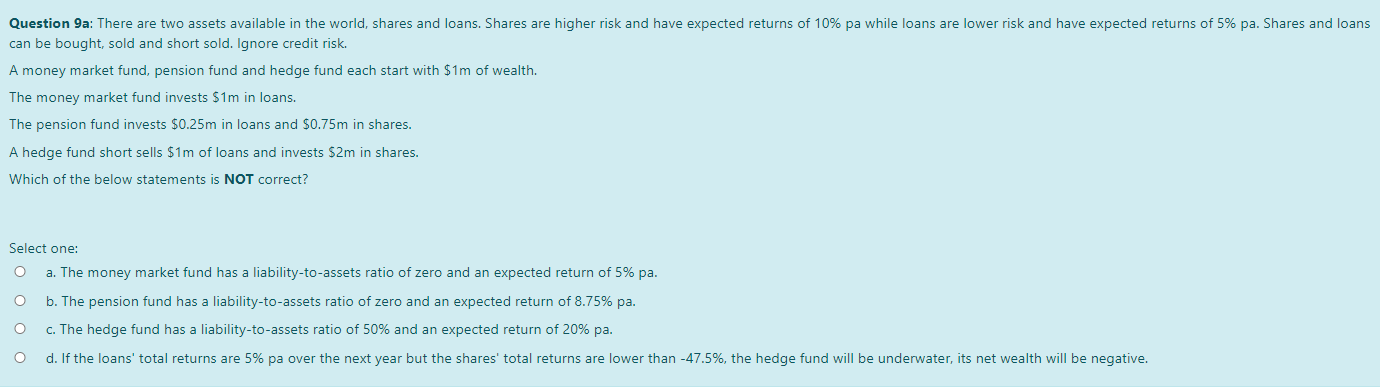

Question 9a: There are two assets available in the world, shares and loans. Shares are higher risk and have expected returns of 10% pa while loans are lower risk and have expected returns of 5% pa. Shares and loans can be bought, sold and short sold. Ignore credit risk. A money market fund, pension fund and hedge fund each start with $1m of wealth. The money market fund invests $1m in loans. The pension fund invests $0.25m in loans and $0.75m in shares. A hedge fund short sells $1m of loans and invests $2m in shares. Which of the below statements is NOT correct? Select one: O a. The money market fund has a liability-to-assets ratio of zero and an expected return of 5% pa. b. The pension fund has a liability-to-assets ratio of zero and an expected return of 8.75% pa. c. The hedge fund has a liability-to-assets ratio of 50% and an expected return of 20% pa. d. If the loans' total returns are 5% pa over the next year but the shares' total returns are lower than -47.5%, the hedge fund will be underwater, its net wealth will be negative. O Question 9a: There are two assets available in the world, shares and loans. Shares are higher risk and have expected returns of 10% pa while loans are lower risk and have expected returns of 5% pa. Shares and loans can be bought, sold and short sold. Ignore credit risk. A money market fund, pension fund and hedge fund each start with $1m of wealth. The money market fund invests $1m in loans. The pension fund invests $0.25m in loans and $0.75m in shares. A hedge fund short sells $1m of loans and invests $2m in shares. Which of the below statements is NOT correct? Select one: O a. The money market fund has a liability-to-assets ratio of zero and an expected return of 5% pa. b. The pension fund has a liability-to-assets ratio of zero and an expected return of 8.75% pa. c. The hedge fund has a liability-to-assets ratio of 50% and an expected return of 20% pa. d. If the loans' total returns are 5% pa over the next year but the shares' total returns are lower than -47.5%, the hedge fund will be underwater, its net wealth will be negative. O