Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question 9 question 10 question 11 just answer. one then 9 Diego Company manufactures one product that is sold for $72 per unit in two

question 9

question 10

question 11

just answer. one then

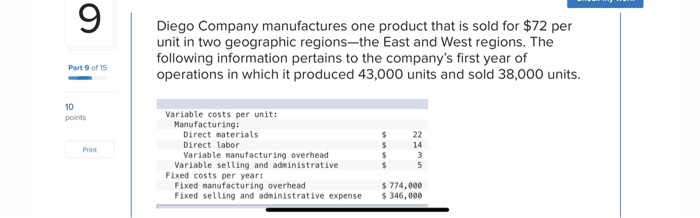

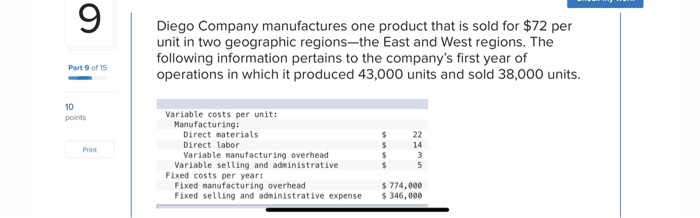

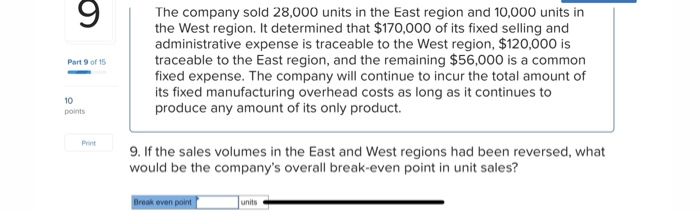

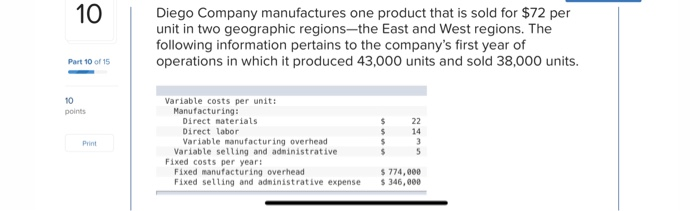

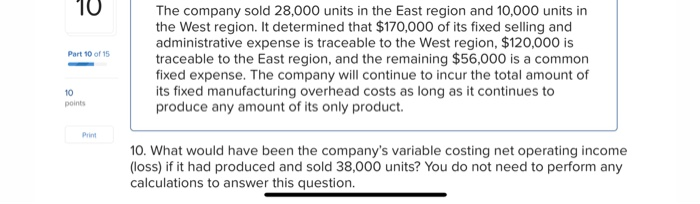

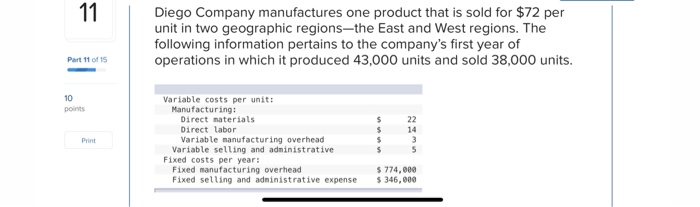

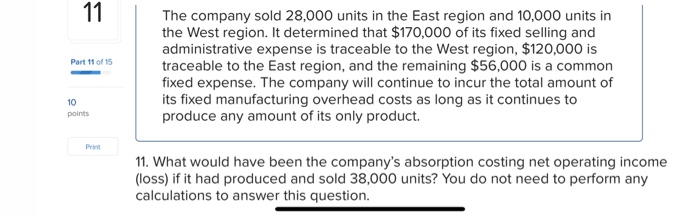

9 Diego Company manufactures one product that is sold for $72 per unit in two geographic regionsthe East and West regions. The following information pertains to the company's first year of operations in which it produced 43,000 units and sold 38,000 units. Part 9 of 15 10 points Print Variable costs per unit: Manufacturing: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expense $ $ $ 14 3 5 $ 774,000 $ 346,000 9 Part 9 of 15 The company sold 28,000 units in the East region and 10,000 units in the West region. It determined that $170,000 of its fixed selling and administrative expense is traceable to the West region, $120,000 is traceable to the East region, and the remaining $56,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to produce any amount of its only product. 10 points Print 9. If the sales volumes in the East and West regions had been reversed, what would be the company's overall break-even point in unit sales? Broak even point! units 10 Diego Company manufactures one product that is sold for $72 per unit in two geographic regions-the East and West regions. The following information pertains to the company's first year of operations in which it produced 43,000 units and sold 38,000 units. Part 10 of 15 10 points Print Variable costs per unit: Manufacturing: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs per year! Fixed manufacturing overhead Fixed selling and administrative expense $ $ $ 5 $ 774,000 $ 346,000 10 Part 10 of 15 The company sold 28,000 units in the East region and 10,000 units in the West region. It determined that $170,000 of its fixed selling and administrative expense is traceable to the West region, $120,000 is traceable to the East region, and the remaining $56,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to produce any amount of its only product. 10 points Print 10. What would have been the company's variable costing net operating income (loss) if it had produced and sold 38,000 units? You do not need to perform any calculations to answer this question. 11 Diego Company manufactures one product that is sold for $72 per unit in two geographic regions-the East and West regions. The following information pertains to the company's first year of operations in which it produced 43,000 units and sold 38,000 units. Part 11 of 15 10 points Variable costs per unit: Manufacturing: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expense $ $ $ 14 3 5 $774,000 $ 346,000 11 Part 11 of 15 The company sold 28,000 units in the East region and 10,000 units in the West region. It determined that $170,000 of its fixed selling and administrative expense is traceable to the West region, $120,000 is traceable to the East region, and the remaining $56,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to produce any amount of its only product. 10 points Print 11. What would have been the company's absorption costing net operating income (loss) if it had produced and sold 38,000 units? You do not need to perform any calculations to answer this Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started