Answered step by step

Verified Expert Solution

Question

1 Approved Answer

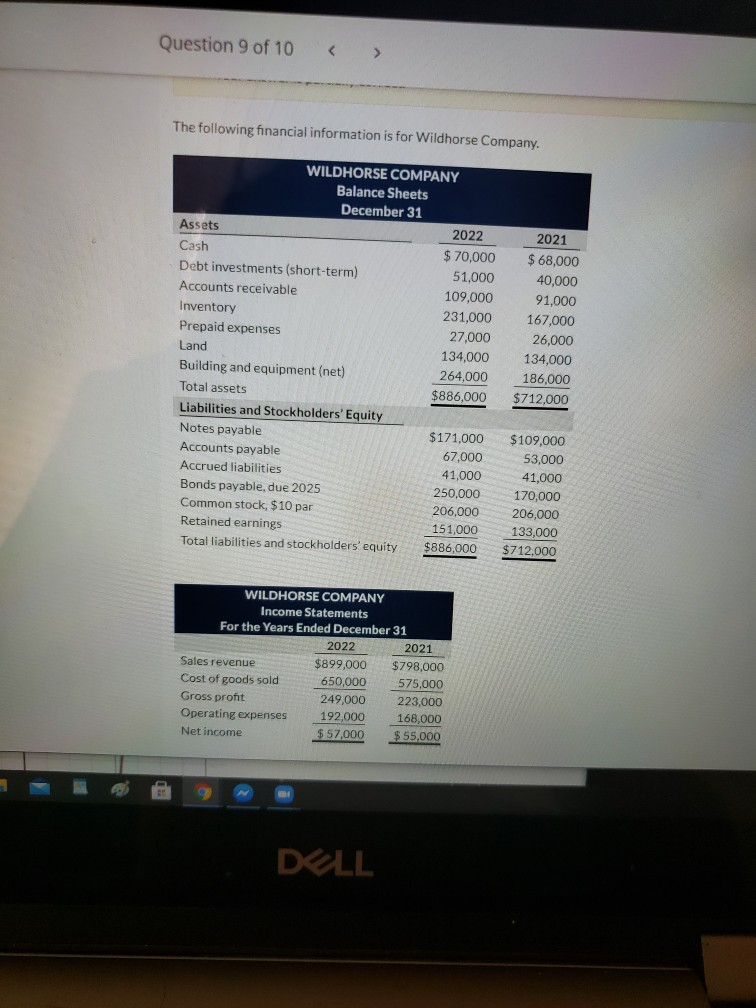

Question 9 of 10 The following financial information is for Wildhorse Company. WILDHORSE COMPANY Balance Sheets December 31 Assets 2022 Cash $ 70,000 Debt investments

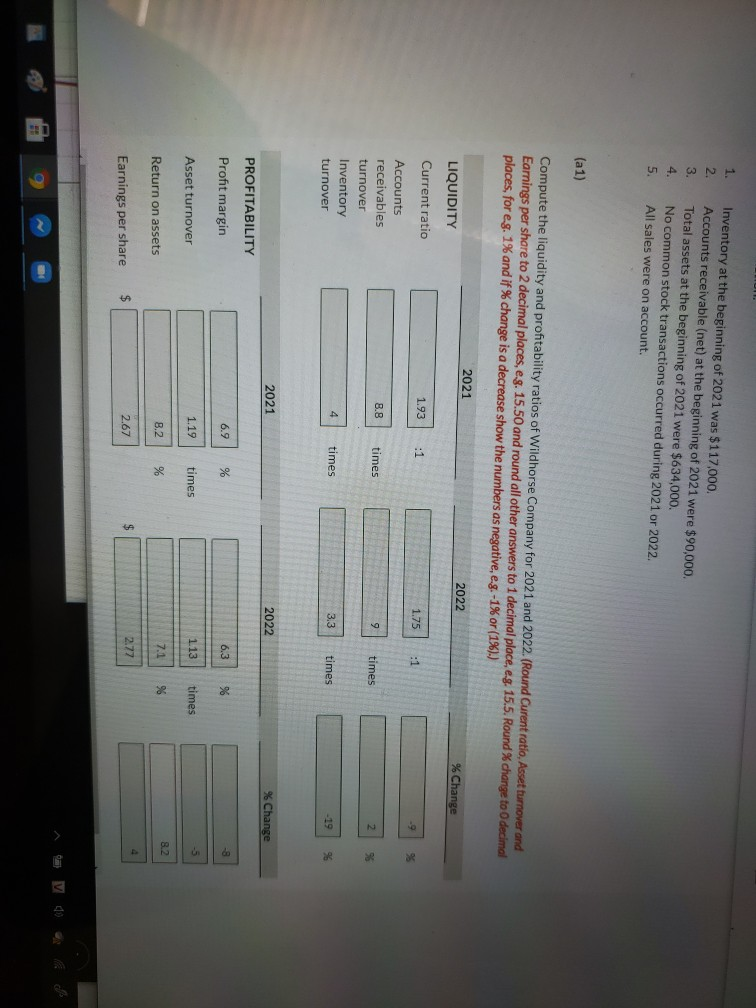

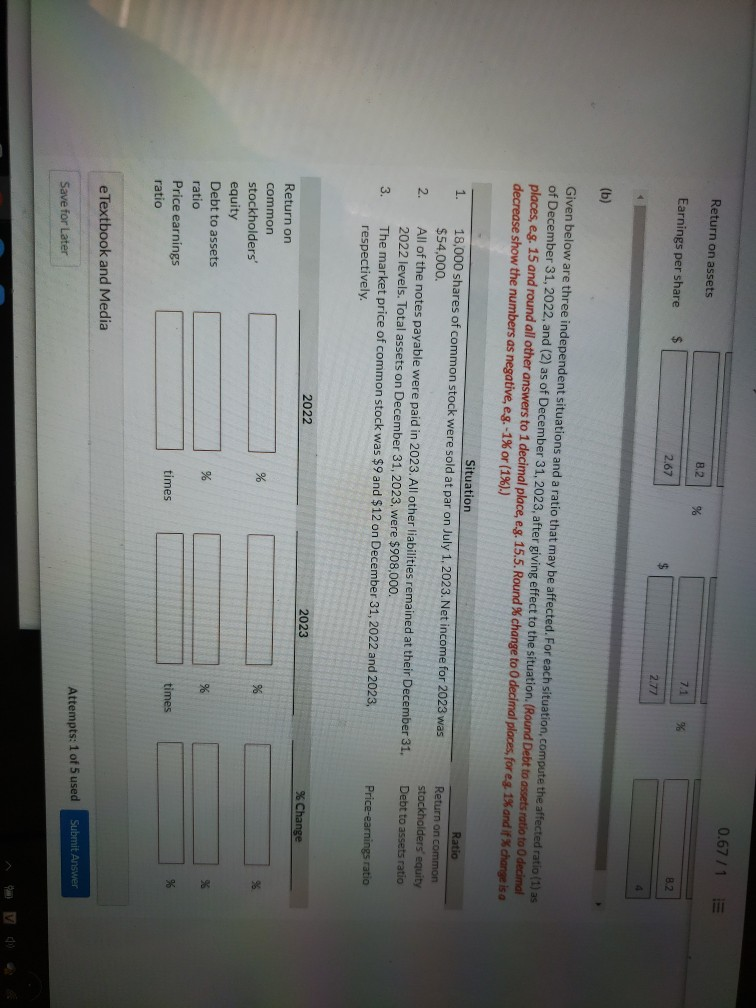

Question 9 of 10 The following financial information is for Wildhorse Company. WILDHORSE COMPANY Balance Sheets December 31 Assets 2022 Cash $ 70,000 Debt investments (short-term) 51,000 Accounts receivable 109,000 Inventory 231,000 Prepaid expenses Land 134,000 Building and equipment (net) 264,000 Total assets $886,000 Liabilities and Stockholders' Equity Notes payable $171,000 Accounts payable 67,000 Accrued liabilities 41,000 Bonds payable, due 2025 250,000 Common stock, $10 par 206,000 Retained earnings 151,000 Total liabilities and stockholders' equity $886,000 2021 $ 68,000 40,000 91,000 167,000 26,000 134,000 186,000 $712,000 27.000 $109,000 53,000 41.000 170,000 206,000 133,000 $712,000 WILDHORSE COMPANY Income Statements For the Years Ended December 31 2022 2021 Sales revenue $899,000 $798,000 Cost of goods sold 650,000 575,000 Gross profit 249,000 223,000 Operating expenses 192,000 168,000 Net income $ 57,000 $ 55,000 DELL 1 2 3. 4. Inventory at the beginning of 2021 was $117,000 Accounts receivable (net) at the beginning of 2021 were $90,000 Total assets at the beginning of 2021 were $634,000. No common stock transactions occurred during 2021 or 2022. All sales were on account. 5. (a1) Compute the liquidity and profitability ratios of Wildhorse Company for 2021 and 2022. (Round Curent ratio, Asset turnover and Earnings per share to 2 decimal places, eg. 15.50 and round all other answers to 1 decimal place, e.g. 15.5. Round % change to decimal places, for eg. 1% and if % change is a decrease show the numbers as negative, e.g. -1% or (1%).) 2021 2022 LIQUIDITY % Change Current ratio 1.93 :1 1.75 8.8 times 9 times 2 Accounts receivables turnover Inventory turnover 4 times 3.3 times -19 96 2021 2022 % Change PROFITABILITY Profit margin 6.9 % 6.3 %% -8 Asset turnover 1.19 times 113 times -5 82 Return on assets 8.2 % 7.1 % $ Earnings per share 2.67 2.77 $ Return on assets 0.67 / 1 8.2 % Earnings per share 71 $ 2.67 $ (b) Given below are three independent situations and a ratio that may be affected. For each situation, compute the affected ratio (1) as of December 31, 2022, and (2) as of December 31, 2023, after giving effect to the situation. (Round Debt to assets ratio to decimal places, eg. 15 and round all other answers to 1 decimal place, e.g. 15.5. Round % change to O decimal places, foreg. 1% and if % change is a decrease show the numbers as negative, e.g.-1% or (1%).) 1. Situation 18,000 shares of common stock were sold at par on July 1, 2023. Net income for 2023 was $54,000. All of the notes payable were paid in 2023. All other liabilities remained at their December 31. 2022 levels. Total assets on December 31, 2023, were $908,000. The market price of common stock was $9 and $12 on December 31, 2022 and 2023, respectively. Ratio Return on common stockholders equity Debt to assets ratio 2. 3. Price-earnings ratio 2022 2023 % Change % %6 % Return on common stockholders equity Debt to assets ratio Price earnings ratio % % times times % e Textbook and Media Submit Answer Attempts: 1 of 5 used Save for Later

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started