domicile Hong Kong Base Currency Hong Kong Dollar Fund Size HK$ 10,318.3 million Initial Charge Up to 5% Management Fee 1.20% p.a. For other charges and expenses, please refer to the Explanatory Memorandum 2015 -5.2 -3.9 400 350 whe O 300 250 manhar 200 R2 Class Units 1 Feb 2017 150 100 02/06 02/07 02/08 02/09 02/10 02/11 02/12 02/13 02/14 02/15 02/16 02/17 02/18 02/19 02/20 Asset Allocation Breakdown (%) HK$11.6433 Available Share Class Shares Retail Class Units R6 Class Units Inception Date 1 Nov 2005 15 Jan 2015 HK$34124 HK$102223 Fund Codes -SN HKO000036530 HKO000229998 Bloomberg PRLSHER HK Equity PRHKERS HK Dividend Policy Quarterly Mar, NA Jun, Sen Dec HKO000229580 PRHKER2 HK NA 1 P Chips 2 Hong Kong Equities 3 H Shares 4 Red Chips 5 Others 6 Cash 31.4 30.2 21.2 8.3 6.4 2.5 9.6 5.8 5.2 4.9 Industry Breakdown (%) Top Ten Holdings Stock Tencent Holdings Ltd AIA Group Ltd HSBC Holdings plc China Construction Bank Corp-H Ping An Insurance Grp Co of China Ltd-H Sunac China Holdings Ltd Hong Kong Exchanges and Clearing Ltd Meituan Dianping-B Industrial & Comm Bank of China Ltd-H BOC Hong Kong (Holdings) Limited Total Total Holdings & 3.3 3.2 3.0 2.8 2.2 2.0 7 6 1 Financials 2 Communication Services 3 Consumer Discretionary 4 Real Estate 5 Industrials 6 Health Care 7 Utilities 8 Information Technology 9 Materials 10 Others 11 Cash 32.8 13.3 12.0 10.6 7.9 4.9 4.6 4.4 3.3 3.8 2.5 5 42.0 87 1 The performance information reflects performance of the retail class units, income re-invested. It is denominated in HK dollar and calculated on NAV to NAV basis. Source: Morningstar 2020 and Principal Asset Management Company (Asia) Limited. Outperforming the Hang Seng Total Return (dividend re-invested) is not specifically included in the objective of the Fund and the figures shown in the table are provided as a comparison only. The two methods of calculation of performance may not be identical. Overall Morningstar Rating 2020 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information in this document. 2 Index of the Fund refers to Hang Seng Total Return (dividend re-invested). 3 The Manager intends to distribute dividend on a quarterly basis in March, June, September and December. For detail of dividend disclosures, please refer to point 3 of the Important Notes above. 4 Investments do not always add up to 100% due to rounding. 5 Investors should be aware that the exposure of the Fund can change significantly on a daily basis. This flyer is to be read in conjunction with the Explanatory Memorandum. Future performance and the capital value of the Fund are not guaranteed. Past performance figures are not indicative of future performance. Investment involves risks. The value of units may rise as well as fall. Investors are reminded that in certain circumstances their right to redeem may be suspended. Full details of the risks of investing in the Fund are contained in the Explanatory Memorandum. We recommend investors obtain and read a copy of the Explanatory Memorandum before investing. This material has not been reviewed by the Securities and Futures Commission. Issuer: Principal Asset Management Company (Asia) Limited