Answered step by step

Verified Expert Solution

Question

1 Approved Answer

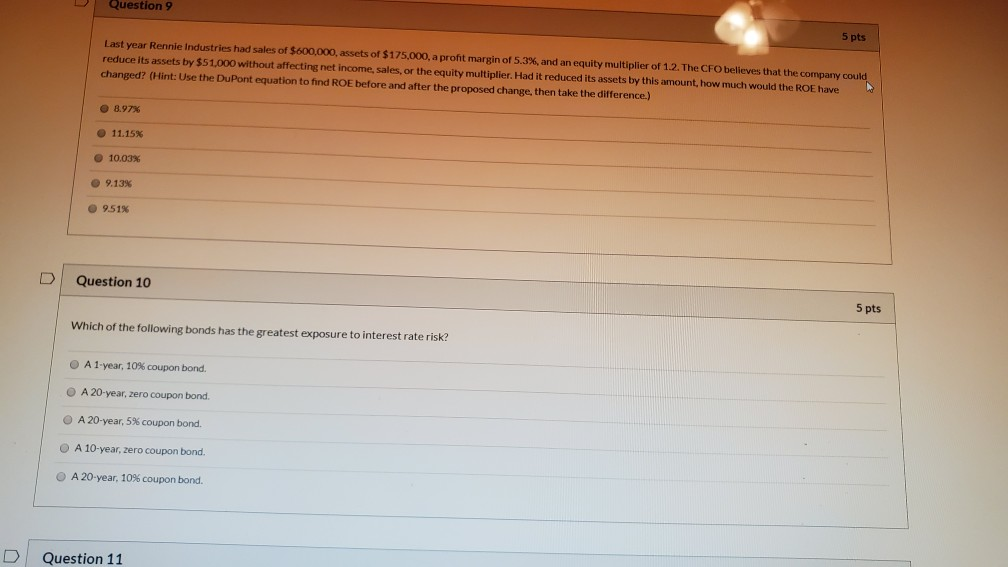

Question 9 5 pts Last year Rennie Industries had sales of $600,000, assets of $175,000, a profit margin of 5.3%, and an equity multiplier of

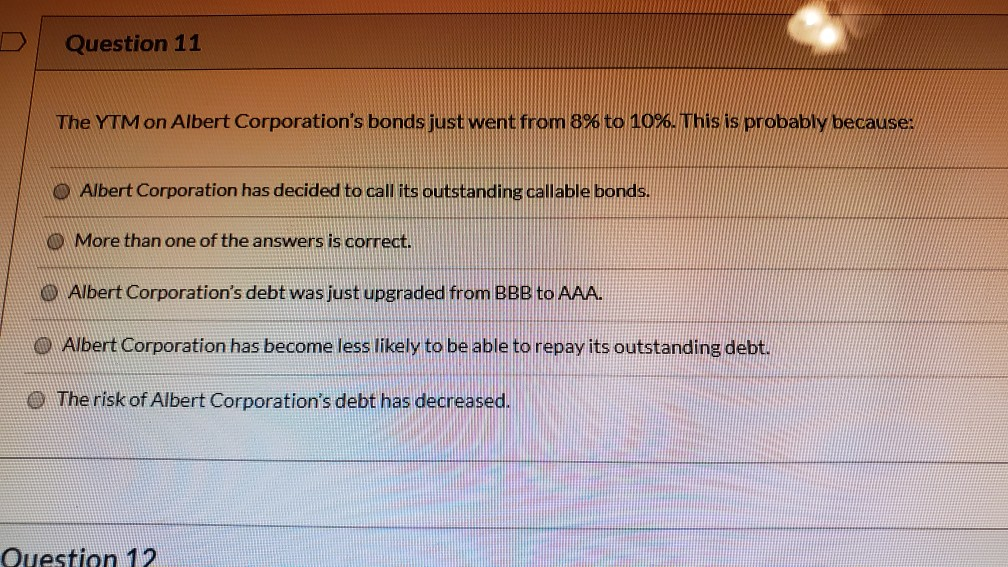

Question 9 5 pts Last year Rennie Industries had sales of $600,000, assets of $175,000, a profit margin of 5.3%, and an equity multiplier of 1.2. The CFO believes that the company could reduce its assets by $51,000 without affecting net income, sales, or the equity multiplier. Had it reduced its assets by this amount, how much would the ROE have changed? (Hint: Use the DuPont equation to find ROE before and after the proposed change, then take the difference.) 8.97% 11.15% 10.03% 9.13% 951% D Question 10 5 pts Which of the following bonds has the greatest exposure to interest rate risk? A 1-year, 10% coupon bond. A 20-year, zero coupon bond. A 20-year, 5% coupon bond. A 10-year, zero coupon bond. A 20-year, 10% coupon bond. Question 11 The YTM on Albert Corporation's bonds just went from 8% to 10%. This is probably because: O Albert Corporation has decided to call its outstanding callable bonds. O More than one of the answers is correct. Albert Corporation's debt was just upgraded from BBB to AAA. O Albert Corporation has become less likely to be able to repay its outstanding debt. The risk of Albert Corporation's debt has decreased. Question 12

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started