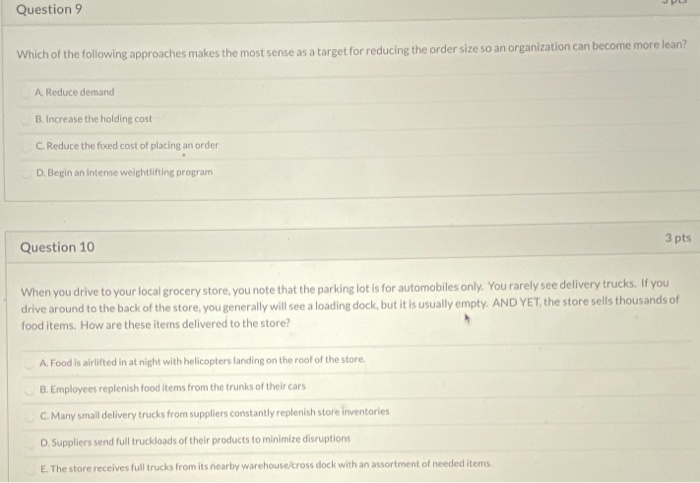

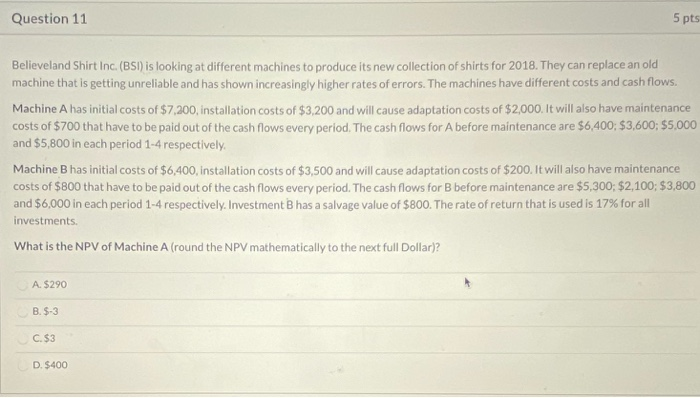

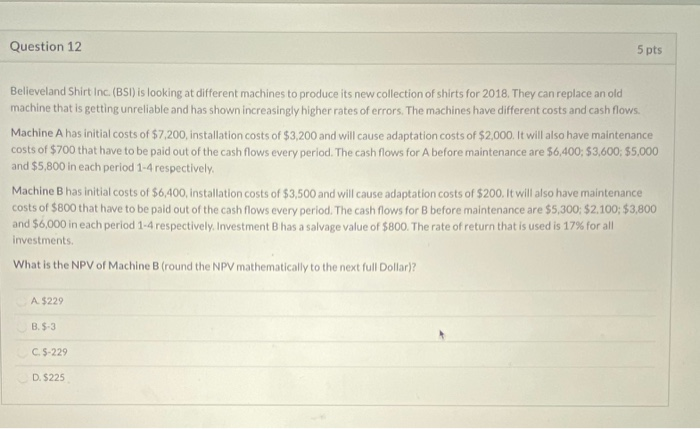

Question 9 Which of the following approaches makes the most sense as a target for reducing the order size so an organization can become more lean? A Reduce demand B. Increase the holding cost C. Reduce the fixed cost of placing an order D. Begin an intense weightlifting program 3 pts Question 10 When you drive to your local grocery store, you note that the parking lot is for automobiles only. You rarely see delivery trucks. If you drive around to the back of the store, you generally will see a loading dock, but it is usually empty. AND YET, the store sells thousands of food items. How are these items delivered to the store? A Food is alrlifted in at night with helicopters landing on the roof of the store B. Employees replenish food items from the trunks of their cars C. Many small delivery trucks from suppliers constantly replenish store inventories D. Suppliers send full truckloads of their products to minimize disruptions E The store receives full trucks from its nearby warehouse/cross dock with an assortment of needed items. Question 11 5 pts Believeland Shirt Inc (BSI) is looking at different machines to produce its new collection of shirts for 2018. They can replace an old machine that is getting unreliable and has shown increasingly higher rates of errors. The machines have different costs and cash flows. Machine A has initial costs of $7,200, installation costs of $3,200 and will cause adaptation costs of $2,000. It will also have maintenance costs of $700 that have to be paid out of the cash flows every period. The cash flows for A before maintenance are $6,400: $3,600: $5,000 and $5,800 in each period 1-4 respectively, Machine B has initial costs of $6,400, installation costs of $3,500 and will cause adaptation costs of $200. It will also have maintenance costs of $800 that have to be paid out of the cash flows every period. The cash flows for B before maintenance are $5,300: $2,100; $3,800 and $6,000 in each period 1-4 respectively. Investment B has a salvage value of $800. The rate of return that is used is 17% for all investments What is the NPV of Machine A (round the NPV mathematically to the next full Dollar)? A $290 B.$-3 C. $3 D. $400 Question 12 5 pts Believeland Shirt Inc. (BSI) is looking at different machines to produce its new collection of shirts for 2018. They can replace an old machine that is getting unreliable and has shown increasingly higher rates of errors. The machines have different costs and cash flows. Machine A has initial costs of $7,200, Installation costs of $3,200 and will cause adaptation costs of $2,000. It will also have maintenance costs of $700 that have to be paid out of the cash flows every period. The cash flows for A before maintenance are $6,400: $3,600, $5,000 and $5,800 in each period 1-4 respectively, Machine Bhas initial costs of $6,400, Installation costs of $3,500 and will cause adaptation costs of $200. It will also have maintenance costs of $800 that have to be paid out of the cash flows every period. The cash flows for B before maintenance are $5,300; $2,100; $3,800 and $6,000 in each period 1-4 respectively. Investment Bhas a salvage value of $800. The rate of return that is used is 17% for all investments. What is the NPV of Machine B (round the NPV mathematically to the next full Dollar)? A $229 B. $-3 C. 5-229 D. $225