Answered step by step

Verified Expert Solution

Question

1 Approved Answer

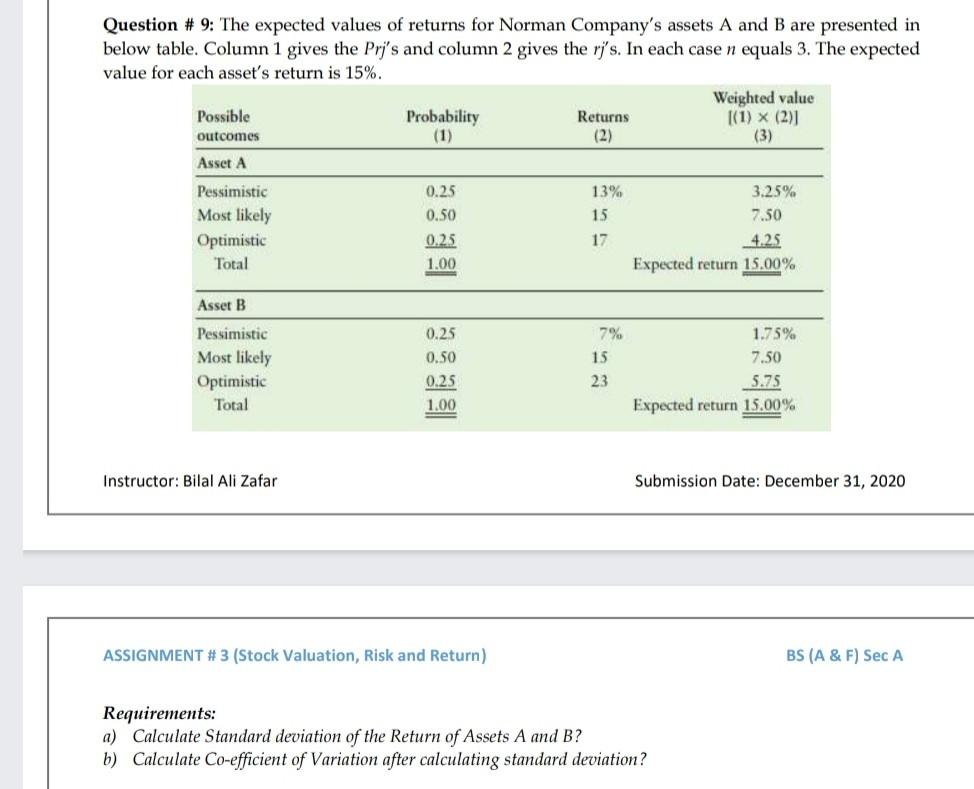

Question # 9: The expected values of returns for Norman Company's assets A and B are presented in below table. Column 1 gives the Pri's

Question # 9: The expected values of returns for Norman Company's assets A and B are presented in below table. Column 1 gives the Pri's and column 2 gives the ri's. In each case n equals 3. The expected value for each asset's return is 15%. Weighted value Possible Probability Returns |(1) X (2) outcomes (2) (3) Asset A 0.25 13% 0.50 15 Pessimistic Most likely Optimistic Total 3.25% 7.50 4.25 Expected return 15.00% 0.25 17 1.00 Asset B Pessimistic Most likely Optimistic Total 0.25 0.50 0.25 1.00 7% 1.75% 15 7.50 23 5.75 Expected return 15.00% Instructor: Bilal Ali Zafar Submission Date: December 31, 2020 ASSIGNMENT #3 (Stock Valuation, Risk and Return) BS (A & F) Sec A Requirements: a) Calculate Standard deviation of the Return of Assets A and B? b) Calculate Co-efficient of Variation after calculating standard deviation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started