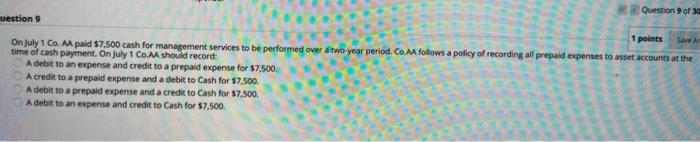

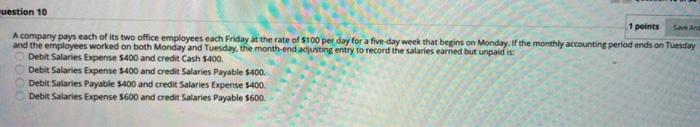

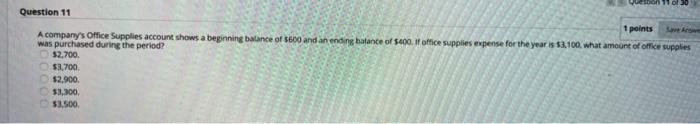

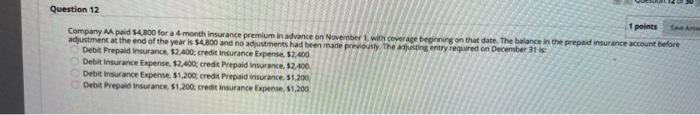

Question 9 of 30 uestion 9 1 points On July 1 Co. A paid $7.500 cash for management services to be performed over two year period. Co AA follows a policy of recording all prepaid expenses to asset accounts at the time of cash payment. On July 1 Co AA should record A debit to an expense and credit to a prepaid expense for 57.500 A credit to a prepaid expense and a debit to Cash for $7.500 A debit to a prepaid expense and a credit to Cash for 37.500. A debit to an expense and credit to Cash for $7.500. uestion 10 1 points Save An A company pays each of its two office employees each Friday at the rate of $100 per day for a five day week that begins on Monday. If the monthly accounting period ends on Tuesday and the employees worked on both Monday and Tuesday, the month-end adjusting entry to record the salaries earned but unpaid is. Debit Salaries Expense $400 and credit Cash 5400 Debit Salaries Expense 5400 and credit Salaries Payable $400 Debit Salaries Payable $400 and credit Salaries Expense 5400 Debit Salaries Expense $600 and credit Salaries Payable 5600 Question 11 1 points A company's Office Supplies account shows a beginning balance of $600 and an ending balance of 5400. if office supplies expense for the year is 53,100. what amount of office supplies was purchased during the period? 52.700 $3.700 $2,900 53,300 $3,500 Question 12 1 points GA Company AA paid 54,800 for a month insurance premium in advance on November 1, with coverage beginning on that date. The balance in the prepaid insurance account before adjustment at the end of the year is $4,800 and no adjustments had been made previously. The adjusting entry required on December 31 Debit Prepaid Insurance, $2,400, credit Insurance Expense. 57.400 Debit insurance Expense. 12,400, credit Prepaid insurance, 12.400 Debit insurance Expense 1.200 credit Prepaid insurance. 31,200 Debit Prepaid insurance, 1.200 credit insurance Expe, 1,200