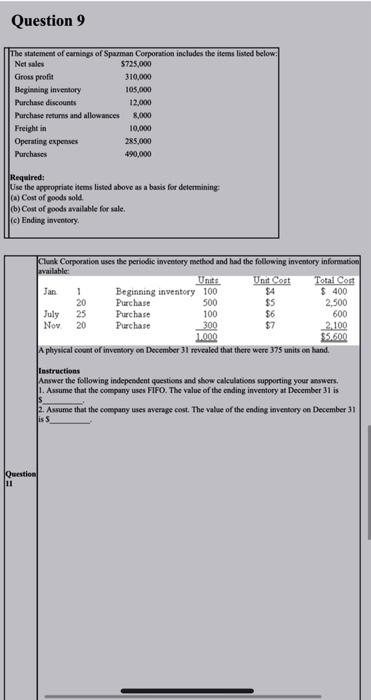

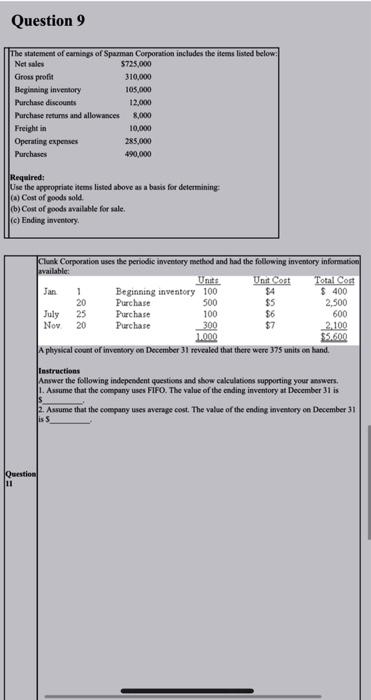

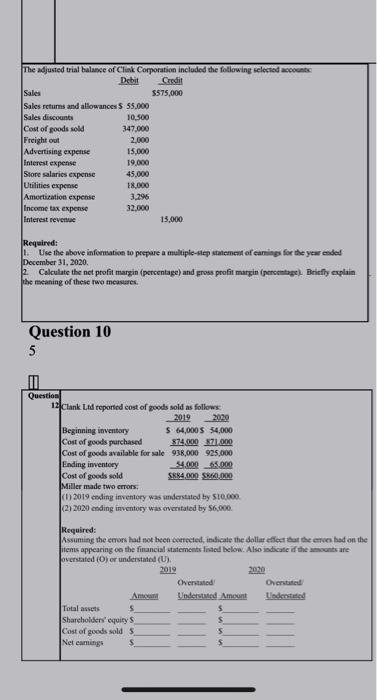

Question 9 The statement of earnings of Sparman Corporation includes the items listed below: Net sales $725,000 Gross profit 310.000 Heginning inventory 105.000 Purchase discounts 12,000 Purchase returns and allowances 8,000 Freight in 10,000 Operating expenses 285,000 Purchases 490,000 Required: Use the appropriate items listed above as a basis for determining (a) Cost of goods sold Cost of goods available for sale. (c) Ending inventory Clunk Corporation uses the periodic inventory method and had the following inventory information available: Units Und Cost Total Cost Jan 1 Beginning investory 100 $4 $ 400 20 Purchase 500 $5 2,500 July 25 Purchase 100 $6 600 Nov 20 Purchase 300 $7 2.100 1.000 $5.600 Aplysical count of inventory on December 31 revealed that there were 375 units en hand. Instructions Answer the following independent questions and show calculations supporting your answers. 1. Assume that the company uses FIFO. The value of the ending inventory at December 31 is 2. Assume that the company uses average cost. The value of the ending inventory on December 31 is 5 Question 11 Question 9 The statement of earnings of Sparman Corporation includes the items listed below: Net sales $725,000 Gross profit 310.000 Heginning inventory 105.000 Purchase discounts 12,000 Purchase returns and allowances 8,000 Freight in 10,000 Operating expenses 285.000 Purchases 490,000 Required: Use the appropriate items listed above as a basis for determining (a) Cost of goods sold c) Cost of goods available for sale. (c) Ending inventory Clunk Corporation uses the periodic inventory method and had the following inventory information available: Units Unit Cost Total Cost Jan 1 Beginning inventory 100 $4 $ 400 20 Purchase 500 $5 2,500 July 25 Purchase 100 $6 600 Nov 20 Purchase 300 $7 2.100 1000 $5.600 A physical count of inventory on December 31 revealed that there were 375 units en hund. Instructions Answer the following independent questions and show calculations supporting your answers. 1. Assume that the company uses FIFO. The value of the ending inventory at December 31 is 2. Assume that the company uses average cost. The value of the ending inventory on December 31 is s Question LI The adjusted trial balance of China Corporation included the following selected not Det Credit Sales $575.000 Sales returns and allowances $ 55.000 Sales discounts 10,500 Cost of goods sold 347.000 Freight out 2,000 Advertising expense 15.000 Interest expense 19.000 Store salaries expense 45,000 Utilities expense 18.000 Amortization expense Income tax expense 32,000 Interest revenue 15,000 3.296 Required: 1. Use the above information to prepare a multiple step statement of earnings for the year ended December 31, 2020 Calculate the net profit margin (percentage) and gross profit margin (percentagel Briefly explain the meaning of these two measures Question 10 5 Question 12 Clank Lad reported cost of goods sold as followe 2019 Beginning inventory $ 64,000 $ 54,000 Cost of goods purchased 574.000 71.000 Cost of goods available for sale 938,000 925,000 Ending inventory 54.000 65.000 Cost of goods sold S884.000 000 Miller made two errors 2019 ending inventory was understated by 510,000 22020 ending inventory was eventated by $6,000 Required: Assuming the errors had not been corrected indicate the dollur effect that the entoes had on the items appearing on the financial statements listed below. Also indicated the mounts are overstated (0) er understated (U). 2019 2020 Overstated Chette Understand Amount Understated Total assets 5 Shareholders' equitys Cost of goods sold 5 Net earnings