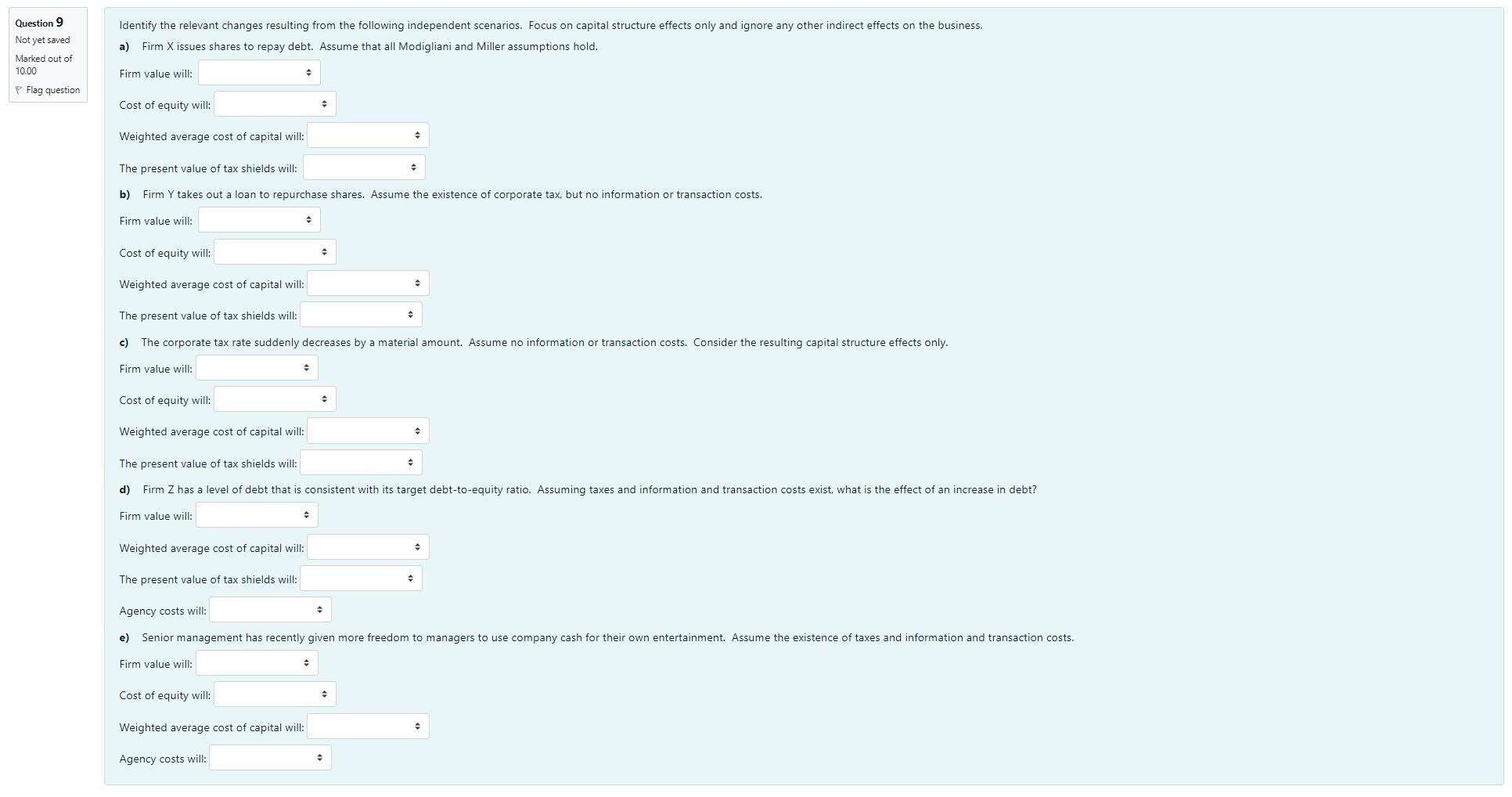

Question 9 Identify the relevant changes resulting from the following independent scenarios. Focus on capital structure effects only and ignore any other indirect effects on the business. Not yet saved a) Firm X issues shares to repay debt. Assume that all Modigliani and Miller assumptions hold. Marked out of 10.00 Firm value will: P Flag question Cost of equity will: Weighted average cost of capital will: The present value of tax shields will: b) Firm Y takes out a loan to repurchase shares. Assume the existence of corporate tax, but no information or transaction costs. Firm value will: Cost of equity will: Weighted average cost of capital will: The present value of tax shields will: c) The corporate tax rate suddenly decreases by a material amount. Assume no information or transaction costs. Consider the resulting capital structure effects only. Firm value will: Cost of equity will: Weighted average cost of capital will: The present value of tax shields will: d) Firm Z has a level of debt that is consistent with its target debt-to-equity ratio. Assuming taxes and information and transaction costs exist, what is the effect of an increase in debt? Firm value will: Weighted average cost of capital will: . The present value of tax shields will: Agency costs will: e) Senior management has recently given more freedom to managers to use company cash for their own entertainment. Assume the existence of taxes and information and transaction costs. Firm value will: Cost of equity will: Weighted average cost of capital will: Agency costs will: Question 9 Identify the relevant changes resulting from the following independent scenarios. Focus on capital structure effects only and ignore any other indirect effects on the business. Not yet saved a) Firm X issues shares to repay debt. Assume that all Modigliani and Miller assumptions hold. Marked out of 10.00 Firm value will: P Flag question Cost of equity will: Weighted average cost of capital will: The present value of tax shields will: b) Firm Y takes out a loan to repurchase shares. Assume the existence of corporate tax, but no information or transaction costs. Firm value will: Cost of equity will: Weighted average cost of capital will: The present value of tax shields will: c) The corporate tax rate suddenly decreases by a material amount. Assume no information or transaction costs. Consider the resulting capital structure effects only. Firm value will: Cost of equity will: Weighted average cost of capital will: The present value of tax shields will: d) Firm Z has a level of debt that is consistent with its target debt-to-equity ratio. Assuming taxes and information and transaction costs exist, what is the effect of an increase in debt? Firm value will: Weighted average cost of capital will: . The present value of tax shields will: Agency costs will: e) Senior management has recently given more freedom to managers to use company cash for their own entertainment. Assume the existence of taxes and information and transaction costs. Firm value will: Cost of equity will: Weighted average cost of capital will: Agency costs will