Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question a answer is $341908.48 please answer question b to c :) and provide sufficient explanations. I will give you a like Exercise to Calculate

question a answer is $341908.48

please answer question b to c :) and provide sufficient explanations. I will give you a like

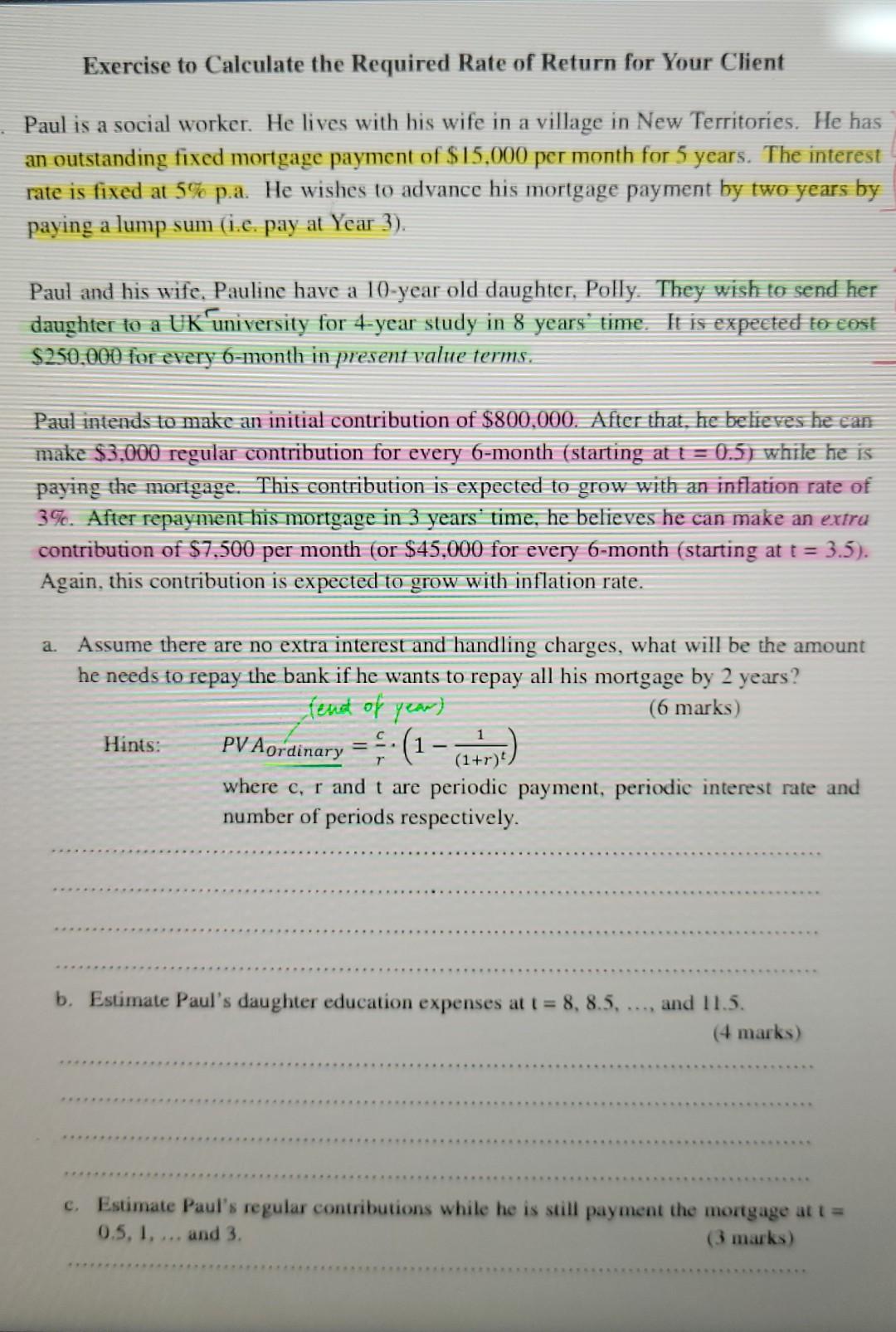

Exercise to Calculate the Required Rate of Return for Your Client Paul is a social worker. He lives with his wife in a village in New Territories. He has an outstanding fixed mortgage payment of $15,000 per month for 5 years. The interest rate is fixed at 5% p.a. He wishes to advance his mortgage payment by two years by paying a lump sum (i.e. pay at Year 3). Paul and his wife, Pauline have a 10-year old daughter, Polly. They wish to send her daughter to a UK university for 4-year study in 8 years' time. It is expected to cost $250,000 for every 6-month in present value terms. Paul intends to make an initial contribution of $800,000. After that, he believes he can make $3,000 regular contribution for every 6-month (starting at t = 0.5) while he is paying the mortgage. This contribution is expected to grow with an inflation rate of 3%. After repayment his mortgage in 3 years' time, he believes he can make an extra contribution of $7,500 per month (or $45,000 for every 6-month (starting at t = 3.5). Again, this contribution is expected to grow with inflation rate. a. Assume there are no extra interest and handling charges, what will be the amount he needs to repay the bank if he wants to repay all his mortgage by 2 years? fent of year) (6 marks) Hints: PV Aordinary = -(1- (1-7) where c, r and t are periodic payment, periodie interest rate and number of periods respectively. (1+r) b. Estimate Paul's daughter education expenses at t = 8, 8.5. ..., and 11.5. (4 marks) c. Estimate Paul's regular contributions while he is still payment the mortgage at i = 0.5, 1, ... and 3 (3 marks) Exercise to Calculate the Required Rate of Return for Your Client Paul is a social worker. He lives with his wife in a village in New Territories. He has an outstanding fixed mortgage payment of $15,000 per month for 5 years. The interest rate is fixed at 5% p.a. He wishes to advance his mortgage payment by two years by paying a lump sum (i.e. pay at Year 3). Paul and his wife, Pauline have a 10-year old daughter, Polly. They wish to send her daughter to a UK university for 4-year study in 8 years' time. It is expected to cost $250,000 for every 6-month in present value terms. Paul intends to make an initial contribution of $800,000. After that, he believes he can make $3,000 regular contribution for every 6-month (starting at t = 0.5) while he is paying the mortgage. This contribution is expected to grow with an inflation rate of 3%. After repayment his mortgage in 3 years' time, he believes he can make an extra contribution of $7,500 per month (or $45,000 for every 6-month (starting at t = 3.5). Again, this contribution is expected to grow with inflation rate. a. Assume there are no extra interest and handling charges, what will be the amount he needs to repay the bank if he wants to repay all his mortgage by 2 years? fent of year) (6 marks) Hints: PV Aordinary = -(1- (1-7) where c, r and t are periodic payment, periodie interest rate and number of periods respectively. (1+r) b. Estimate Paul's daughter education expenses at t = 8, 8.5. ..., and 11.5. (4 marks) c. Estimate Paul's regular contributions while he is still payment the mortgage at i = 0.5, 1, ... and 3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started