Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 9 (5.5 points) Reno Limited is a stable growth company. Its operating profit is expected to be $150 million in Year 1, growing

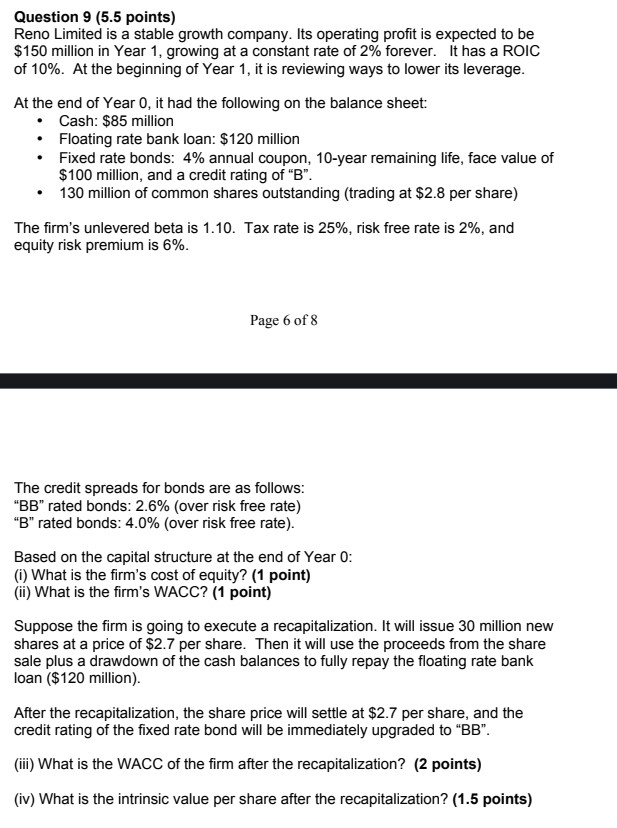

Question 9 (5.5 points) Reno Limited is a stable growth company. Its operating profit is expected to be $150 million in Year 1, growing at a constant rate of 2% forever. It has a ROIC of 10%. At the beginning of Year 1, it is reviewing ways to lower its leverage. At the end of Year 0, it had the following on the balance sheet: Cash: $85 million Floating rate bank loan: $120 million Fixed rate bonds: 4% annual coupon, 10-year remaining life, face value of $100 million, and a credit rating of "B". 130 million of common shares outstanding (trading at $2.8 per share) The firm's unlevered beta is 1.10. Tax rate is 25%, risk free rate is 2%, and equity risk premium is 6%. Page 6 of 8 The credit spreads for bonds are as follows: "BB" rated bonds: 2.6% (over risk free rate) "B" rated bonds: 4.0% (over risk free rate). Based on the capital structure at the end of Year 0: (i) What is the firm's cost of equity? (1 point) (ii) What is the firm's WACC? (1 point) Suppose the firm is going to execute a recapitalization. It will issue 30 million new shares at a price of $2.7 per share. Then it will use the proceeds from the share sale plus a drawdown of the cash balances to fully repay the floating rate bank loan ($120 million). After the recapitalization, the share price will settle at $2.7 per share, and the credit rating of the fixed rate bond will be immediately upgraded to "BB". (iii) What is the WACC of the firm after the recapitalization? (2 points) (iv) What is the intrinsic value per share after the recapitalization? (1.5 points)

Step by Step Solution

★★★★★

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

i To calculate the firms cost of equity we can use the Capital Asset Pricing Model CAPM Cost of Equity RiskFree Rate Beta Equity Risk Premium Given RiskFree Rate 2 Equity Risk Premium 6 Unlevered Beta ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started