Answered step by step

Verified Expert Solution

Question

1 Approved Answer

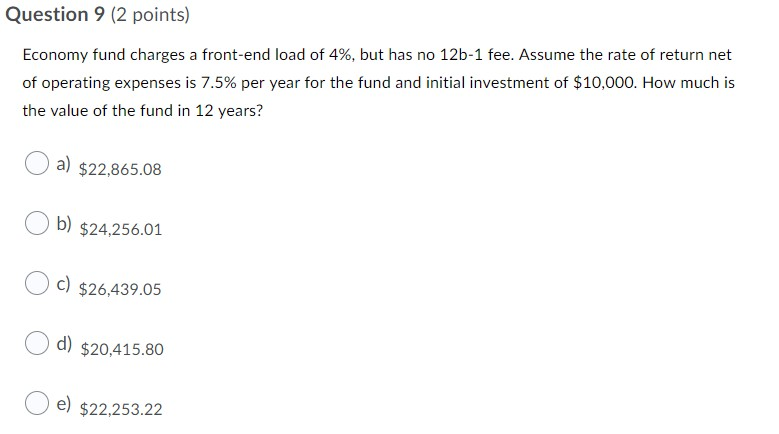

Question 9 (2 points) Economy fund charges a front-end load of 4%, but has no 12b-1 fee. Assume the rate of return net of operating

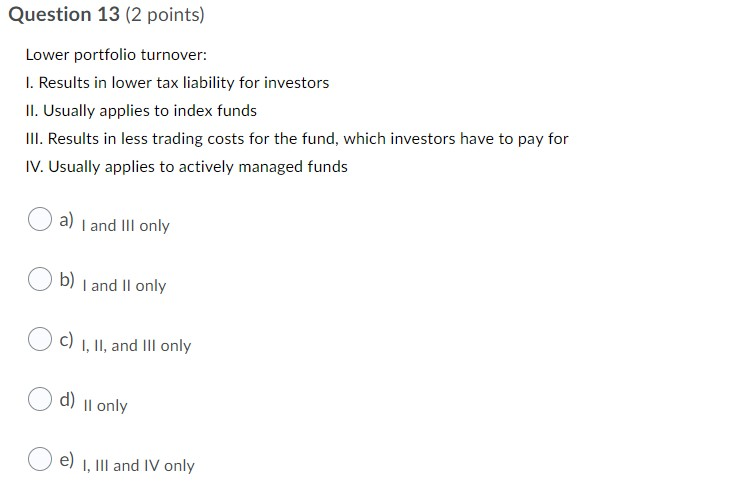

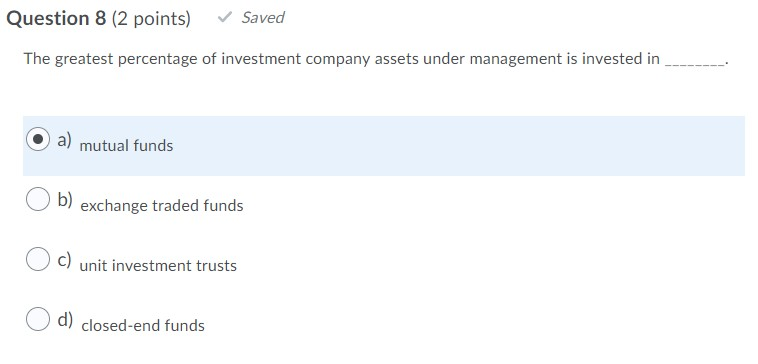

Question 9 (2 points) Economy fund charges a front-end load of 4%, but has no 12b-1 fee. Assume the rate of return net of operating expenses is 7.5% per year for the fund and initial investment of $10,000. How much is the value of the fund in 12 years? a) $22,865.08 Ob) $24,256.01 OC) $26,439.05 O d) $20,415.80 O e) $22,253.22 Question 13 (2 points) Lower portfolio turnover: I. Results in lower tax liability for investors II. Usually applies to index funds III. Results in less trading costs for the fund, which investors have to pay for IV. Usually applies to actively managed funds a) I and III only b) I and II only O C) I, II, and Ill only O d) ll only O e) 1. III and IV only Question 5 (2 points) Saved Which of the following funds invest specifically in stocks of consistently high dividend yield companies? a) money market funds Ob) balanced funds OC) equity income funds d) industry or sector funds O e) growth equity funds Question 8 (2 points) Saved The greatest percentage of investment company assets under management is invested in a) mutual funds b) exchange traded funds c) unit investment trusts d) closed-end funds

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started