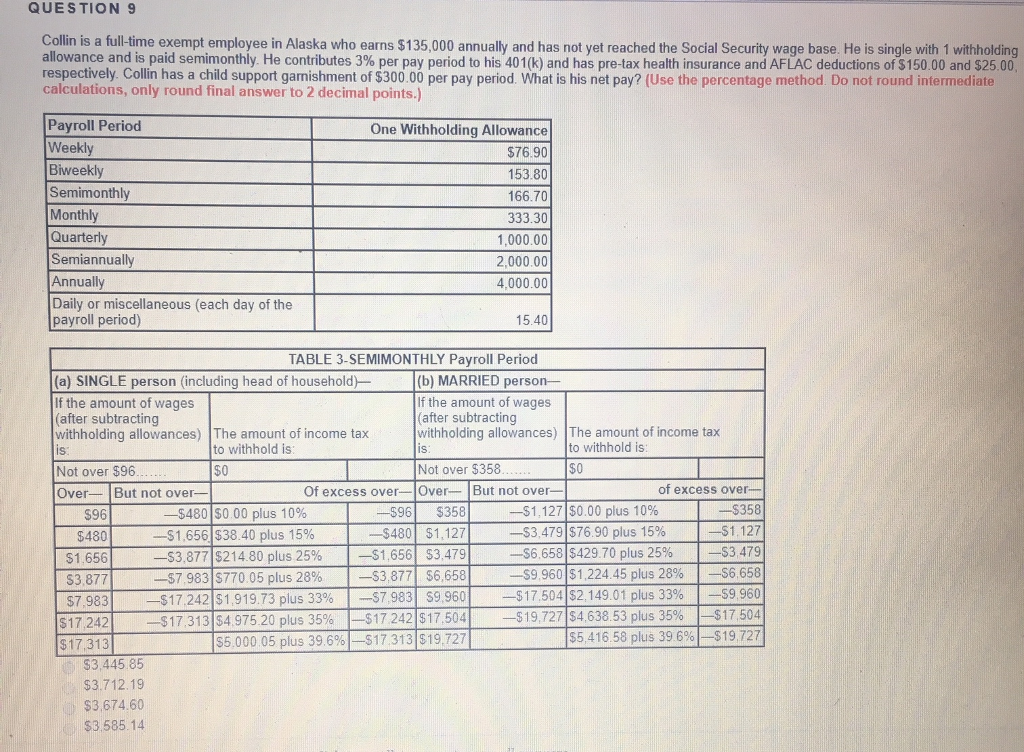

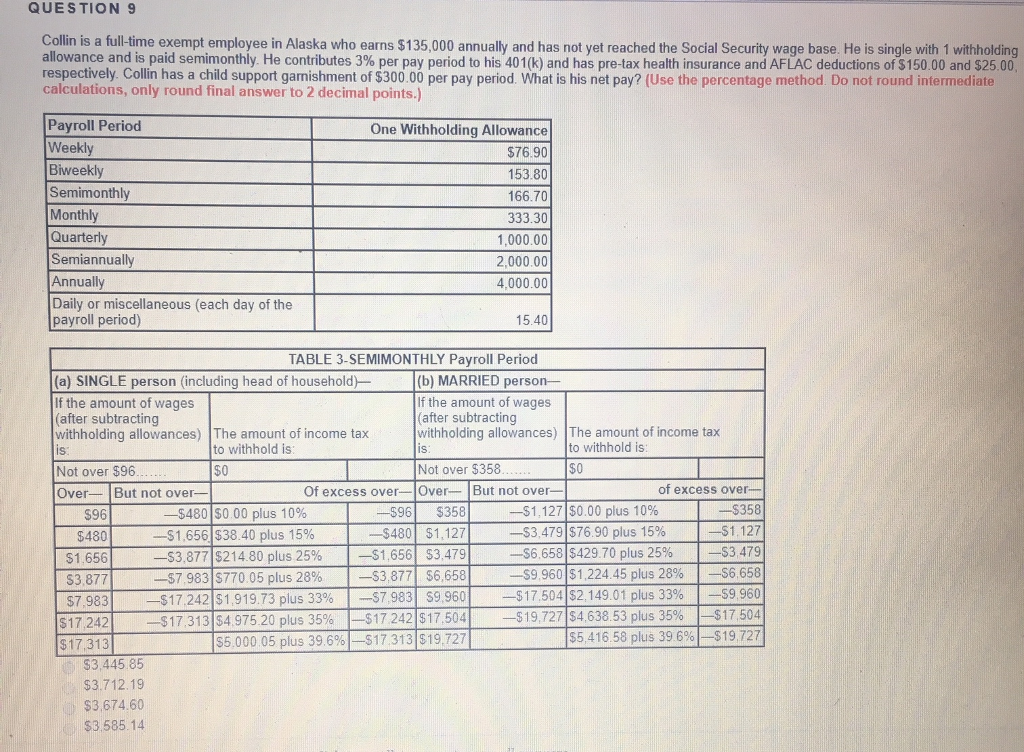

QUESTION 9 ty wage base. He is single with 1 withholding allowance and is paid semimonthly. He contributes 3% per pay period to his 401(k) and has pre-tax health insurance and AFLAC deductions of $150.00 and $25 00 respectively. Collin has a child support gamishment of $300.00 per pay period. What is his net pay? (Use the percentage method. Do not round intermediate calculations, only round final answer to 2 decimal points.) Payroll Period Weekly Biweekly Semimonthly Monthly Quarterly Semiannually Annually Daily or miscellaneous (each day of the payroll period) One Withholding Allowance 76.90 153.80 166.70 333.30 1,000.00 2,000.00 4,000.00 15.40 TABLE 3-SEMIMONTHLY Payroll Period (a) SINGLE person (including head of household(b) MARRIED person- If the amount of wages If the amount of wages (after subtracting withholding allowances) The amount of income tax iS after subtracting withholding allowances) The amount of income tax to withhold is $0 to withhold is $0 IS Not over $358 Not over $96 Over But not over- of excess over- $358 -$1.127 S3,479 ?59.960|$1,224.45 plus 28% -56.658 $9960 -519,727|$4,638.53 plus 35% $17,504 $5416.58 plus 396%)--$19,727 Of excess over- Over- But not over- -51127|$0.00 plus 10% $3,479 $76.90 plus 15% --S6 658|$429.70 plus 25% 96 $358 $480 $1,127 -53.877|$214.80 plus 25% |-$1.656|53.479 -S3,877 $6,658 $17.242|$1.919.73 plus 33% |-67.983| $9.960 -517313|$4975.20 plus 35% I-517242|$17.504 $5,000.05 plus 39.6%|-517313|$19,727 -$480|$0 00 plus 10% $1,656/$38.40 plus 15% $96 $480 $1.656 S3,877 $7,983 $17 242 $17,313 -57 983|$770.05 plus 28% 17.504 $2,149.01 plus 33%9 $3 44585 $3.712.19 3 674.60 $3.585.14 QUESTION 9 ty wage base. He is single with 1 withholding allowance and is paid semimonthly. He contributes 3% per pay period to his 401(k) and has pre-tax health insurance and AFLAC deductions of $150.00 and $25 00 respectively. Collin has a child support gamishment of $300.00 per pay period. What is his net pay? (Use the percentage method. Do not round intermediate calculations, only round final answer to 2 decimal points.) Payroll Period Weekly Biweekly Semimonthly Monthly Quarterly Semiannually Annually Daily or miscellaneous (each day of the payroll period) One Withholding Allowance 76.90 153.80 166.70 333.30 1,000.00 2,000.00 4,000.00 15.40 TABLE 3-SEMIMONTHLY Payroll Period (a) SINGLE person (including head of household(b) MARRIED person- If the amount of wages If the amount of wages (after subtracting withholding allowances) The amount of income tax iS after subtracting withholding allowances) The amount of income tax to withhold is $0 to withhold is $0 IS Not over $358 Not over $96 Over But not over- of excess over- $358 -$1.127 S3,479 ?59.960|$1,224.45 plus 28% -56.658 $9960 -519,727|$4,638.53 plus 35% $17,504 $5416.58 plus 396%)--$19,727 Of excess over- Over- But not over- -51127|$0.00 plus 10% $3,479 $76.90 plus 15% --S6 658|$429.70 plus 25% 96 $358 $480 $1,127 -53.877|$214.80 plus 25% |-$1.656|53.479 -S3,877 $6,658 $17.242|$1.919.73 plus 33% |-67.983| $9.960 -517313|$4975.20 plus 35% I-517242|$17.504 $5,000.05 plus 39.6%|-517313|$19,727 -$480|$0 00 plus 10% $1,656/$38.40 plus 15% $96 $480 $1.656 S3,877 $7,983 $17 242 $17,313 -57 983|$770.05 plus 28% 17.504 $2,149.01 plus 33%9 $3 44585 $3.712.19 3 674.60 $3.585.14