Answered step by step

Verified Expert Solution

Question

1 Approved Answer

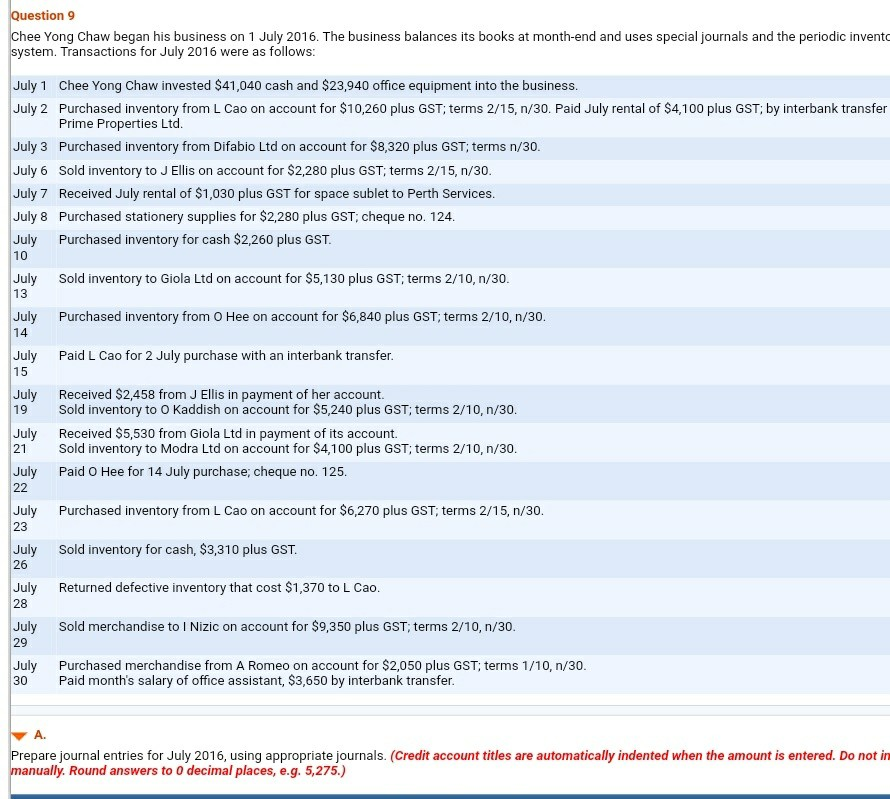

Question 9 Chee Yong Chaw began his business on 1 July 2016. The business balances its books at month-end and uses special journals and the

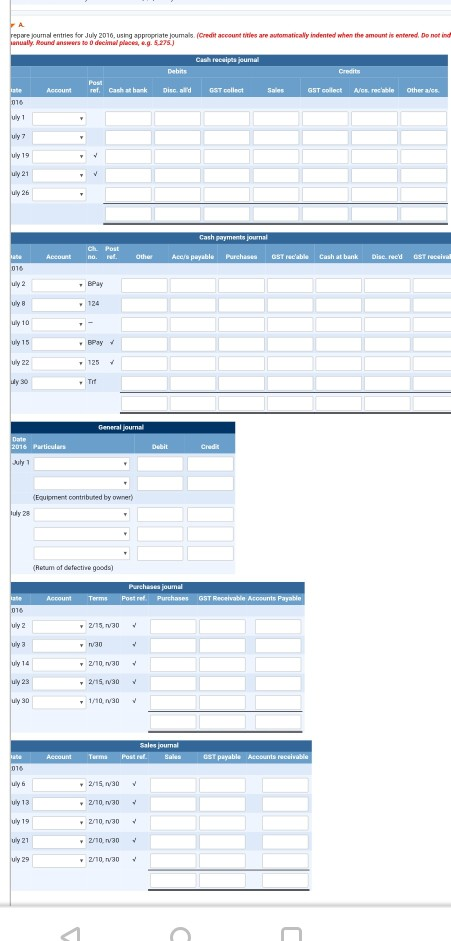

Question 9 Chee Yong Chaw began his business on 1 July 2016. The business balances its books at month-end and uses special journals and the periodic invento system. Transactions for July 2016 were as follows: July 1 Chee Yong Chaw invested $41,040 cash and $23,940 office equipment into the business. July 2 Purchased inventory from L Cao on account for $10,260 plus GST; terms 2/15, n/30. Paid July rental of $4,100 plus GST; by interbank transfer Prime Properties Ltd. July 3 Purchased inventory from Difabio Ltd on account for $8,320 plus GST; terms n/30. July 6 Sold inventory to J Ellis on account for $2,280 plus GST; terms 2/15, n/30. July 7 Received July rental of $1,030 plus GST for space sublet to Perth Services. July 8 Purchased stationery supplies for $2,280 plus GST: cheque no. 124. July Purchased inventory for cash $2,260 plus GST. 10 July 13 Sold inventory to Giola Ltd on account for $5,130 plus GST; terms 2/10,n/30. July 14 Purchased inventory from o Hee on account for $6,840 plus GST; terms 2/10,n/30. July 15 Paid L Cao for 2 July purchase with an interbank transfer. July 19 July 21 Received $2,458 from J Ellis in payment of her account. Sold inventory to 0 Kaddish on account for $5,240 plus GST; terms 2/10,n/30. Received $5,530 from Giola Ltd in payment of its account. Sold inventory to Modra Ltd on account for $4,100 plus GST; terms 2/10, n/30. Paid o Hee for 14 July purchase; cheque no. 125. July 22 July 23 Purchased inventory from L Cao on account for $6,270 plus GST; terms 2/15, n/30. Sold inventory for cash, $3,310 plus GST. July 26 July 28 Returned defective inventory that cost $1,370 to L Cao. July 29 Sold merchandise to I Nizic on account for $9,350 plus GST, terms 2/10,n/30. July 30 Purchased merchandise from A Romeo on account for $2,050 plus GST; terms 1/10,n/30. Paid month's salary of office assistant, $3,650 by interbank transfer. A. Prepare journal entries for July 2016, using appropriate journals. (Credit account titles are automatically indented when the amount is entered. Do not in manually. Round answers to 0 decimal places, e.g. 5,275.) repare joumal entries for July 2016, using appropriate joumals (Credit account titles are automatically indented when the amount is entered. Do not ind anual. Round answers to decimale. 3.275) Cash receipts journal Debits Credits Post rel, Cash at bank Account Discald GST collect Sales GST collect Alos rewbie Other als Late 016 uly 1 uly 2 uly 19 7 uly 21 uy 2 Cash payments journal Ch Post no. rel Account Other Acc/e payable Purchase GST recable Cash at bank Discrec'd OST received 016 uly 2 BPay uly B 124 tay 1 uly 15 Pay uly 22 125 wly 30 THE General journal Debit Credit Date 2016 Particulars July 1 (Equipment contributed by owner) uly 28 (Reum of defective goods) Purchases journal Portret Purchases Late Account Terms GST Receivable Accounts Payable 016 uly 2 - 2/15. van uly 3 30 uly 14 2/10.30 uly 23 2/15, 130 uly 30 1/10, 1/30 Sales journal Postre Account Terma OST payable Accounts receivable 016 uly 6 2/15 30 uly 13 2/10.30 My 19 2/10.30 7 uly 21 2/10 Van wy 29 - 2/10 n

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started