Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question 9 please Problem 2: Trade Taxes & Quotas [12 Points] Suppose that we are considering the domestic market for tires and live in indonesia.

question 9 please

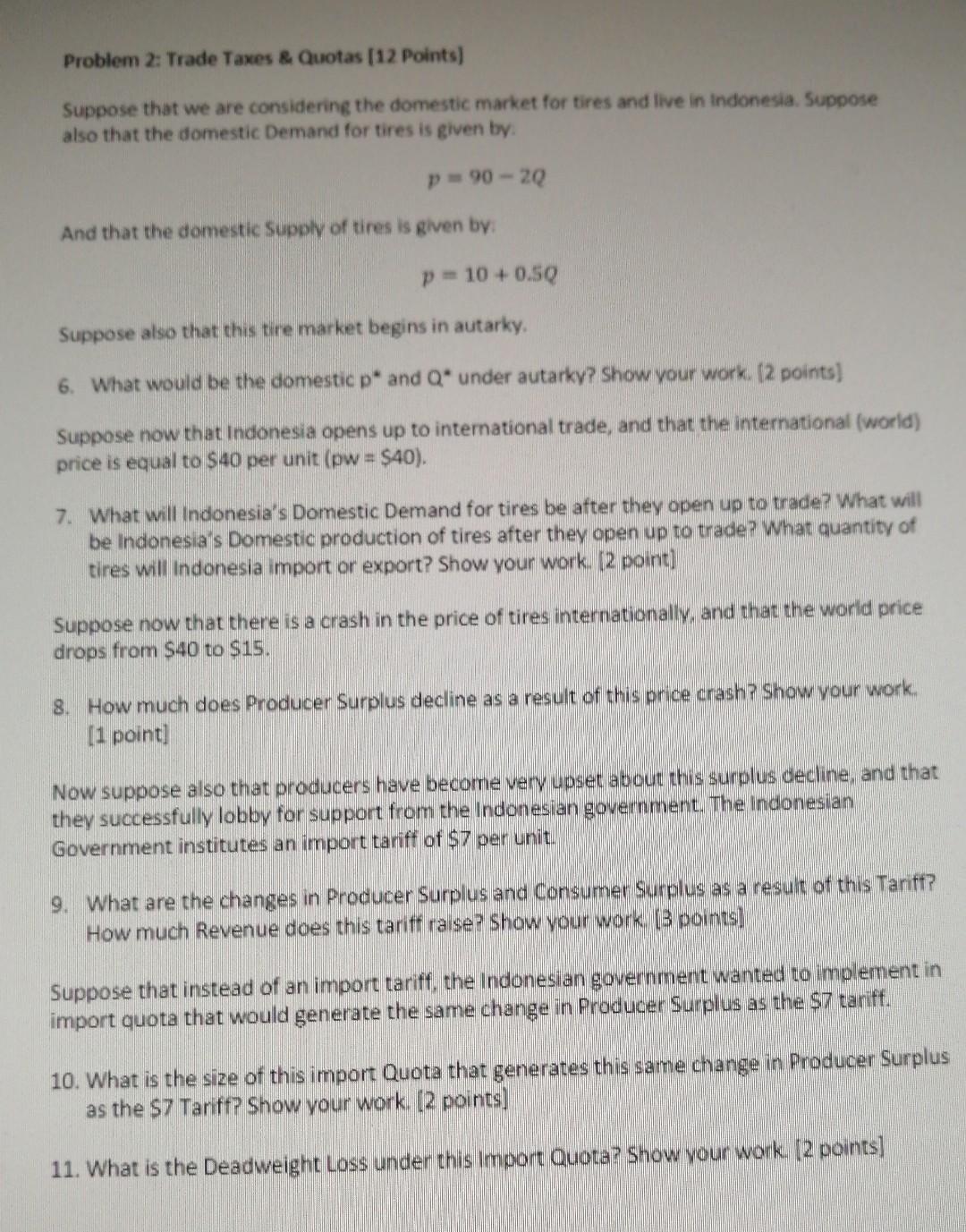

Problem 2: Trade Taxes \& Quotas [12 Points] Suppose that we are considering the domestic market for tires and live in indonesia. Suppose also that the domestic Demand for tires is given by. p=902Q And that the domestic supply of tires is given by: p=10+0.5Q Suppose also that this tire market begins in autarky. 6. What would be the domestic p and Q under autarky? Show your work. [2 points] Suppose now that Indonesia opens up to international trade, and that the international (world) price is equal to $40 per unit (pw=$40 ). 7. What will Indonesia's Domestic Demand for tires be after they open up to trade? What will be Indonesia's Domestic production of tires after they open up to trade? What quantity of tires will indonesia import or export? Show your work. [ 2 point] Suppose now that there is a crash in the price of tires internationally, and that the worid price drops from $40 to $15. 8. How much does Producer Surplus decline as a result of this price crash? Show your work. [1 point] Now suppose also that producers have become very upset about this surplus decline, and that they successfully lobby for support from the Indonesian government. The indonesian Government institutes an import tariff of $7 per unit. 9. What are the changes in Procucer Surplus and Consumer Surplus as a resuit of this Tariff? How much Revenue does this tariff ralse? Show your work. [3 points] Suppose that instead of an import tariff, the Indonesian government wanted to implement in import quota that would generate the same change in Producer Surplus as the $7 tariff. 10. What is the size of this import Quota that generates this same change in Producer Surplus as the 57 Tariff? Show your work. [2 points] 11. What is the Deadweight Loss under this import Quota? Show your work. [2 points]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started