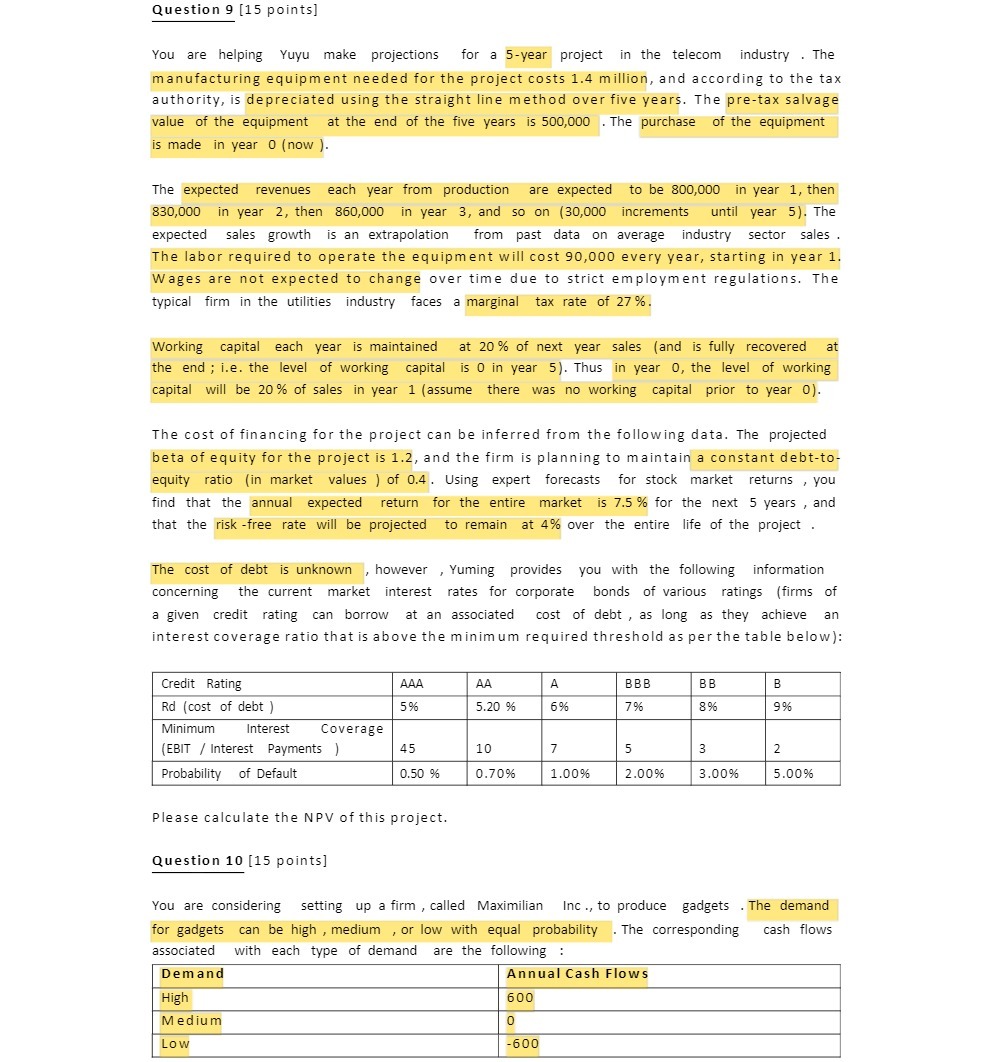

Question 9 [15 points] You are helping Yuyu make projections for a 5year project in the teleoom industry . The manufacturing equipment needed for the project costs 1.4 million, and according to the tax authority, is depreciated using the straight line method over five years. The pre-tax salvage value of the equipment at the end of the ve years is 500,000 .The purchase of the equipment is made in year 0 (now ]. The expected revenues each year from production are expected to be 800,000 in year 1.then 830,000 in year 2, then 860,000 in year 3, and so on [30,000 increments until year 5}. The expected sales growth is an extrapolation from past data on average industry sector sales. The labor required to operate the equipment will cost 90,000 every year, starting in year 1. Wages are not expected to change over time due to strict employment regulations. The typical rm in the utilities industry faces a marginal tax rate of 2?%. Working capital each year is maintained at 20% of next year sales (and is Jlly recovered at the end; i.e. the level of working capital is 0 in year 5]. Thus in year 0, the level of working capital will be 20% o'fsales in year 1 (assume there was no working capital prior to year 0). The cost of financing for the project can be inferred from the following data. The projected beta of equity for the project is 1.2, and the firm is planning to maintain a constant debtto equity ratio [in market values ] of 0.4. Using expert forecasts for stock market returns , you nd that the annual expected return for the entire market is 15% for the next 5 years , and that the risk free rate will be projected to remain at 4% over the entire life of the project . The cost of debt is unknown ,however , Yuming provides you with the following information concerning the current market interest rates for corporate bonds of various ratings {rms of a given credit rating can borrow at an associated cost of debt , as long as they achieve an interest coverage ratio that is above the minim um required threshold as perthe table below]: Credit Rating Rd {cost of debt i MA Minimum Interest Coverage [EBIT Ji'lnterest Payments J Probability of Defauft Please calculate the NPV of this project. Question 10 [15 points] You are considering setting up a rm , called Maximilian Inc ..to produce gadgets .The demand for gadgets can be high , medium .or low with equal probability .The corresponding cash ows associated with each type of demand are the following Demand AnnualCaslI Flows