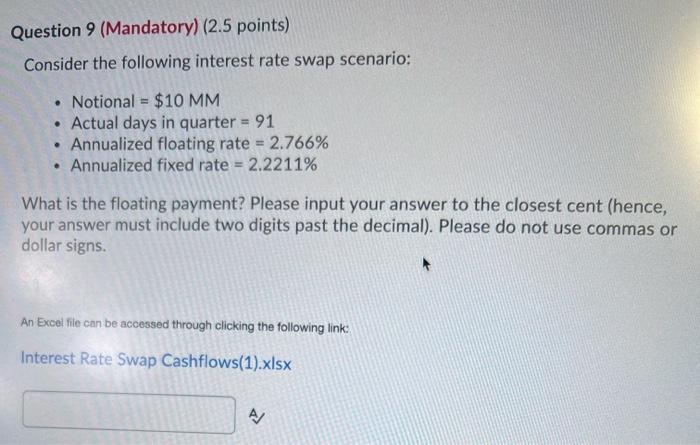

Question: Question 9 (Mandatory) (2.5 points) Consider the following interest rate swap scenario: Notional = $10 MM Actual days in quarter = 91 Annualized floating rate

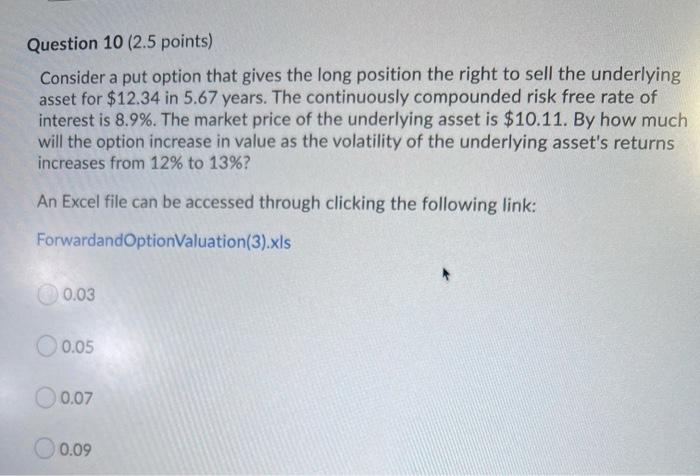

Question 9 (Mandatory) (2.5 points) Consider the following interest rate swap scenario: Notional = $10 MM Actual days in quarter = 91 Annualized floating rate = 2.766% Annualized fixed rate = 2.2211% What is the floating payment? Please input your answer to the closest cent (hence, your answer must include two digits past the decimal). Please do not use commas or dollar signs. An Excel file can be accessed through clicking the following link: Interest Rate Swap Cashflows(1).xlsx A Question 10 (2.5 points) Consider a put option that gives the long position the right to sell the underlying asset for $12.34 in 5.67 years. The continuously compounded risk free rate of interest is 8.9%. The market price of the underlying asset is $10.11. By how much will the option increase in value as the volatility of the underlying asset's returns increases from 12% to 13%? An Excel file can be accessed through clicking the following link: ForwardandOptionValuation(3).xls 0.03 0.05 0.07 0.09

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts