Answered step by step

Verified Expert Solution

Question

1 Approved Answer

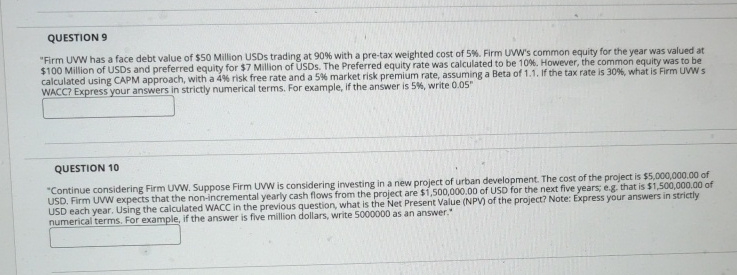

QUESTION 9 Firm UWW has a face debt value of $ 5 0 Million USDs trading at 9 0 % with a pre - tax

QUESTION

"Firm UWW has a face debt value of $ Million USDs trading at with a pretax weighted cost of Firm UMw's common equity for the year was valued at $ Million of USDs and preferred equity for $ Million of USDS. The Preferred equity rate was calculated to be However, the common equity was to be calculated using CAPM approach, with a risk free rate and a market risk premium rate, assuming a Beta of If the tax rate is what is Firm UWW userf Fvnrace vnur answers in strictly numerical terms. For example, if the answer is write

QUESTION

"Continue considering Firm UVW. Suppose Firm UVW is considering investing in a new project of urban development. The cost of the project is $ of USD. Firm UVW expects that the nonincremental yearly cash flows from the project are $ of USD for the next five years; eg that is $ of USD each year. Using the calculated WACC in the previous question, what is the Net Present Value NPV of the project? Note: Express your answers in strictly numbriral terms. For example, if the answer is five million dollars, write as an answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started