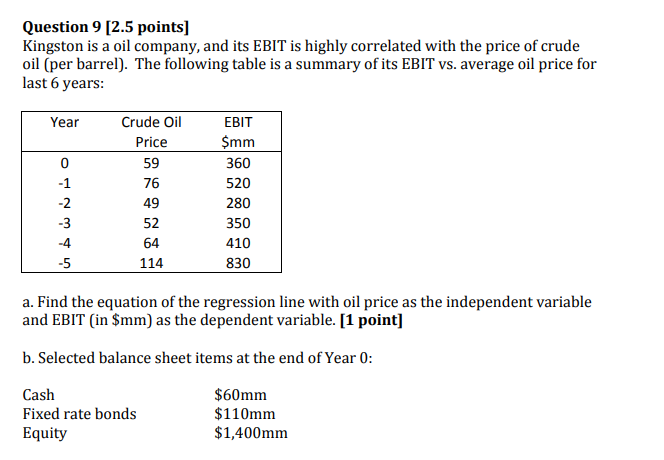

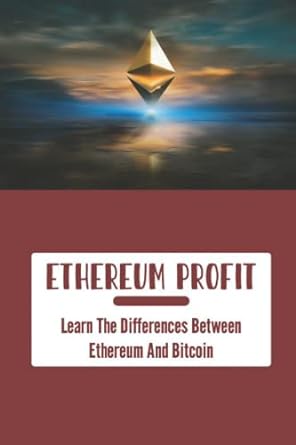

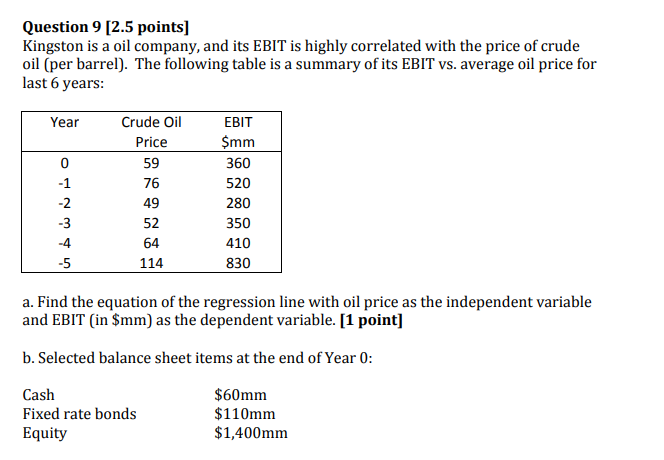

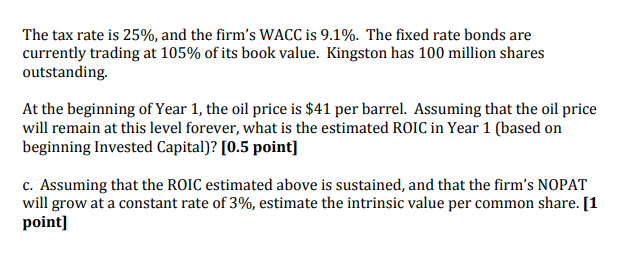

Question 9 [2.5 points] Kingston is a oil company, and its EBIT is highly correlated with the price of crude oil (per barrel). The following table is a summary of its EBIT vs. average oil price for last 6 years: Year 0 -1 -2 -3 -4 -5 Crude Oil Price 59 76 49 52 64 114 EBIT $mm 360 520 280 350 410 830 a. Find the equation of the regression line with oil price as the independent variable and EBIT in $mm) as the dependent variable. [1 point] b.Selected balance sheet items at the end of Year 0: Cash Fixed rate bonds Equity $60mm $110mm $1,400mm The tax rate is 25%, and the firm's WACC is 9.1%. The fixed rate bonds are currently trading at 105% of its book value. Kingston has 100 million shares outstanding. At the beginning of Year 1, the oil price is $41 per barrel. Assuming that the oil price will remain at this level forever, what is the estimated ROIC in Year 1 (based on beginning Invested Capital)? [0.5 point] c. Assuming that the ROIC estimated above is sustained, and that the firm's NOPAT will grow at a constant rate of 3%, estimate the intrinsic value per common share. [1 point] Question 9 [2.5 points] Kingston is a oil company, and its EBIT is highly correlated with the price of crude oil (per barrel). The following table is a summary of its EBIT vs. average oil price for last 6 years: Year 0 -1 -2 -3 -4 -5 Crude Oil Price 59 76 49 52 64 114 EBIT $mm 360 520 280 350 410 830 a. Find the equation of the regression line with oil price as the independent variable and EBIT in $mm) as the dependent variable. [1 point] b.Selected balance sheet items at the end of Year 0: Cash Fixed rate bonds Equity $60mm $110mm $1,400mm The tax rate is 25%, and the firm's WACC is 9.1%. The fixed rate bonds are currently trading at 105% of its book value. Kingston has 100 million shares outstanding. At the beginning of Year 1, the oil price is $41 per barrel. Assuming that the oil price will remain at this level forever, what is the estimated ROIC in Year 1 (based on beginning Invested Capital)? [0.5 point] c. Assuming that the ROIC estimated above is sustained, and that the firm's NOPAT will grow at a constant rate of 3%, estimate the intrinsic value per common share. [1 point]