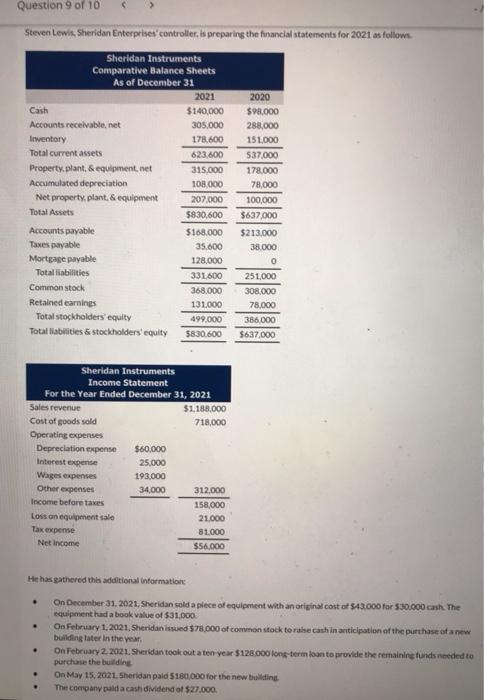

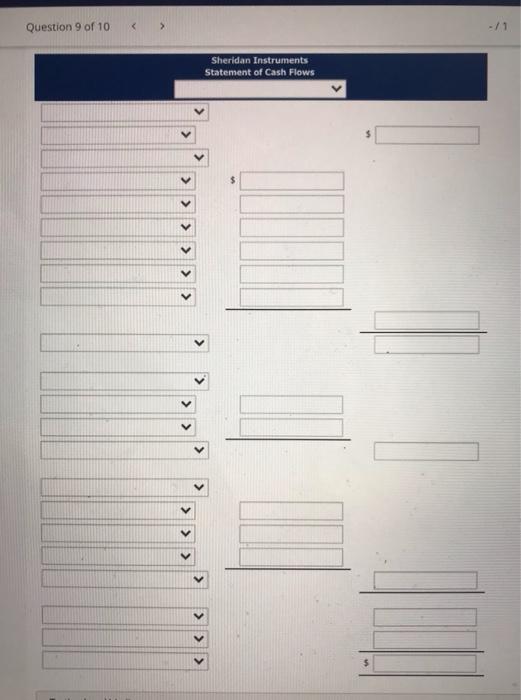

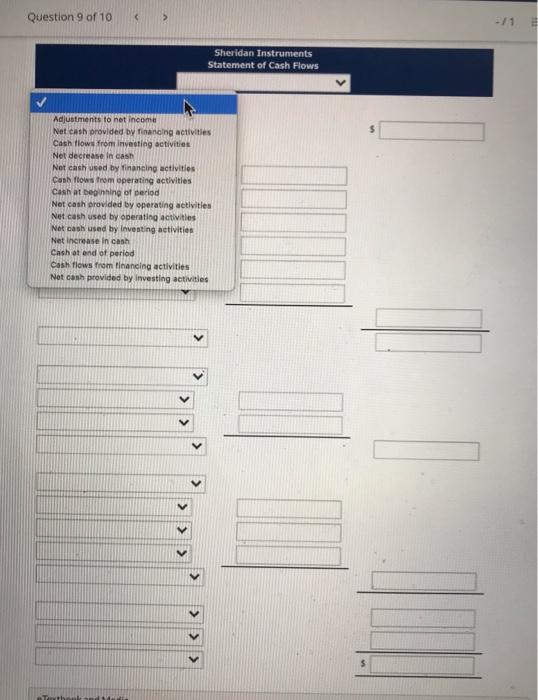

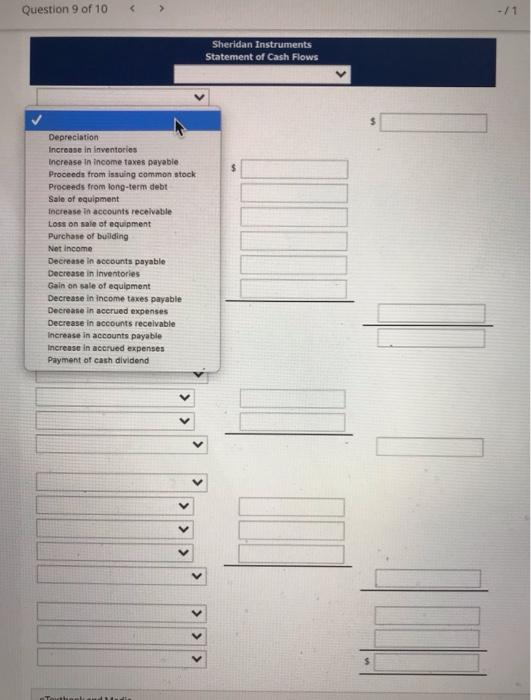

Question 9 of 10 Steven Lewis, Sheridan Enterprises controller, is preparing the financial statements for 2021 as follows 2020 Sheridan Instruments Comparative Balance Sheets As of December 31 2021 Cash $140,000 Accounts receivable.net 305.000 Inventory 178,600 Total current assets 623,600 Property, plant, & equipment.net 315.000 Accumulated depreciation 108.000 Net property, plant, & equipment 207.000 Total Assets $830.600 Accounts payable $168.000 Taxes payable 35.600 Mortgage payable 128.000 Total liabilities 331.600 Common stock 368.000 Retained earnings 131.000 Total stockholders' equity 499.000 Total abilities & stockholders equity 5830.600 $98.000 288,000 151.000 537.000 178,000 78,000 100,000 $637,000 $213.000 38.000 0 251.000 308,000 78,000 386.000 $637,000 Sheridan Instruments Income Statement For the Year Ended December 31, 2021 Sales revenue $1,188,000 Cost of goods sold 718,000 Operating expenses Depreciation expense $60,000 Interest expense 25.000 Wages expenses 193.000 Other expenses 34,000 312,000 Income before taxes 158,000 Loss on equipment sale 21.000 Tax expense 81.000 Net Income $56.000 He has gathered this additional Information . . On December 31, 2021. Sheridan sold a plece of equipment with an original cost of $43.000 for $30.000 cash. The equipment had a book value of $31.000 On February 1.2021. Sheridan issued $75,000 of common stock to rahe cash in anticipation of the puthase of building later in the year On February 2, 2021. Sheridan took out a ten year $128.000 long-term loan to provide the remaining funds needed to purchase the building On May 15, 2021. Sheridan paid $180.000 for the new building The company paid a cash dividend of $27.000 . Question 9 of 10 - / 1 Sheridan Instruments Statement of Cash Flows > Sheridan Instruments Statement of Cash Flows Adjustments to net income Net cash provided by financing activities Cash flow from investing activities Net decrease in cas Net cash used by financing activities Cash flows from operating activities cash at beginning of period Net cash provided by operating activities Net cash used by operating activities Net cash used by Inventing activities Net increase in cash Cash at end of period cash flows from financing activities Net cash provided by investing activities > >