Answered step by step

Verified Expert Solution

Question

1 Approved Answer

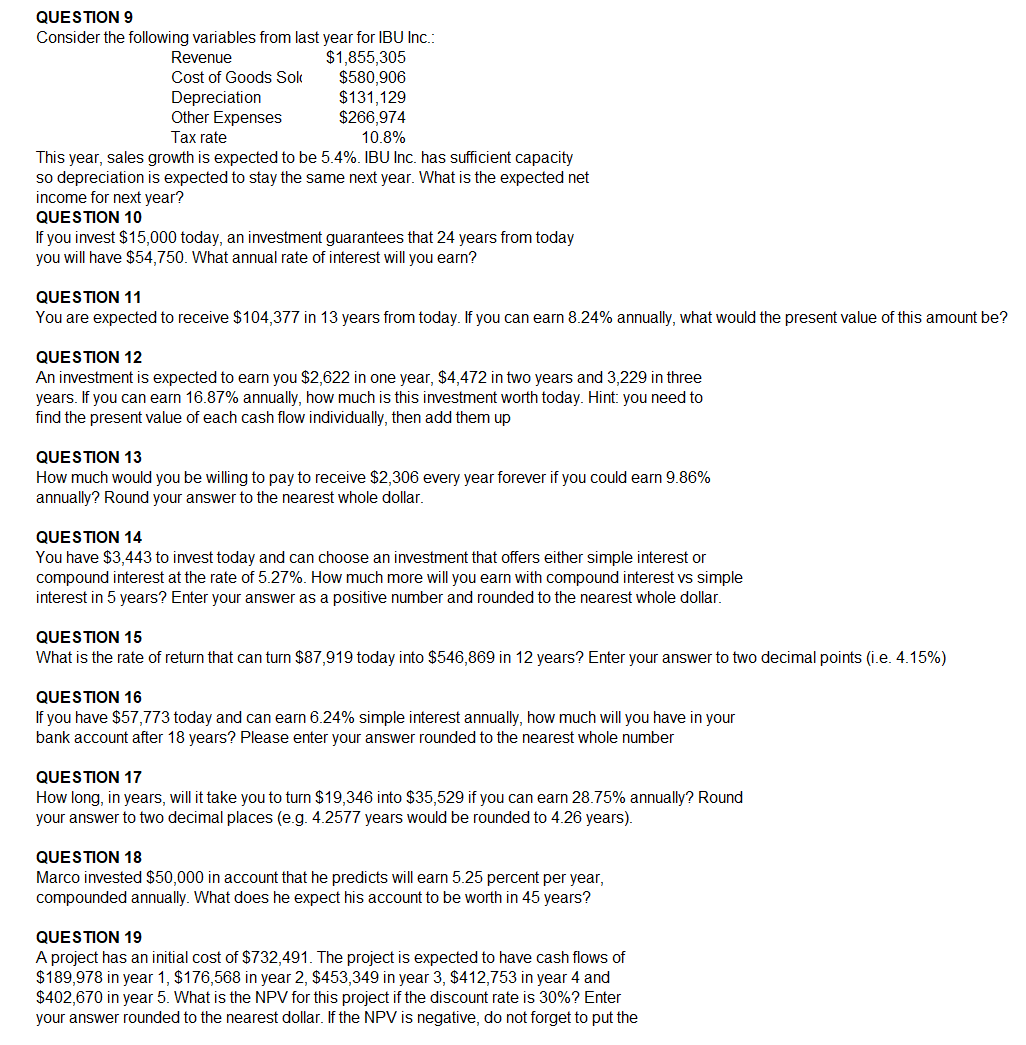

QUESTION 9 Consider the following variables from last year for IBU Inc.: This year, sales growth is expected to be 5 . 4 % .

QUESTION

Consider the following variables from last year for IBU Inc.:

This year, sales growth is expected to be IBU Inc. has sufficient capacity

so depreciation is expected to stay the same next year. What is the expected net

income for next year?

QUESTION

If you invest $ today, an investment guarantees that years from today

you will have $ What annual rate of interest will you earn?

QUESTION

You are expected to receive $ in years from today. If you can earn annually, what would the present value of this amount be

QUESTION

An investment is expected to earn you $ in one year, $ in two years and in three

years. If you can earn annually, how much is this investment worth today. Hint: you need to

find the present value of each cash flow individually, then add them up

QUESTION

How much would you be willing to pay to receive $ every year forever if you could earn

annually? Round your answer to the nearest whole dollar.

QUESTION

You have $ to invest today and can choose an investment that offers either simple interest or

compound interest at the rate of How much more will you earn with compound interest vs simple

interest in years? Enter your answer as a positive number and rounded to the nearest whole dollar.

QUESTION

What is the rate of return that can turn $ today into $ in years? Enter your answer to two decimal points ie

QUESTION

If you have $ today and can earn simple interest annually, how much will you have in your

bank account after years? Please enter your answer rounded to the nearest whole number

QUESTION

How long, in years, will it take you to turn $ into $ if you can earn annually? Round

your answer to two decimal places eg years would be rounded to years

QUESTION

Marco invested $ in account that he predicts will earn percent per year,

compounded annually. What does he expect his account to be worth in years?

QUESTION

A project has an initial cost of $ The project is expected to have cash flows of

$ in year $ in year $ in year $ in year and

$ in year What is the NPV for this project if the discount rate is Enter

your answer rounded to the nearest dollar. If the NPV is negative, do not forget to put the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started