Question 9-20

I'm confused on part B could you explain it. Seems like there's also a comment on the question saying the numbers are wrong.

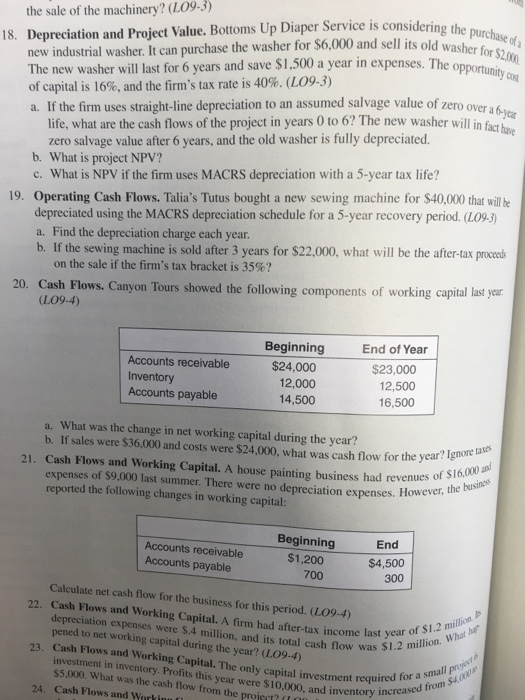

the sale of the machinery? (LO9.3) considering the purchase of asher for S2.00. in 18. Depreciation and Project Value. Bottoms Up Diaper Service is consider new industrial washer. It can purchase the washer for $6,000 and sell its old washer fo of of capital is 16%, and the firm's tax rate is 40%. (109-3) a. If the firm uses straight-line depreciation to an assumed salvage value of zero over a 6 and save $1,500 a year in expenses. The life, what are the cash flows of the project in years 0 to 6? The new washer will in fact zero salvage value after 6 years, and the old washer is fully depreciated. b. What is project NPV? c. What is NPV if the firm uses MACRS depreciation with a 5-year tax life? 19. Operating Cash Flows. Talia's Tutus bought a new sewing machine for $40,000 that will he depreciated using the MACRS depreciation schedule for a 5-year recovery period. (LO9-3) a. Find the depreciation charge each year. b. If the sewing machine is sold after 3 years for $22,000, what will be the after-tax proceeds on the sale if the firm's tax bracket is 35%? 20. Cash Flows. Canyon Tours showed the following components of working c following components of working capital last year (LO9-4) Beginning $24,000 Accounts receivable Inventory Accounts payable End of Year $23,000 12,500 16,500 12,000 14,500 a. What was the change in net working capital during the year? b. If sales were $36,000 and costs were $24.000, what was cash flow for the year?g 21. Cash Flows and Working Capital. A house painting business had revenues of lok of $16,000 an expenses. However, the busins of $16,000 expenses of $9,000 last summer. There were no depreciation expenses. reported the following changes in working capital: Accounts receivable Accounts payable Beginning $1,200 End $4,500 700 300 Calculate net cash flow for the business for this period. (LO9-4) 22. Cash Flows and Working Capital. A firm had after-tax income last year o depreciation expenses were $.4 million, and its total cash flow was S1. pened to net working capital during the year? (LO9-4) Cash Flows and Working Capital. The only capital investment requ investment in inventory. Profits this $5,000. What was the cash flow from the Cash Flows and Worki cash flow ast year of $1.2 milion P million. What h 23. Lo9. pr increased from SA nvestment required for a smal a small prvjet year were $10,000, and inventory increased project inventory increased from