Question

Question (a) cash Accounts receivable Inventory Equipment Accounts Payable Unearned Revenue Bank Loan Capital Revenue Expense Note Open Balance (i) (ii) (iii) (iv) (v) (vi)

| cash | Accounts receivable | Inventory | Equipment | Accounts Payable | Unearned Revenue | Bank Loan | Capital | Revenue | Expense | Note | ||

| Open Balance | ||||||||||||

| (i) | ||||||||||||

| (ii) | ||||||||||||

| (iii) | ||||||||||||

| (iv) | ||||||||||||

| (v) | ||||||||||||

| (vi) | ||||||||||||

| (vii) | ||||||||||||

| (viii) | ||||||||||||

| (ix) | ||||||||||||

| (x) | ||||||||||||

| End Balance | ||||||||||||

Question (b)

| Belle's Toy Store | |

| Income Statement | |

| for the month of July 2022 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Belle's Toy Store | |

| Balance Sheet | |

| as at 31 July 2022 | |

| Assets | |

| Current assets: |

|

|

|

|

|

|

|

|

|

|

| Total current assets | |

| Non-Current Assets: |

|

|

|

|

| Total assets | |

| Liabilities |

|

| Current liabilities: |

|

|

|

|

|

|

|

| Total current liabilities |

|

| Non-current liabilities: |

|

|

| |

| Total liabilities |

|

| Equity |

|

|

| |

| Total liabilities and Equity |

|

| Belle's Toy Store | |

| Statement of Cash Flows | |

| for the month of July 2022 | |

| Operating Cash Flows |

|

|

|

|

|

|

|

| Total Operating Cash Flows | |

|

|

|

| Investing Cash Flows |

|

|

|

|

| Total Investing Cash Flows | |

|

|

|

| Financing Cash Flows |

|

|

|

|

|

|

|

| Total Financing Cash Flows | |

|

|

|

| Net change in cash flows |

|

| + Opening Cash Balance |

|

| = Closing Cash Balance |

|

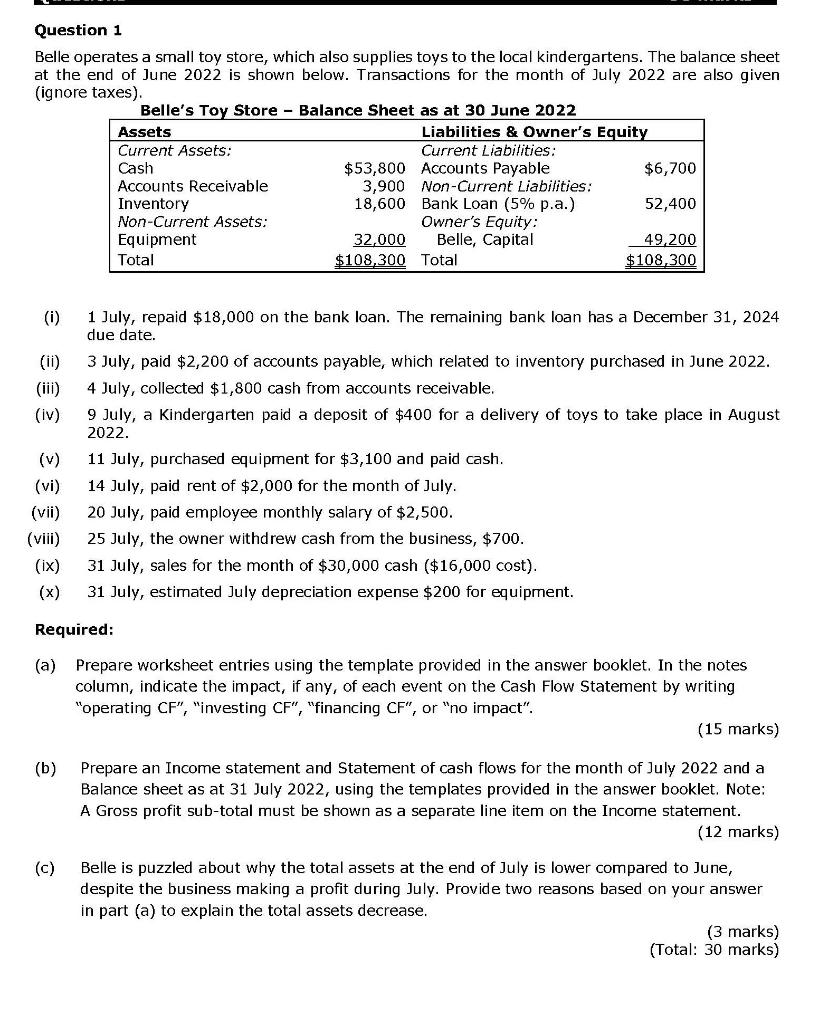

Question 1 Belle operates a small toy store, which also supplies toys to the local kindergartens. The balance sheet at the end of June 2022 is shown below. Transactions for the month of July 2022 are also given (ignore taxes). Relle's Tov Store - Balance Sheet as at 30 Iune 2022 (i) 1 July, repaid $18,000 on the bank loan. The remaining bank loan has a December 31,2024 due date. (ii) 3 July, paid $2,200 of accounts payable, which related to inventory purchased in June 2022. (iii) 4 July, collected $1,800 cash from accounts receivable. (iv) 9 July, a Kindergarten paid a deposit of $400 for a delivery of toys to take place in August 2022. (v) 11 July, purchased equipment for $3,100 and paid cash. (vi) 14 July, paid rent of $2,000 for the month of July. (vii) 20 July, paid employee monthly salary of $2,500. (viii) 25 July, the owner withdrew cash from the business, $700. (ix) 31 July, sales for the month of $30,000 cash ($16,000 cost). (x) 31 July, estimated July depreciation expense $200 for equipment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started