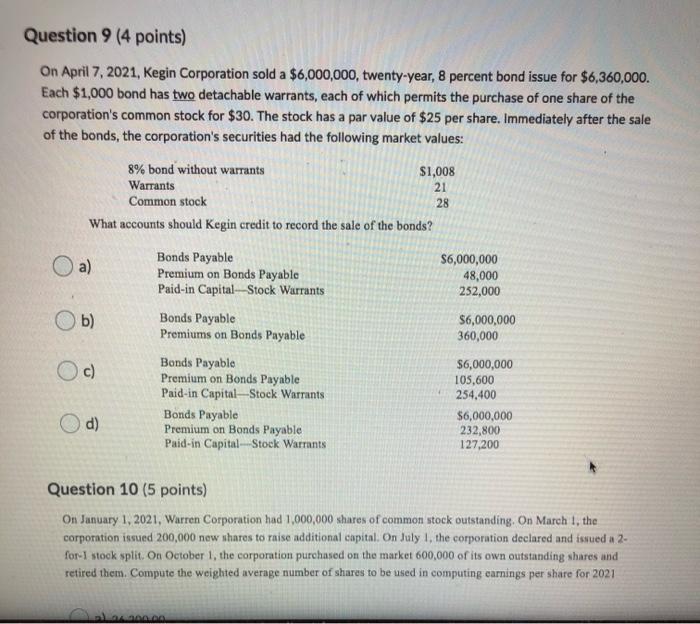

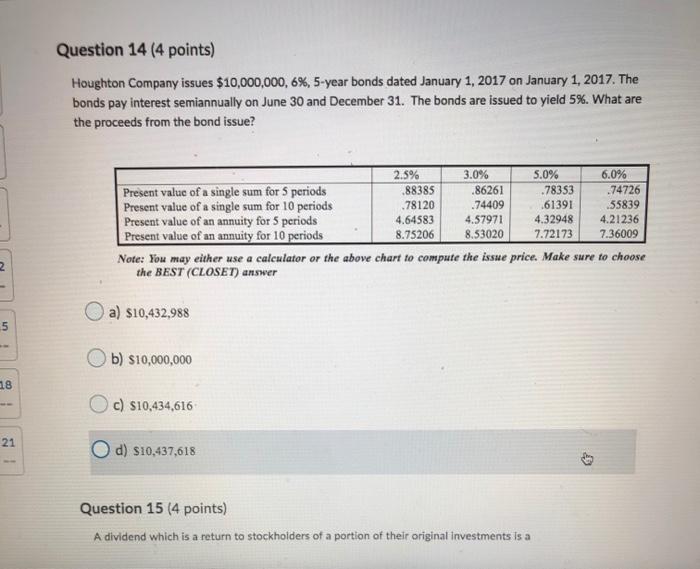

Question 9 (4 points) On April 7, 2021, Kegin Corporation sold a $6,000,000, twenty-year, 8 percent bond issue for $6,360,000. Each $1,000 bond has two detachable warrants, each of which permits the purchase of one share of the corporation's common stock for $30. The stock has a par value of $25 per share. Immediately after the sale of the bonds, the corporation's securities had the following market values: 8% bond without warrants $1,008 Warrants Common stock What accounts should Kegin credit to record the sale of the bonds? 21 28 a) $6,000,000 48,000 252,000 Ob) $6,000,000 360,000 Bonds Payable Premium on Bonds Payable Paid-in Capital - Stock Warrants Bonds Payable Premiums on Bonds Payable Bonds Payable Premium on Bonds Payable Paid-in Capital - Stock Warrants Bonds Payable Premium on Bonds Payable Paid-in Capital - Stock Warrants Oc) $6,000,000 105,600 254,400 $6,000,000 232,800 127,200 d) Question 10 (5 points) On January 1, 2021, Warren Corporation had 1,000,000 shares of common stock outstanding on March 1, the corporation issued 200,000 new shares to raise additional capital. On July 1, the corporation declared and issued a 2- for-1 stock split. on October 1, the corporation purchased on the market 600,000 of its own outstanding shares and retired them. Compute the weighted average number of shares to be used in computing earnings per share for 2021 A. Question 14 (4 points) Houghton Company issues $10,000,000, 6%, 5-year bonds dated January 1, 2017 on January 1, 2017. The bonds pay interest semiannually on June 30 and December 31. The bonds are issued to yield 5%. What are the proceeds from the bond issue? 2.5% 3.0% 5.0% 6.0% Present value of a single sum for 5 periods 88385 .86261 .78353 .74726 Present value of a single sum for 10 periods .78120 -74409 .61391 55839 Present value of an annuity for 5 periods 4.64583 4.57971 4.32948 4.21236 Present value of an annuity for 10 periods 8.75206 8.53020 7.72173 7.36009 Note: You may either use a calculator or the above chart to compute the issue price. Make sure to choose the BEST (CLOSET) answer 2. a) $10,432,988 5 b) $10,000,000 18 OC) 510.434,616 21 d) $10,437,618 Question 15 (4 points) A dividend which is a return to stockholders of a portion of their original investments is a