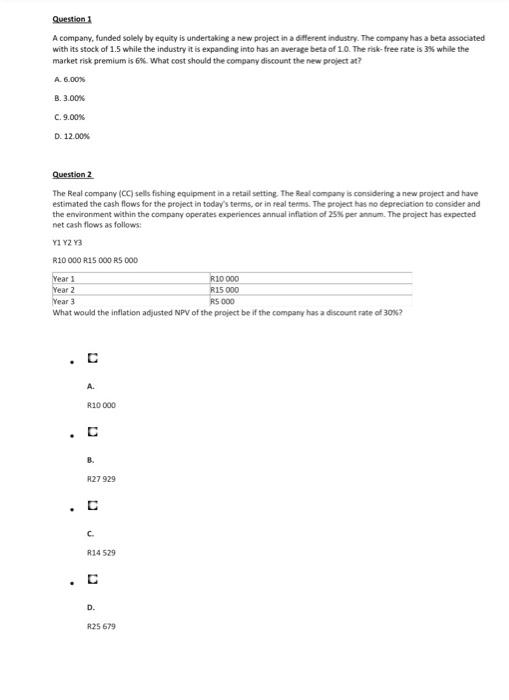

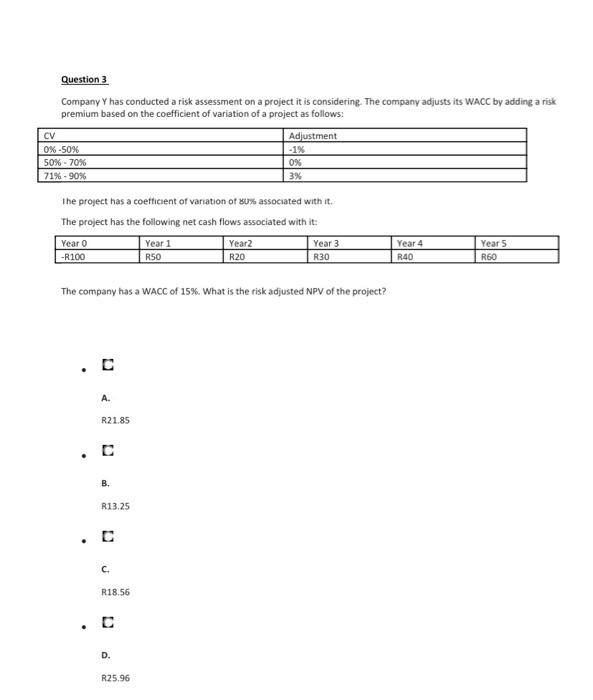

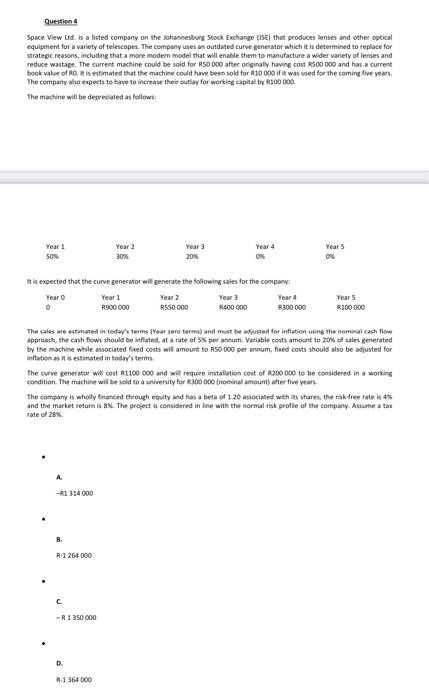

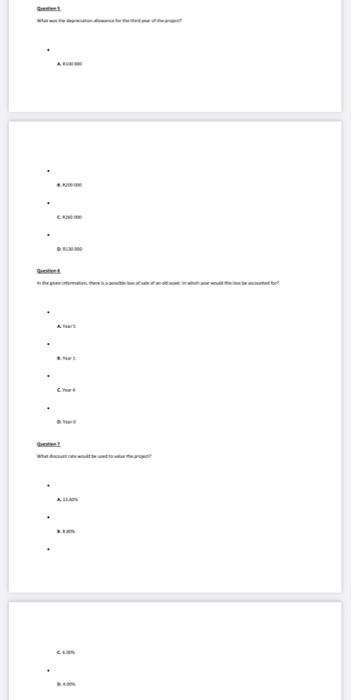

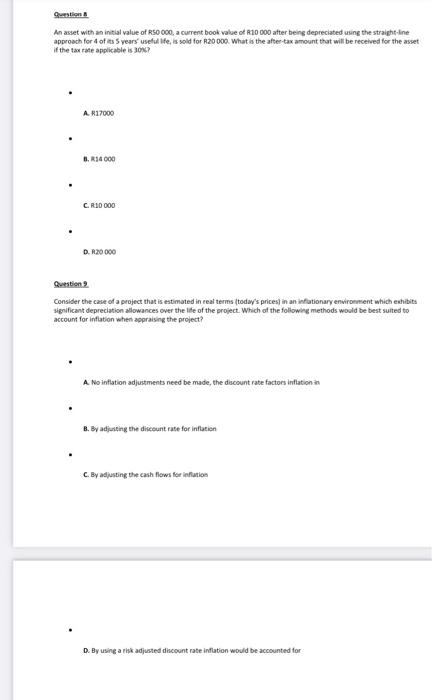

Question A company, funded solely by equity is undertaking a new project in a different industry. The company has a beta associated with its stock of 1.5 while the industry it is expanding into has an average beta of 10. The risk-free rate is 3% while the market risk premium is 6%. What cost should the company discount the new project at? A. 6.00% B.3.00% C. 9.00% D. 12.00% Question 2 The Real company (CC) sells fishing equipment in a retail setting. The Real company is considering a new project and have estimated the cash flows for the project in today's terms, or in real terms. The project has no depreciation to consider and the environment within the company operates experiences annual inflation of 25% per annum. The project has expected net cash flows as follows: YI Y2Y3 R10 000 R15 000 RS 000 Year 1 Year 2 Year 3 R10 000 R15 000 RS 000 What would the Inflation adjusted NPV of the project be if the company has a discount rate of 30%? A. R10 000 B. R27 929 C. R14 529 D. R25 679 Question 3 Company Y has conducted a risk assessment on a project it is considering. The company adjusts its WACC by adding a risk premium based on the coefficient of variation of a project as follows: CV Adjustment 0% -50% 50% - 70% 71% - 90% - 1% 0% 3% The project has a coefficient of variation of 80% associated with it. The project has the following net cash flows associated with it: Year o -R100 Year 1 RSO Year2 R20 Year 3 R30 Year 4 R40 Year 5 R60 The company has a WACC of 15%. What is the risk adjusted NPV of the project? A. R21.85 B. R13.25 . C. R18.56 C . D. R25.96 Question 4 Space View Ltd. is a listed company on the Johannesburg Stock Exchange (ISE) that produces lenses and other optical equipment for a variety of telescopes. The company uses an outdated curve generator which it is determined to replace for strategic reasons, including that a more modern model that will enable them to manufacture a wider variety of lenses and reduce wastage. The current machine could be sold for R50 000 after originally having cost RS00 000 and has a current book value of Rot is estimated that the machine could have been sold for R10 000 if it was used for the coming five years The company also expects to have to increase their outly for working capital by R100 000 The machine will be deprecated as follows Year SOM Year 2 30% Year 3 20% Year 4 ON Year 5 ON It is expected that the curve generator will generate the following sales for the company Year Year 1 Year 2 Year 3 Year 4 o R900 000 RSSO 000 R400 000 R300 000 Years R100 000 The sales are estimated in today's terms Year seroterma and must be adjusted for inflation using the nominal cash flow approach, the cash flows should be inflated at a rate of 5% per annum. Variable costs amount to 20% of sales generated by the machine while associated foed costs will amount to R50 000 per annum, fed costs should also be adjusted for inflation as it is estimated in today's terms The curve generator will cost R1100 000 and will require installation cost of 200000 to be considered in a working condition. The machine will be sold to a university for R300 000 nominal amount) after five years. The company is wholly financed through equity and has a beta of 120 associated with its shares, the risk free rate is 4% and the market return is 8. The project is considered in line with the normal tisk profile of the company. Assume a tax rate of 28% A -R1 314000 B. R-1 264 000 c. -R 1 350 000 D. R-1364000 A CE Quest An asset with an initial value of R50 000, a current book value of R10 000 after being depreciated using the straight line approach for of 5 years' useful life is sold for R20 000. What is the after-tax amount that will be received for the asset if the tax rate applicable is BON? A 17000 1. R$4000 CRIO 000 D. R.20 000 Question Consider the case of a project that is estimated in real terms (today's prices in an inflationary environment which exhibits significant depreciation allowances over the life of the project. Which of the following methods would be best suited to account for Inflation when appraising the project? A No inflation adjustments need be made, the dacount rate factors inflation an B. By adjusting the discount rate for inflation C.By adjusting the cash flows for inflation D. By using a risk adjusted discount rate inflation would be accounted for