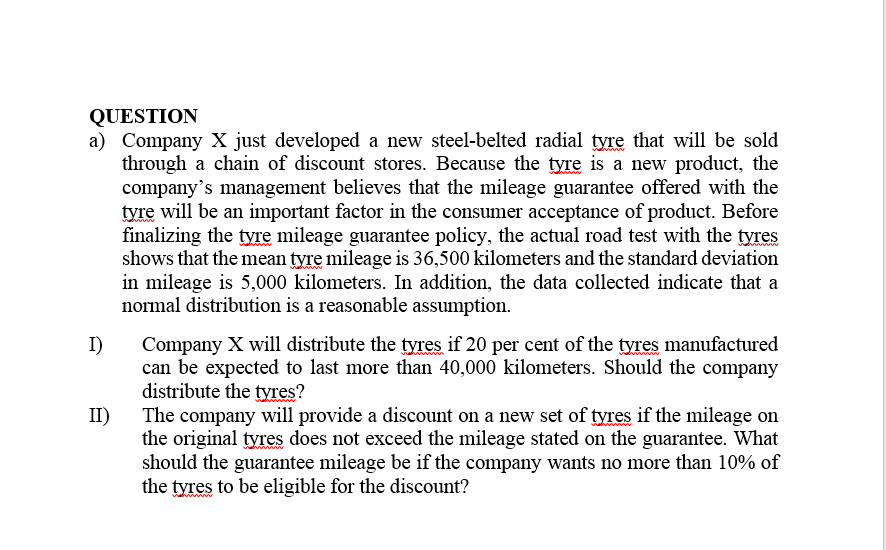

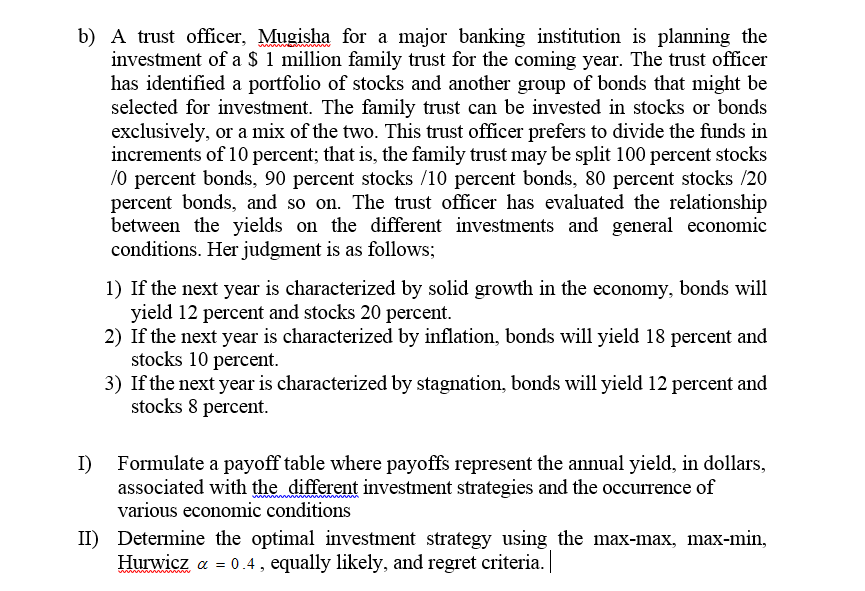

QUESTION a) II) Company X just developed a new steel-belted radial Me, that will be sold through a chain of discount stores. Because the Me, is a new product, the company's management believes that the mileage guarantee offered with the tyre, will be an important factor in the consumer acceptance of product. Before nalizing the tyre, mileage guarantee policy, the actual road test with the types, shows that the meanmrueumileage is 36,500 kilometers and the standard deviation in mileage is 5,000 kilometers. In addition, the data collected indicate that a normal distribution is a reasonable assumption. Company X will distribute the Egg if 20 per cent of the m manufactured can be expected to last more than 40,000 kilometers. Should the company distribute the m? The company will provide a discount on a new set of Mes, if the mileage on the original type; does not exceed the mileage stated on the guarantee. What should the guarantee mileage be if the company wants no more than 10% of the Mes, to be eligible for the discount? b) n) A trust ofcer, Mugisha for a major banking institution is planning the investment of a $ 1 million family trust for the coming year. The trust officer has identied a portfolio of stocks and another group of bonds that might be selected for investment. The family trust can be invested in stocks or bonds exclusively, or a mix of the two. This trust ofcer prefers to divide the funds in increments of 10 percent; that is, the family trust may be split 100 percent stocks it] percent bonds, 90 percent stocks Ill] percent bonds, 80 percent stocks 20 percent bonds, and so on. The trust ofcer has evaluated the relationship between the yields on the different investments and general economic conditions. Her judgment is as follows; 1) If the next year is characterized by solid growth in the economy, bonds will yield 12 percent and stocks 20 percent. 2) If the next year is characterized by ination, bonds will yield 18 percent and stocks 10 percent. 3) If the next year is characterized by stagnation, bonds will yield 12 percent and stocks 8 percent. Formulate a payoff table where payoffs represent the annual yield, in dollars, associated with the different investment strategies and the occurrence of various economic conditions Determine the optimal investment strategy using the max-max, max-min, Hurwicz a = o .4 , equally likely, and regret criteria