Question

QUESTION 9 The following information was drawn from the Year 8 balance sheets of two companies: Company Assets = Liabilities + Common Stock + Retained

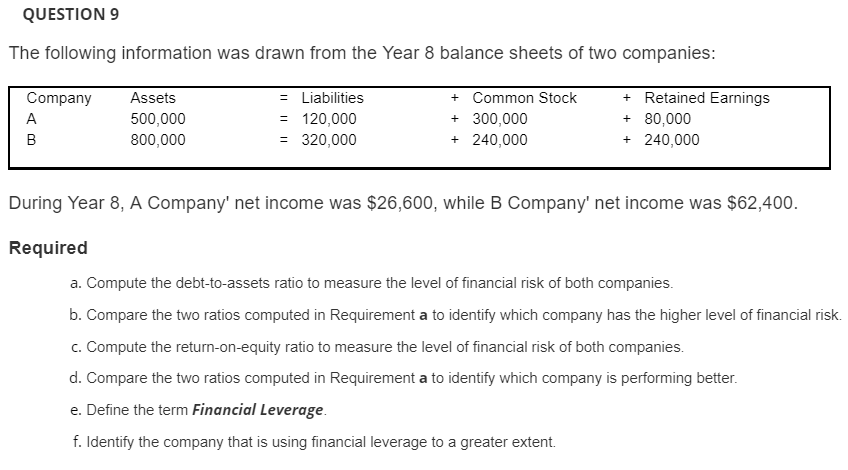

QUESTION 9

The following information was drawn from the Year 8 balance sheets of two companies:

Company Assets = Liabilities + Common Stock + Retained Earnings

A 500,000 = 120,000 + 300,000 + 80,000

B 800,000 = 320,000 + 240,000 + 240,000

During Year 8, A Company' net income was $26,600, while B Company' net income was $62,400.

Required

a. Compute the debt-to-assets ratio to measure the level of financial risk of both companies.

b. Compare the two ratios computed in Requirement a to identify which company has the higher level of financial risk.

c. Compute the return-on-equity ratio to measure the level of financial risk of both companies.

d. Compare the two ratios computed in Requirement a to identify which company is performing better.

e. Define the term Financial Leverage.

f. Identify the company that is using financial leverage to a greater extent.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started